Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. Japan dropped 1.1%, followed by Indonesia (down 0.8%). China moved up 0.7%. Europe is currently mostly down. Italy and Spain are down 1%, followed by Stockholm (down 0.8%), Russian (down 0.7%) and Norway (down 0.6%). Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up slightly. Oil, which was up overnight, is now flat. Copper is up. Gold and silver are up.

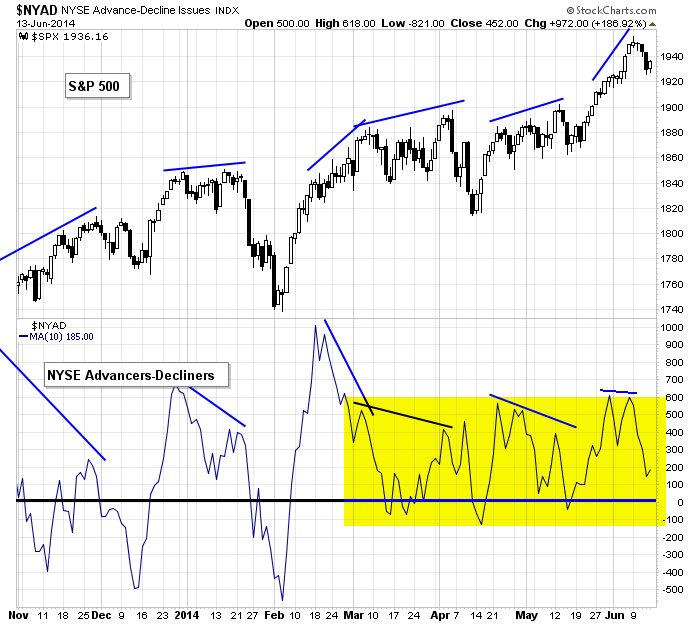

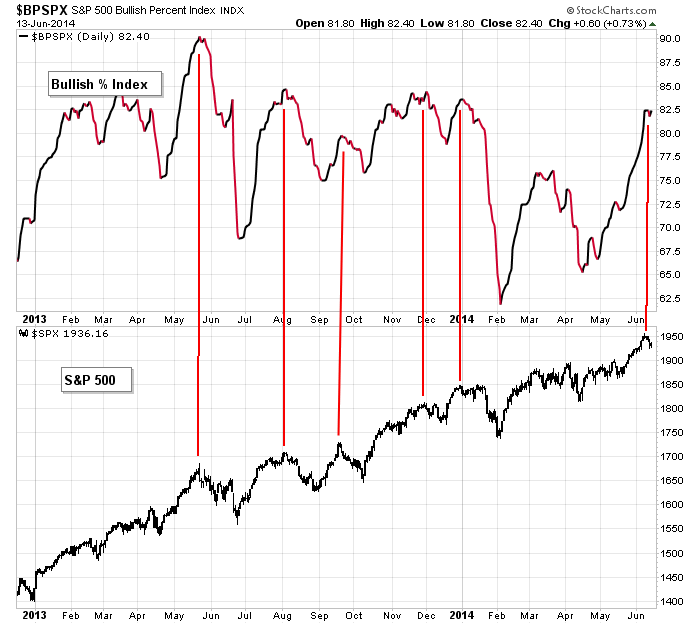

I don’t have anything to add to the conclusion drawn in my weekly Index Report posted yesterday. Overall the market is in good shape. I’m a little concerned the NYSE AD line and NYSE AD volume couldn’t breakout of their ranges and surge to a high level. Given the extent of the move off the mid-May low, a stronger technical setting would have entailed higher prints. I’m also a little concerned the Nas bullish percent is not at a higher level. The Nas isn’t far from a new high, but its bullish percent is well off its high. But surges from new highs and a high print from the SPX bullish percent as well as high prints from the percent of SPX stocks at a 20-day high and above their 20-day MA tell us the intermediate term rally has legs and the market should see higher prices. Overall I like the market and expect higher prices, but in the near term, it’s unclear if last week’s mini correction is over.

I’m swinging for singles while the market does some backing and filling. More after the open.

To partially illustrate what’s stated above, here’s the AD…

And here’s the SPX bullish percent…

Stock headlines from barchart.com…

Norwegian Cruise Line (NCLH -0.18%) was downgraded to ‘Neutral’ from ‘Buy’ at SunTrust.

AK Steel (AKS +0.63%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill.

Williams (WMB +0.70%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies with a price target of $65.

CenterPoint Energy (CNP +0.25%) was upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital.

DISH (DISH -0.14%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

RenaissanceRe (RNR +0.85%) was downgraded to ‘Market Perform’ from ‘Outperform’ at JMP Securities due to valuation.

Micron (MU +1.04%) was upgraded to ‘Outperform’ from ‘Neutral’ at RW Baird.

GNC Holdings (GNC -5.51%) was downgraded to ‘Neutral’ from ‘Outperform’ at RW Baird.

Medtronic (MDT -0.15%) jumped 11% in pre-market trading after Sanford C. Bernstein said that Medtronic’s acquisition of Covidien will allow it to challenge Johnson & Johnson as the world’s biggest medical device company.

Covidien Plc (COV -0.03%) surged 35% in pre-maket trading after Medtronic agreed to buy the company for $42.9 billion.

Eminence Capital reported a 5.1% passive stake in Allscripts (MDRX -1.63%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Empire State Mfg Survey

9:00 Treasury International Capital

9:15 Industrial Production

10:00 NAHB Housing Market Index

Notable earnings before today’s open: LAYN, MPAA

Notable earnings after today’s close: ANFI, KFY

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 16)”

Leave a Reply

You must be logged in to post a comment.

Happy Monday indeed.

We are between two levels:

Resistance above at 1836.50 up thru 1839 ish.

Support below, same as posted on Friday, at 1925 down thru 1916.

It’s summer, volume is lighter, and they’ve been trading sloppily around their levels, so give some (a little)leeway to the numbers above.

FOMC mtg starts tomorrow, report at 2 PM Wed. No big eco reports til then, so things might be a yawner til Wed.

Futures were negative all night, -9.25 at the low, now at 9:10 -3.0