Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

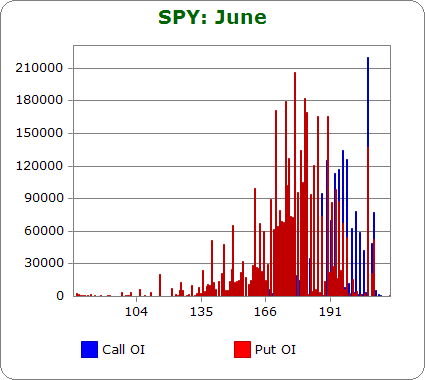

SPY (closed 194.28)

Puts out-number calls 2.6-to-1.0…slightly more bearish than April.

Call OI is highest between 188 and 195 and then again at 200.

Put OI is highest between 175 and 192.

There’s some overlap between 188 and 192. but most of the call OI is at 192 and above. SPY will need to close in the middle of upper part of this range to cause max pain. Today’s close was at 194.28 – well above the range. This means, as of now, some call buyers are in line to make money. SPY will need to move down a couple points the next couple days for max pain to be realized.

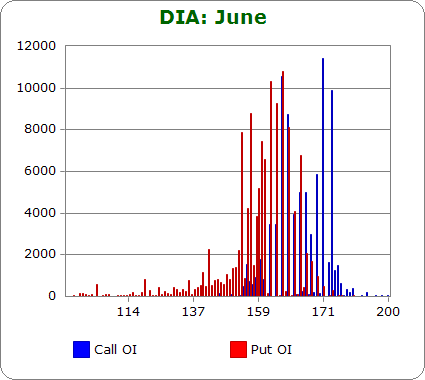

DIA (closed 167.73)

Puts out-number calls 1.6-to-1.0….more bearish than April.

Call OI is highest at 164 & 165 an then again at 170, 171 & 173.

Put OI is highest at 153, 156 and between 159 & 165.

Very little OI results in a lack of smooth data. Nevertheless there’s some overlap near 164/165. Today’s close was at 167.73 – well above the needed area. Like SPY, a move down is needed to cause max pain.

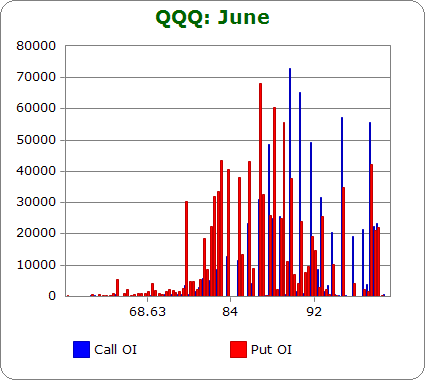

QQQ (closed 92.41)

Puts out-number calls 1.5-to-1.0…much more bearish than in previous months.

Call OI is highest between 87 & 92 and at 94/95 and 98/99.

Put OI is highest between 82 & 90 and at 94/95 and 98/99.

There’s overlap between 87 and 90 and then matching OI strikes at higher levels (94/95 and 98/99). Someone is going to make money here…the question is who and how much. If we ignore the matching strikes, a close between 87 and 90 would cause a lot of pain, while the higher strike put buyers make money. If we get a move to those matching strikes, the call buyers between 87 and 92 would cash in. Let’s ignore the higher strikes. Today’s close was at 92.41 – a couple points above ideal range (87-90). The Q’s need to move down to accomplish the max pain mission.

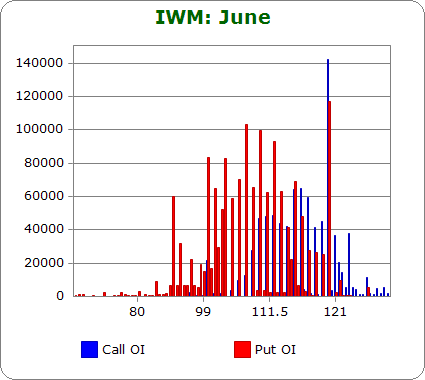

IWM (closed 116.13)

Puts out-number calls 2.0-to-1.0…much less bearish than April.

Call OI is highest between 110 and 120, with the big spike taking place at 120.

Put OI is highest between 100 and 114, and there’s a big spike at 120.

The data here is smooth. Let’s ignore the big spike at 120. There’s overlap between 110 and 114, so a close in here – preferable at the higher end of the range – would cause max pain. Today’s close was at 116.13 – a couple points above the range. A move down is needed the next couple days.

Overall Conclusion: The bears pressed their cause with SPY, DIA and QQQ options but lighted up with IWM. In all cases these ETFs are above where they need to be to cause max pain, so a move down is needed by Friday’s close. I guess last week’s pullback wasn’t enough. As of now, call buyers will makes some money.