Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan, Australia and South Korea led the way; New Zealand was a noticeable loser. Europe is currently mostly up. Belgium and Italy are leading the way followed by Amsterdam, Norway, Stockholm, France and London. Futures here in the States point towards a slight down open for the cash market.

The dollar is down. Oil is down, copper up. Gold is up, silver down.

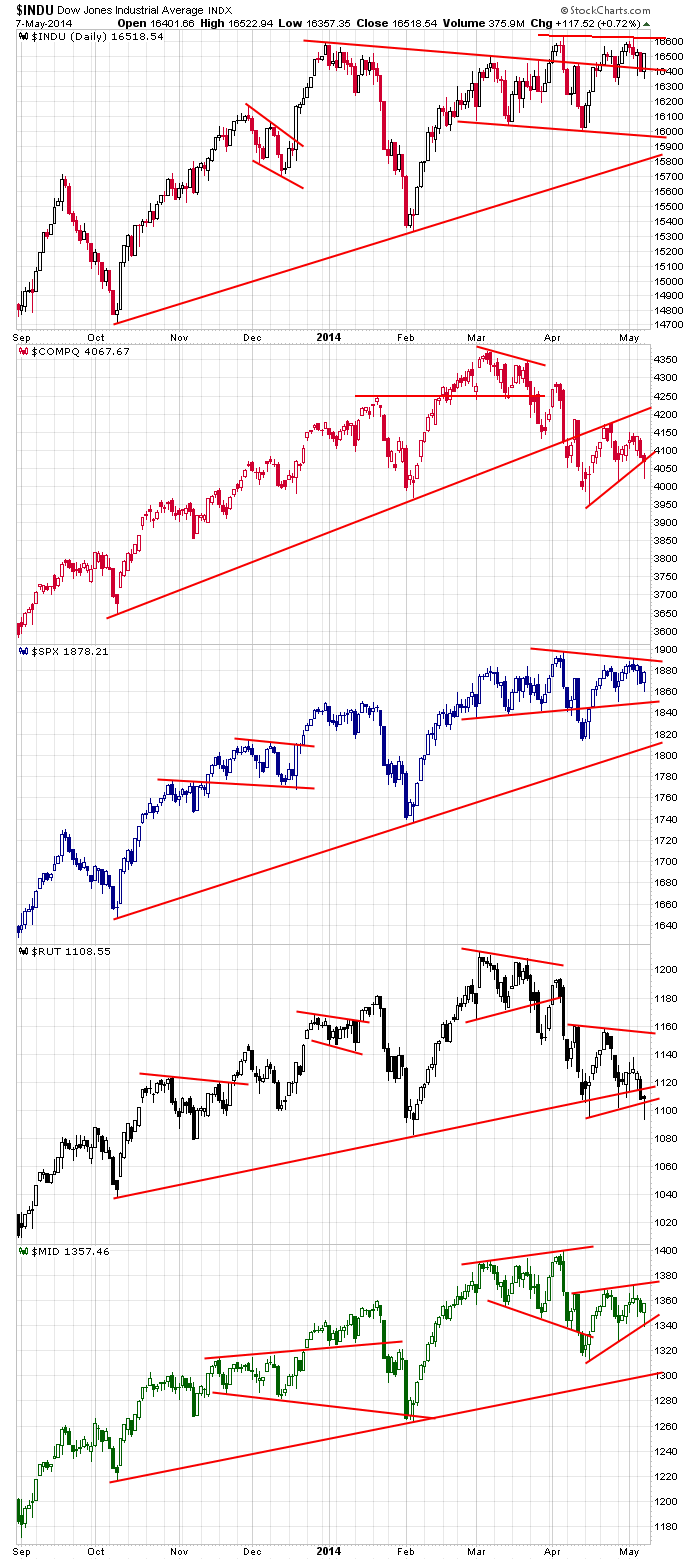

The market staged a solid intraday reversal yesterday…the daily candles now sport long lower tails. Here’s an update of the index charts. The Dow and SPX continue to be very well positioned to bust out and run. The Nas and Russell sliced through support but bounced all the way back. The mid caps bounced off support and closed in the middle of its pattern. It’s a tale of two markets…the Dow and SPX look good…the Nas and small caps are trending down (albeit with lots of big swings).

The near term continues to be a crap shoot. Rallies get sold, dips get bought. No move lasts long, so we’ve had to be content with smaller gains instead of aiming for bigger returns.

As I’ve stated numerous times, the battles that will determine the market’s next trending move are between the small caps and large caps and between the Nas and S&P 500 (or NYSE or Dow). When the market is strong, the Nas and small caps lead; the opposite is true when the market lags. Right now the Nas and small caps are lagging. If they can firm and move up, the Dow and S&P will break out to a new high. If they can’t the best case scenario is range bound trading. Don’t guess what will happen. Let the movement of the market be your guide. More after the open.

Stock headlines from barchart.com…

Priceline Group (PCLN -3.13%) reported Q1 EPS of $7.81, well above consensus of $6.84.

The WSJ reported that DirecTV (DTV +7.96%) has engaged Goldman Sachs (GS +0.63%) to evaluate a potential deal with AT&T (T +0.76%) .

Kindred Healthcare (KND +0.80%) reported Q1 EPS ex-items of 32 cents, below consensus of 33 cents.

JP Morgan Chase reported a 10.2% passive stake in Cross Country Healthcare (CCRN -5.96%) .

Transocean (RIG +0.63%) climbed more than 3% in pre-market trading after it reported Q1 adjusted EPS of $1.43, well above consensus of $1.02.

CF Industries (CF +0.55%) reported Q1 adjusted EPS of $4.51, below consensus of $4.54.

Avis Budget (CAR +0.28%) reported Q1 EPS ex-items of 16 cents, double consensus of 8 cents.

CenturyLink (CTL +0.55%) reported Q1 adjusted EPS of 66 cents, better than consensus of 61 cents.

Caesar’s (CZR +14.12%) reported a Q1 EPS loss of -$2.82, a much wider loss than consensus of -$1.15.

Prudential (PRU +0.99%) reported Q1 EPS of $2.40, higher than consensus of $2.26.

McDermott (MDR unch) reported a Q1 EPS loss of -21 cents, a wider loss than consensus of -12 cents.

Tesla (TSLA -2.86%) dropped over 5% in after-hours trading after it reported Q1 EPS of 12 cents, better than consensus of 10 cents, but then said battery cell supply will constrain Q2 production.

21st Century Fox (FOXA -0.89%) reportED Q3 adjusted EPS OF 47 cents, stronger than consensus of 35 cents.

Roundy’s (RNDY -2.86%) reported Q1 EPS of 1 cents, weaker than consensus of 3 cents.

Unum Group (UNM +1.57%) reported Q1 adjusted EPS of 87 cents, better than consensus of 85 cents.

Keurig Green Mountain (GMCR -3.21%) jumped over 6% in after-hours trading after it reported Q2 adjusted EPS of $1.08, higher than consensus of 94 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

8:00 Fed’s Plosser: Monetary Policy

8:30 Daniel Tarullo speech

8:30 Initial Jobless Claims

9:30 Yellen testify before Senate Banking Committee

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AEE, AES, AGO, AMCX, AMED, AMRC, APA, APO, BBEP, BCRX, BDBD, BITA, BPI, CAJ, CBB, CCC, CCOI, CDW, CECE, CECO, CRIS, CRNT, CSTE, CVC, DF, DISH, DNDN, FLY, FSYS, FUN, FXCM, GBDC, GLP, GOLD, GTN, GTXI, HCN, HII, HIMX, HSC, ICE, IRC, JASO, KEM, KERX, LIOX, LNCE, LPI, LPX, LQDT, LXP, LXRX, MGA, MMS, MNK, MPEL, NICE, NPSP, NXST, NXTM, ONE, PCLN, PCP, PKD, POZN, PRFT, REGN, RGEN, RSTI, SKYW, SNI, SPH, SRPT, STE, SUNE, TDC, THS, VC, VITC, VNDA, VRX, WAC, WD, WEN, WIN, WMC, WWAV

Notable earnings after today’s close: ABCO, ACET, ADEP, AHT, AIRM, AL, ALIM, ALNY, AMRS, APEI, AREX, ATHX, AUQ, BCEI, BEBE, BIOS, BPZ, BRKS, CBS, CLNE, CLVS, CPE, CSC, CUTR, DAR, DEPO, DIOD, DMD, DVR, EAC, EBS, ECPG, ED, ELON, ENOC, ENV, EVC, FF, FRT, FUEL, FXEN, GCAP, GRUB, GXP, JAZZ, JCOM, JMBA, KRO, MDRX, MDVN, MELI, MNST, MNTX, MTD, NES, NFG, NOG, NUAN, NVDA, OLED, ORA, PAAS, PFMT, PPO, PXLW, QTWO, RPTP, SF, SGMS, SLW, SLXP, SPPI, SSRI, SSTK, SYMC, TNGO, TUES, TUMI, UBNT, UEPS, UNXL, WAGE, WIFI, XNPT, ZGNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers