Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Korea, China, Hong Kong, Taiwan and New Zealand did well. Europe currently leans to the upside. Italy and Russia are leading the way, followed by Greece and Austria. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is flat, copper is up. Gold and silver are up.

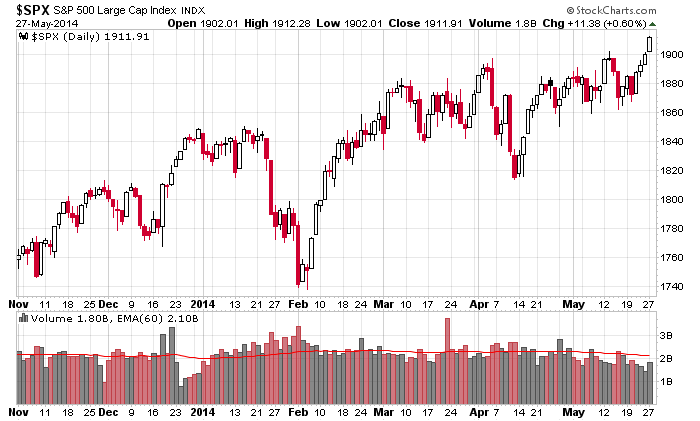

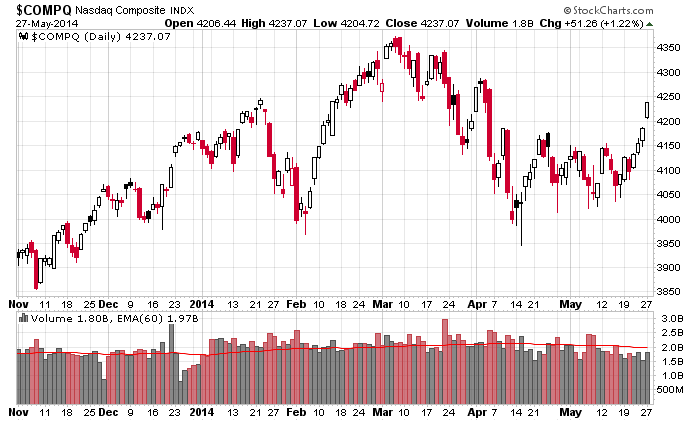

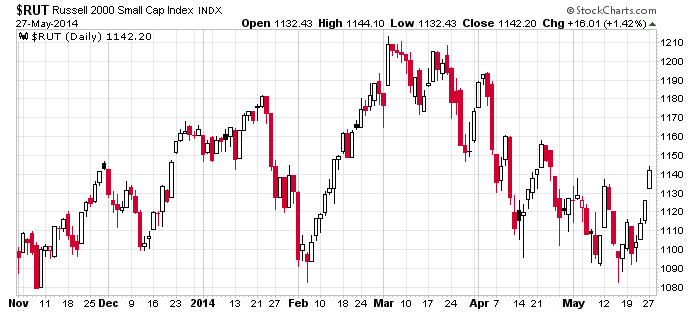

The market followed through very nicely yesterday. The price action was great, but volume was a little on the lighter side. Still, getting follow through several days off a low is needed to somewhat confirm the bottom. That’s what we got…delayed follow through. Everything has been slowly improving for over a week. The index charts, charts of individual stocks, indicators – either flat or upward movement for all of them.

The S&P 500 hit a new all-time high.

The Nas has followed through and put some distance between itself and its consolidation pattern.

The Russell has now taken out two previous highs and is sitting at its highest level in four weeks.

I continue to like the market and absent news that rocks the boat, I expect prices to move sideways and up going forward. More after the open.

Stock headlines from barchart.com…

Michael Kors Holdings (KORS -0.68%) reported Q4 EPS of 78 cents, well ahead of consensus of 68 cents.

Toll Brothers (TOL +0.39%) jumped nearly 7% in pre-market trading after it reported Q2 EPS of 35 cents, better than consensus of 26 cents.

Barclays raised its price estimate for Apple (AAPL +1.87%) to $655 from $590 due to higher overseas iPhone sales, the potential iWatch and new services.

Twitter (TWTR +0.03%) was upgraded to ‘Buy’ from ‘Neutral’ at Nomura.

Lowe’s (LOW +1.53%) was downgraded to ‘Sell’ from ‘Hold’ at Canaccord.

Live Nation (LYV +1.03%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

Williams-Sonoma (WSM -0.66%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

DSW (DSW -1.25%) reported Q1 adjusted EPS of 42 cents, below consensus of 48 cents.

Brown Shoe (BWS +2.32%) reported Q1 EPS of 35 cents, higher than consensus of 31 cents.

Gates Capital reported a 5.1% passive stake in Barnes Group (B +1.79%) .

According to BLoomberg, Xerox (XRX +0.75%) beat out Hewlett-Packard (HPQ -1.84%) for a contract to replace New York’s Medicaid management system valued at an estimated $500 million.

OZ Management reported a 5.37% passive stake in BE Aerospace (BEAV +0.34%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

1:00 PM FRN 2-Yr Note Auction

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: BMO, BWS, CBRL, CHS, DAKT, DSW, KORS, NADL, SDRL, TOL

Notable earnings after today’s close: CPRT, GMAN, PANW, PLKI, SB, TLYS, UHAL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers