Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mixed. India rallied 1.3% followed by Taiwan (up 0.9%), Indonesia and Korea (up 0.7%) and China (up 0.6%). Australia dropped 0.9%. Europe is currently mixed. Russian, Italy and Spain are down the most; there are no big up markets. Futures here in the States point towards a flat-do-down open for the cash market.

The dollar is flat. Oil is down, copper up. Gold and silver are down.

As is typically the case on a Monday morning, I don’t have anything to add to the comments made over the weekend in the weekly Index Report.

The SPX is in good shape, and the indicators are positioned to move up and support a rally should the market want to bust out and run.

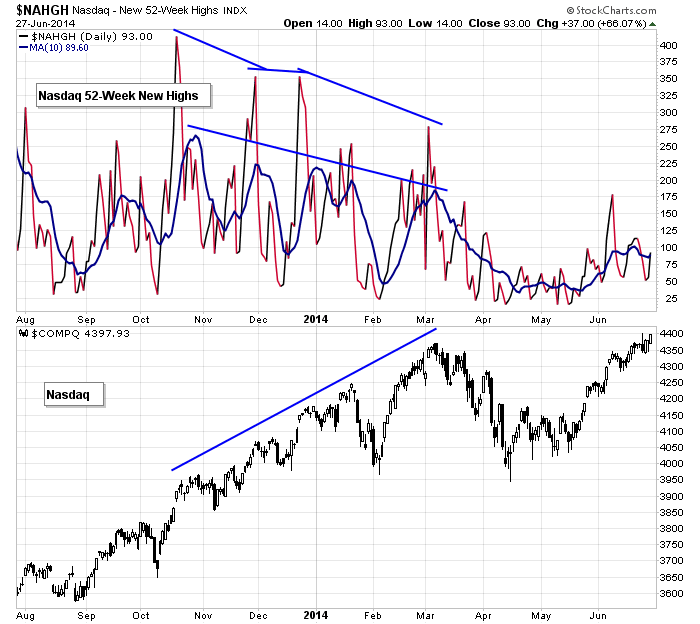

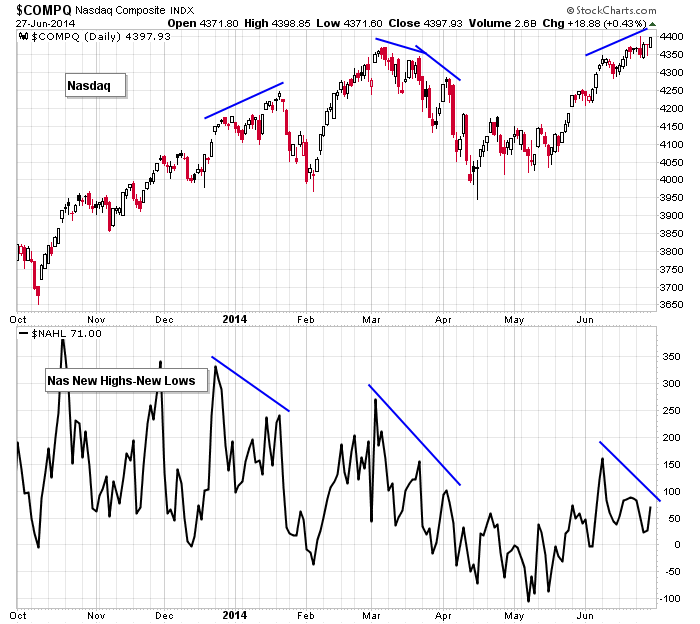

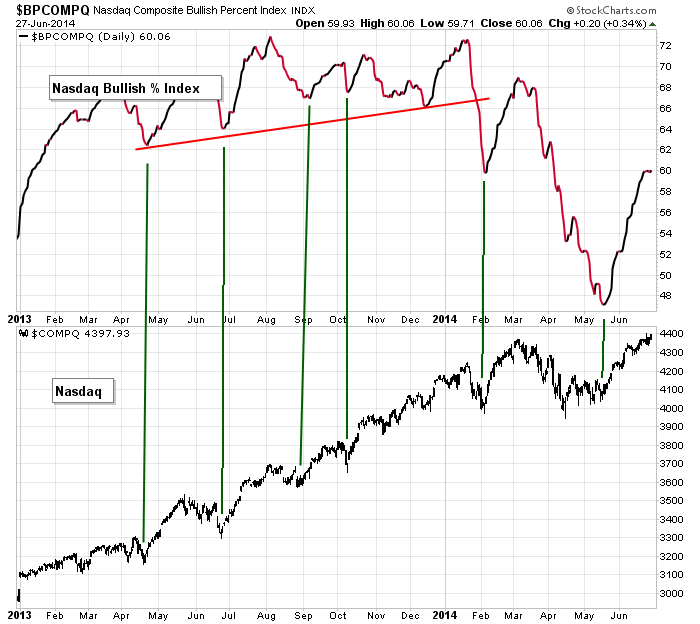

But support for a Nasdaq rally isn’t here. New highs are declining at a time when the Nas is sitting at its highest level since 2000. New highs-new lows has put in a lower high while the underlying pushes to new highs. And the bullish percent is nowhere near where it was the last time the Nas was at this level. I’m a little concerned with the weak Nasdaq breadth, so my stance remains the same. Long term I like the market; short term we need to be cautious.

Here are the charts just mentioned.

NASDAQ vs. NASDAQ New Highs:

NASDAQ vs. NASDAQ New Highs-New Lows:

NASDAQ vs. NASDAQ Bullish Percent Index:

Stock headlines from barchart.com…

KLA-Tencor (KLAC +1.44%) was upgraded to ‘Buy’ from ‘Neutral’ at B. Riley.

Affiliated Managers (AMG +0.95%) will replace Forest Labs (FRX -0.19%) in the S&P 500 Index as of today’s close.

Amedisys (AMED +29.81%) was upgraded to ‘Hold’ from ‘Sell’ at Deutsche Bank.

DaVita (DVA +1.87%) was initiated with a ‘Buy’ at Jefferies with a price target of $86.

Yahoo (YHOO +1.75%) rose nearly 2% in pre-market trading after Piper Jaffray raised its outlook on the stock to ‘Overweight.”

Claren Road Asset reported a 4.96% passive stake in YRC Worldwide (YRCW +3.15%) .

Martin Marietta (MLM +1.61%) will replace U.S. Steel (X -0.31%) in the S&P 500 as of the close on July 1.

MSDC Management reported a 5.6% passive stake in Ring Energy (REI -2.76%) .

D.E. Shaw reported a 5.1% passive stake in Beazer Homes (BZH +2.60%) .

bebe stores (BEBE +0.64%) said it sees Q4 Same-Store-Sales in the negative low single digit range. The company was then downgraded to ‘Neutral’ from ‘Buy’ at B. Riley.

Point72 Asset reported a 5.5% passive stake in TRI Pointe Homes (TPH -1.29%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:45 Chicago PMI

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Outlook

Notable earnings before today’s open: none

Notable earnings after today’s close: IRET

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 30)”

Leave a Reply

You must be logged in to post a comment.

This is going to be a short week, and the attention will begin to focus on Thurs morning with the monthly non-farm payrolls/unemployment rate report.

In the meantime, Friday was a bullish day and as Jason predicted, the volume was immense due the the Russell rebalancing. They traded it technically by hitting support and finishing the day at that support’s target.

For today and this week: There is support at SPX equivalent 1956 which futures reacted to at 7 am. That extends to 1954. The target for that support is 1964.

If 1954 breaks, we can drop to 1953-1951 and still be bullish. We’ll have to watch to see if the upper support holds, which it appears to be doing.

Futures were +1.50 to -4.00 overnight, at 9 am -.50