Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Singapore and Malaysia moved up. Hong Kong, China, India and South Korea moved down. Europe leans to the downside, although several markets are closed. Italy, Spain and Greece lead to the downside; Russia is up 1.1%. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is down. Oil is flat, copper is down. Gold and silver are down.

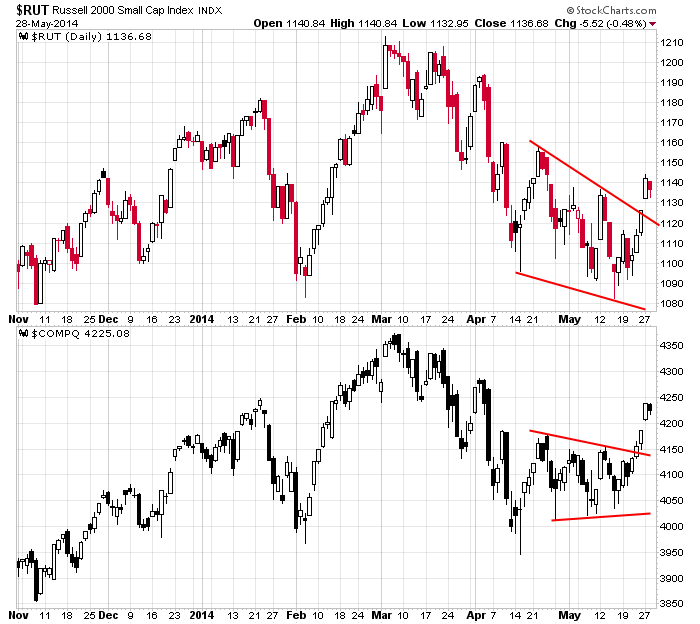

The market mostly rested yesterday…well deserved coming off a nice run that pushed the SPX to a new high and the Russell and Nas out of consolidation patterns. I’ve been saying the small caps hold the key. They lagged during March and April and prevented the large caps from rallying. Now they’re moving up, so it’s no surprise the large caps are at a new high. Going forward, the small caps still hold the key, along with the Nas. As you can see below, both jumped out of several weeks of sideways movement and then rested yesterday. If these two – and there are many stocks which are in both RUT and COMPQ – can hold their current level and leg up again, the large caps will do the same. But if they drop and drop and drop and fall pack into their patterns, the large caps will make no upside progress. The small caps and Nas are in control.

Stock headlines from barchart.com…

Twitter (TWTR +10.69%) was upgraded to ‘Buy’ from Hold at Cantor Fitzgerald.

Palo Alto (PANW -0.14%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James.

Dollar Tree (DLTR -0.73%) was upgraded to ‘Buy’ from ‘Neutral’ at Sterne Agee.

Dollar General (DG -3.02%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

UBS keeps a ‘Buy’ rating on Apple (AAPL -0.26%) and raises its price target for the stock to $700 from $625.

Celgene (CELG -0.54%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Biogen (BIIB -0.31%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

Costco (COST +0.32%) reported Q3 EPS of $1.07, below consensus of $1.09.

Pall Corporation (PLL +0.15%) reported Q3 EPS of 81 cents, weaker than consensus of 83 cents.

Bloomberg reports that American Electric (AEP +0.46%) may decide to sell some of it power plants this year.

Okumus Fund reported a 8.67% passive stake in LifeLock (LOCK +2.52%) .

Apple (AAPL -0.26%) will acquire Beats Music & Beats electronics for $3 billion.

Leidos (LDOS +0.77%) was awarded a $900 million contract by the U.S. Air Force to provide research, development, testing and evaluation for homeland defense and security technical area tasks.

Amerco (UHAL +0.81%) reported Q4 EPS of $2.00, well ahead of consensus of $1.69.

EnerSys (ENS +0.82%) reported Q4 adjusted EPS of $1.18, better than consensus of $1.05.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q1

8:30 Fed’s Pianalto: ‘Inflation and Monetary Policy’

8:30 Corporate Profits

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ANF, COST, FRED, IKGH, MOD, PLL, QSII, SAFM, SBLK, SOL, TECD

Notable earnings after today’s close: AVGO, BLOX, BNNY, ESL, EXPR, FWM, GES, LGF, NMBL, OVTI, PSUN, SPLK, VEEV, VMEM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 29)”

Leave a Reply

You must be logged in to post a comment.

What’s not to like here (assuming you’re bullish)?

We’ve hit my target of 1910. And there are higher targets. Don’t forget there is one I mentioned at 1933 still.

For now, if we hold Wed low at 1907 (can go lower to 1905), they’ll be targeting 1920.

Nearer term, if 1910 (down to 1908) is held, they’ll be targeting 1916.

On the downside, if 1905 is broken, it is possible they go all the way to 1880-1875. If they do,

I’ll update then.

Futures were quiet overnight, most recently hit a high of +3. Just off that now at 9:05.

Will be unable to post Mon and Tues. Should be here tomorrow.

BTW, IBD finally went to “Uptrend confirmed” on their Big Picture segment in yesterday morning’s edition after NASDAQ’s follow thru on Tuesday.