Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly down. Australia dropped 1.3%; New Zealand and Taiwan also dropped noticeably. Indonesia and Singapore did well. Europe is currently mostly down. Belgium and Greece are down more than 2%; Russia, London and Italy are down more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil is down, copper down. Gold is up, silver down.

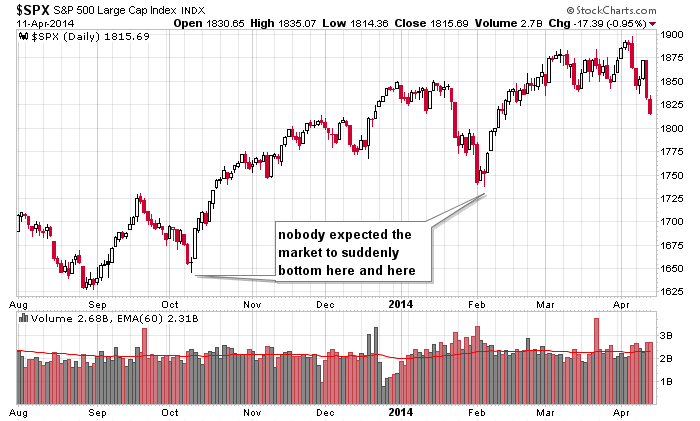

Last week was bad one for the bulls and a great one for the bears. The S&P and Dow finally succumbed to the weakness from the Nas and small caps. For several weeks those indexes were weak and moving down (they had put in lower highs and lower lows), but the Dow and SPX held up in their patterns. Not any more. All the indexes are now sitting at their lowest levels since early February…the Nas and small caps are near their February lows; the Dow and SPX still have room to move.

On an intermediate term basis, the path of least resistance is down. Several indicators, which have been weak and supportive of the bear’s case, have room to move before hitting extremely low levels. From a technical standpoint, I’d be surprised if the market just put in a bottom right here…although we shouldn’t be too surprised. It’s happened before (see chart below).

On a short term basis, anything goes. This is always the case, so we need to be prepared for most reasonable scenarios. The biggest up moves occur within downtrends, and with this being options expiration week and holiday-shortened, you never know.

Over the next few months I see more downside, but I don’t expect a crash like many are predicting. More after the open.

Stock headlines from barchart.com…

Yahoo (YHOO -1.59%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

Eaton Vance (EV -1.21%) was upgraded to ‘Neutral’ from ‘Sell’ at Citigroup.

Whole Foods Market (WFM -0.22%) was downgraded to ‘Hold’ from ‘Buy’ at BB&T.

Bebe stores (BEBE -3.01%) were upgraded to ‘Buy’ from ‘Neutral’ at Janney Capital.

British Petroleum (BP -1.72%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord.

Eli Lilly (LLY -0.36%) was upgraded to ‘Hold’ from ‘Underperform’ at Jefferies.

Johnson & Johnson (JNJ +0.34%) fell 1% in European trading after Jeffries downgraded the stock to ‘Hold’ from ‘Buy,’ citing valuation.

Fiera Capital reported a 8.02% passive stake in Richmont Mines (RIC -2.07%) .

Dow Jones reports that Amazon.com (AMZN -1.70%) plans to launch a smartphone in the second half of this year.

Fitch Ratings downgraded the credit ratings for Alcoa (AA -1.26%) to ‘BB+’ from ‘BBB-‘ and kept the rating outlook stable.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Retail Sales

10:00 Business Inventories

Notable earnings before today’s open: C, JBHT, LAYN, MTB

Notable earnings after today’s close: LEDS, OZRK, PBY, TPLM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 14)”

Leave a Reply

You must be logged in to post a comment.

Market reached a decision point Friday.

The low Friday is a significant level which it must hold (all the way down to 1796 or so).

The resistance I referred to Thurs at 1875-76 did stop the uptrend.

Resistance now is at 1829 up through 1834. If those levels are conquered, the bulls have

taken momentum. There is more resistance above, but besting those levels would be a sign of bullish

strength.

If those levels aren’t, expect to work lower with first tgt around 1800.

Today will tell us which trend is in play.

Futures gapped down at the open last night, but acting bullish since early morning.

Expect to gap higher at the bell. I’m on a back up computer, so I’m estimating futures are in the neighborhood of +10. Should retrace after the open, and if so, go no lower than 1810 for the bullish case.

This is my last post until about the 23rd. My son is returning from a Navy deployment to the Persian Gulf, and I am heading to Norfolk to reunite with him and his squadron later this week. We have catching up to do: T-giving, Christmas and his birthday.

Happy Resurrection Day to all.

Last of the “best 6 months” of the market IE. Traders Almanac

Doesnt mean market gonna crash here but comeback into value (IMHO)

gonna get a “counter-trend” rally this week imagine esp since it’s expiration week

Again just my op. that and $1.50 will buy ya a soda! 🙂

Jack