Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. The biggest losses came from Japan (down 2.9%), Hong Kong, China, South Korea, Australia and India. Europe is currently mostly up. Germany, France, Amsterdam, Russia and Greece are leading. Futures here in the States point towards a gap up open for the cash market.

The dollar is up slightly. Oil is up, copper down. Gold is down, silver flat.

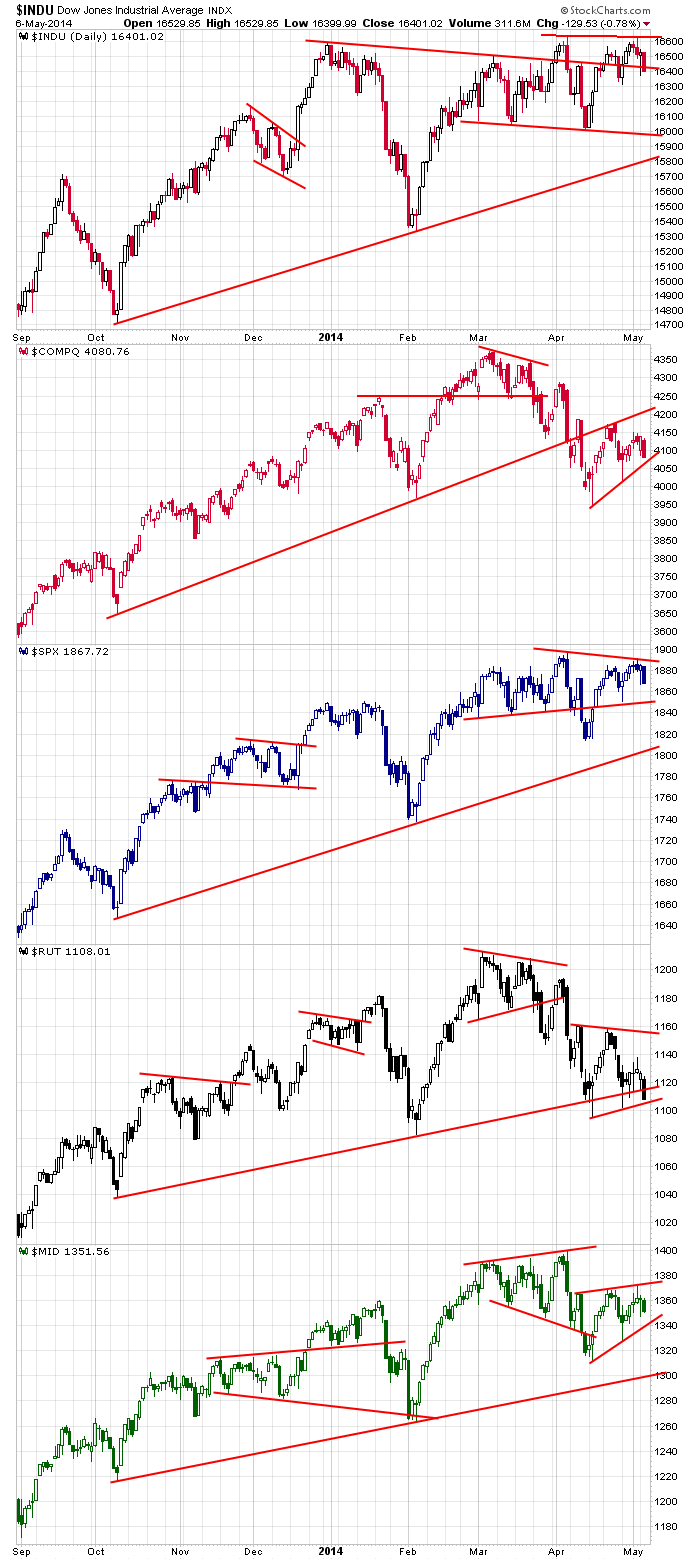

The daily charts look ominous. The Dow and S&P have put in double tops (or lower highs – however you want to look at it). The Nas and S&P mid caps are forming bearish rising wedges. The Russell small caps are forming a large symmetrical triangle. The Dow and SPX are neutral. The others hint at bad things to come. Patterns are never 100% reliable – not even close – and they’re less reliable on index charts than on charts of individual stocks. Still, they give us frame of reference, and right now the picture is potentially very bearish.

The battle right now is simple to explain. Any solid, proven company that has earnings, a proven business model and some visibility is holding up or moving up. Any company that has no earnings, an unproven business model or a model that doesn’t support their sky-high valuation is getting hit hard. YELP, LNKD, TWTR – all getting hit hard. Whole Foods (WFM) is getting clobbered this morning. Can the good hold up until the bad bottoms? Or will the bad eventually pull the good down. That’s the battle. More after the open.

Stock headlines from barchart.com…

Humana (HUM -0.30%) reported Q1 EPS of $2.35, well above consensus of $1.96.

Duke Energy (DUK -0.61%) reported Q1 EPS of $1.17, better than consensus of $1.12.

Southwest Gas (SWX -1.29%) reported Q1 EPS of $1.51, well below consensus of $1.69.

Marathon Oil (MRO -0.71%) reported Q1 adjusted EPS of 88 cents, well ahead of consensus of 72 cents.

Trimble Navigation (TRMB -0.88%) reported Q1 EPS of 39 cents, weaker than consensus of 42 cents.

Microchip Technology (MCHP -0.88%) reported Q4 EPS of 64 cents, higher than consensus of 61 cents.

GNC Holdings (GNC -1.00%) reported Q1 EPS of 75 cents, less than consensus of 76 cents, and then lowered guidance on fiscal 2014 EPS to $3.05-$3.10, below consensus of $3.20.

Pioneer Natural (PXD -0.07%) reported Q1 adjusted EPS of $1.26, higher than consensus of $1.06.

Live Nation (LYV -2.06%) reported a Q1 EPS loss of -16 cents, a much narrower loss than consensus of -35 cents.

Disney (DIS -0.23%) reports Q2 EPS ex-items of $1.11, better than consensus of 96 cents.

Groupon (GRPN -2.47%) fell 4% in pre-market trading even after it reported a Q1 adjusted EPS loss of -1 cent, a smaller loss than consensus of -3 cents.

First Solar (FSLR -1.42%) rose over 4% in pre-market trading after it reported Q1 EPS $1.10, nearly double consensus of 56 cents.

Activision Blizzard (ATVI -0.57%) reported Q1 adjusted EPS of 19 cents, almost double consensus of 10 cents.

Allstate (ALL -0.96%) reported Q1 EPS of $1.30, higher than consensus of $1.19.

Electronic Arts (EA -2.47%) surged over 15% in after-hours trading after it reported Q4 EPS of 48 cents, over four times higher than consensus of 11 cents, and then raised guidance on fiscal 2015 EPS to $1.85, well above consensus of $1.52.

Whole Foods (WFM -0.68%) sank over 15% in after-hours trading after it reported Q2 EPS of 38 cents, below consensus of 41 cents, and then lowered guidance on fiscal 2014 EPS to $1.52 – $1.56 from $1.58 – $1.65, below consensus of $1.61.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Productivity and Costs

8:30 Gallup U.S. Job Creation Index

10:00 Janet Yellen speech

10:30 EIA Petroleum Inventories

11:00 Global Composite PMI

11:00 Global Services PMI

1:00 PM Results of $24B, 10-Year Note Auction

3:00 PM Consumer Credit

Notable earnings before today’s open: AGN, ALE, AOL, ARIA, ARQL, ATRO, AVA, AYR, BAM, BUD, CHK, CLH, COT, CTSH, DUK, DVN, DWSN, DX, EE, ENB, END, FWLT, GTIV, GWPH, HNT, HTZ, HUM, INXN, KELYA, KING, LAMR, LGND, LINC, LMIA, MDLZ, MEMP, MZOR, NAVB, NJR, NTLS, NVDQ, POM, PRGO, QRE, RIGL, ROC, SBGI, SE, SEP, SFUN, SNSS, SPAR, SPB, STRA, SUSP, SUSS, TAP, THI, TLM, TMHC, TPC, TRGT, USAC, VOYA, VSI, WBAI, WPX, WRES, XEC

Notable earnings after today’s close: ACAS, ANAC, ANDE, APU, AR, ASYS, ATLS, ATO, AVG, AWK, BALT, BKD, BODY, BREW, BRKR, CAR, CDE, CDXS, CF, CLR, CODI, COUP, CSLT, CTL, CTRP, CXW, CZR, DCTH, DK, DYN, ERII, ESS, EXPD, FANG, FMI, FNV, FURX, GEOS, GMCR, GPOR, GTAT, GTY, HAIN, HK, HNSN, IL, IPAR, KGC, KIM, KND, KW, LCI, LGP, LHCG, LPSN, LXU, MCP, MDR, MHLD, MIDD, MKL, MM, MRIN, MWE, NKTR, NLY, NRP, NSTG, NVAX, NVEC, NVTL, OSUR, PAA, PGTI, PHH, PL, PMT, PNNT, PODD, POWR, PRU, QEP, QTM, RATE, REG, RIG, RNDY, RST, SCMP, SCTY, SD, SFM, SN, SWM, TCAP, TGB, TGI, TROX, TSLA, TWO, TWTC, TXTR, UGI, UIL, UNM, WGL, WR, WTR, XOMA, Z.

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 7)”

Leave a Reply

You must be logged in to post a comment.

They took it close to THE line for the bulls. 1866

Futures have climbed overnight to a high of +7.25 and have since retreated.

Bulls need to hold the pullback at 1872 (anticipate a positive gap open).

It’s possible they bring it back to 1867-68,

but 1866 is THE line.

In addition to all we’re fighting as Jason described, we are in

the bearish seasonal period of “sell in May and go away.”

And don’t forget the flash crash of a few years ago. The traders haven’t.

Just watch 1866, very critical level.

At 9 am futures are +4.25.

I will not be posting tomorrow or Friday, will be at The Players Golf tournament.

Have a good weekend.

money chase’s yeild

both the bond market and equity markets cant be both right atm

my marsian contacts tell me earth has been sold to mars

is this the end of the world

until earth buys back its future and pays off its debt