Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

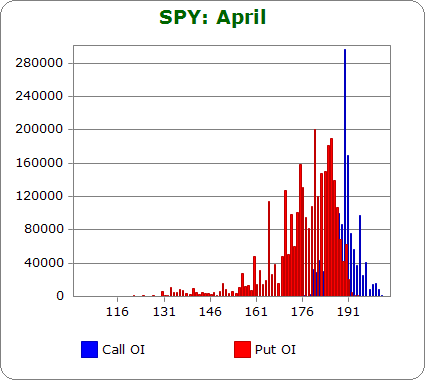

SPY (closed 182.94)

Puts out-number calls 2.3-to-1.0…about the same as last month.

Call OI is highest between 186 and 192 and then at 195. The two big spikes are at 190 and 191.

Put OI is highest between 170 and 186.

There’s a pretty clear dividing line between the high OI call and put strikes. They meet at 186 with calls being moderately high above and puts being very heavy below. A close right at 186 would cause the most pain. Today’s close was at 182.94, three points lower than ideal. As of now, some of those higher strike put buyers will make money. To cause max pain, SPY will need to move up the next three days.

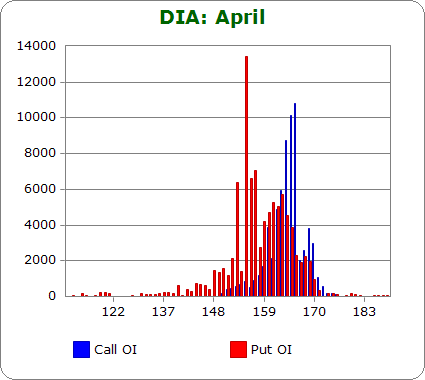

DIA (closed 161.45)

Puts and calls are nearly equal at 1.25-to-1.0….less bearish than last month.

Call OI is highest between 162 and 166.

Put OI is highest between 153 and 156 again between 159 and 164.

There’s a little overlap between 162 and 164. If DIA closes near the bottom of this range so the highest put OI strikes between 153 and 156 and the highest call OI strikes between 162 and 166 close worthless, option buyers will feel lots of pain. Today’s close was at 161.45, a perfect place. No movement is needed the rest of the week to cause max pain.

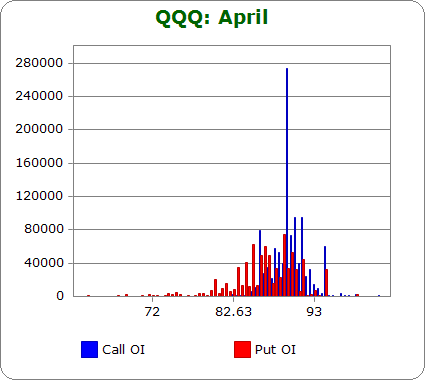

QQQ (closed 84.77)

Calls out-number puts 1.2-to-1.0…about the same as last month.

Call OI is highest at 86 and between 89.63 and 91.63; the biggest spike is at 89.63.

Put OI is highest between 84 and 90.

There’s a lot of overlap here, but the highest put and call OI strikes are at 89.63 and 89.00, so let’s key in here (especially the giant call spike). Today’s close was at 84.77 – well below that big spike. At this level, a good number of put buyers will make money. A move up would lower their profits without allowing call buyers to make much. Hence, a move up of a couple points is needed to cause max pain.

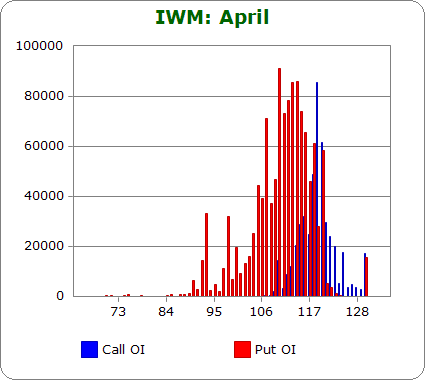

IWM (closed 110.72)

Puts out-number calls 2.7-to-1.0…slightly less bearish than last month.

Call OI ramps up between 114 and 120 with the biggest spike coming at 119.

Put OI is pretty steady between 107 and 120.

There’s overlap between the highest strikes between 118 and 120. A close in there would cause most of the calls and puts to expire worthless or with very little value. Today’s close was at 110.72, well below the ideal area. As of now put buyers will cash in big time. To cause max pain, a big move up is needed the next three days.

Overall Conclusion: Thanks to the market’s recent weakness, put buyers are nicely positioned to cash in on this options cycle. SPY, QQQ and IWM are all well below where they need to be to cause max pain. A relatively big move up is needed the next three days if the invisible hand of the market wants to cause max pain this month.