Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan led with a 1.1% gain followed by Taiwan (up 0.5%) and India (up 0.4%). Singapore dropped the most (down 0.4%) followed by Australia (down 0.3%). Europe is currently mostly up. Greece is up 1.1% followed by London and France (up 0.6%) and Norway (up 0.5%). Prague is down 0.9%. Futures here in the States point towards an up open for the cash market.

The dollar is flat. Oil is up, copper down. Gold is flat, silver is up.

Yesterday was slow…this is a holiday-shortened week…and there’s a good chance traders use today’s US soccer game as an excuse to either not show up at work to leave early, so I’m not expecting much to happen today. Perhaps a repeat of yesterday.

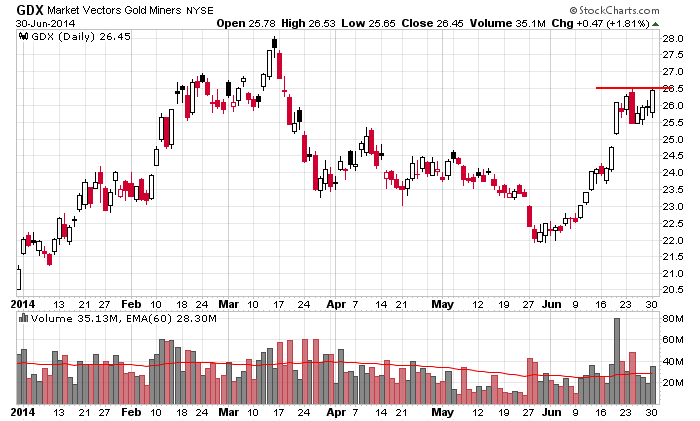

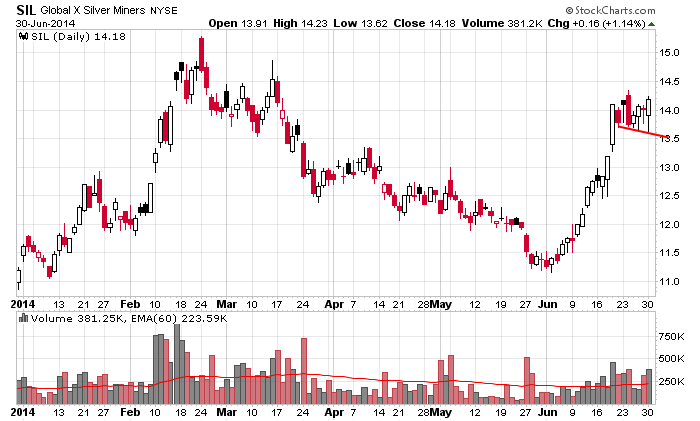

Gold and silver, which went on a nice run and are now resting, appear eager to bust out again. The first move off a depressed level is the easy one, but if the metals can breakout and rally again, the 4-year downtrend may officially be over. Here are GDX and SIL – ETFs.

My stance remains the same. Long term I like the market. Short term the market is iffy, so we need to be careful.

Stock headlines from barchart.com…

Goldman Sachs upgraded Netflix (NFLX -0.33%) to ‘Buy’ from ‘Neutral’ and raised their price target on the stock to $590 from $380.

BofA/Merrill lowered Goldman Sach’s (GS +0.40%) Q2 EPS estimate to $3.00 from $3.44, vs. consensus of $3.16 and Morgan Stanley’s (MS +2.47%) Q2 EPS estimate to 54 cents from 63 cents, vs. consensus of 58 cents to reflect lower trading revenues and mixed capital markets activity.

FBR Capital reiterated its ‘Outperform’ rating on Hanesbrands (HBI +0.19%) and raised their price target on the stock to $111 following the company’s acquisition of DBApparel.

Urban Outfitters (URBN +0.36%) was downgraded to ‘Neutral’ from ‘Outperform’ at Wedbush.

Symantec (SYMC +0.57%) was downgraded to ‘Market Perform’ from ‘Outperform’ at BMO Capital.

Martin Marietta (MLM -0.14%) will replace U.S. Steel (X +0.08%) in the S&P 500 as of the close of trading today.

Boeing (BA -1.02%) was awarded a $1.94 billion fixed-price-incentive-fee government contract for the full rate production of 11 Lot 38 F/A-18E aircraft for the U.S. Navy and 33 EA-18G aircraft for the U.S. Navy and the government of Australia.

Northrop Grumman (NOC -0.86%) was awarded a $3.64 billion government contract modification for the procurement of 25 full rate production E-2D Advanced Hawkeye aircraft.

Bloomberg reports that BNP Paribas (BNPQY +0.40%) agreed to plead guilty to processing transactions involving Sudan, Iran and Cuba and will pay $8.8 billion in fines.

Expedia (EXPE -0.24%) was initiated with an ‘Outperform’ at Oppenheimer with a price target of $90.

Goldman Sachs (GS +0.40%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Bernstein.

Priceline (PCLN -0.20%) was initiated with an ‘Outperform’ at Oppenheimer with a price target of $1450.

TECO Energy (TE +0.76%) filed to sell 15.5 million shares of common stock.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:45 ICSC Retail Store Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

11:00 Global Manufacturing PMI

Notable earnings before today’s open: AYI

Notable earnings after today’s close: CAMP, PAYX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 1)”

Leave a Reply

You must be logged in to post a comment.

We hit 1964 as expected, then the rest of the day was a yawner. Summertime.

This morning they’ve taken it higher and if they hold what we have, we’ll gap up to that 1964 region.

We still are targeting 1969, and we’ll get there but that would be a stretch right at the open.

Instead, after the gap higher at the open, anticipate a pullback to no lower than 1960 or so.

They should bounce it there.

If they don’t, they can bring it down to another support level at 1955-1952 and the market still

remains bullish.

You can short the pullbacks, just don’t overstay your welcome. Those support levels are powerful.

Overnight futures were bullish: +1.00 to +5.75

At 905, +4.75

Might not be able to post tomorrow. If not, should be able to Thurs after the big two eco reports.

He we are at 1969 level…5th wave up…going to the 101.8 % fib level…if that means anything…

TKS, Jim. FYI, short now. Seeing if this is a top for a little bit.

same here…dia 169p at .50

Not yet.

what is your trigger?

Jim. Simple version: I have signals (sell in this case) with tight stops. As secondary, I use “ticks” and VIX (5 min candles). All three have to agree. Vix is dropping (bullish), ticks are strong + (bullish) at every sell signal so far.

Some days they just run it up and keep it there.

ok, i use the adv with the tick and ur right…looks like it wants to stay put…i had some -600 ticks at the 9:55 est.

Agree, 955. 10 am can be a good reversal time, I liked what I saw at 10:15-17, but VIX never got very negative and I decided to bail out even. Since then VIX has been heading lower. Good for the bulls and not for shorts.

They look to be headed for another target equivalent to 1976-77 (which I thought was out of sight for today), so I’ll set an alert and see if they decide to take a breather there. Til then I’m “watch and wait.”

the ”tick’ indicator with vix is a good combination

but for quite a while now, the volitility just hasnt been their for myself to be a active daytrader

so ive been playing up and making a fool of myself at other things

long live the futures index daytraders

No indicator is perfect, but I’m blind without VIX which I’ve found to be the most reliable (next to price.) It has been “true” this morning, tell ya.

Ticks are helpful, particularly when they exceed 1000 in either direction, which usually precedes a reversal.

We all have our favorites, and one thing I’ve found is that what works for one, doesn’t work for another. And you’ve got to know your indicator, like when you can trust it and when you can’t. As well as how to display it so that it works for your style.

Just my opinion.

Looks like their goal is Dow 17K, got to 16998.7 and had to fall back and reload. Such drama.

yea i was telling my wife that dow 17k was an area for the correction to begin..via harry dent

If you’re able, plot VIX on 5 min candles. You’ll see at 1:15 it predicted the top before price which topped at 1:25.

yes at 12:10 est it bottomed…thx will start to look at that..

just woke up to aussie wed morning

some very insightfully comments made today

does anyone use the NY trader piviot points as well

the instos use them a lot to place their buy/sells

i have been using ZANER MORNING MARKET OVERVIEW. It will have S, R and pivot

Aussie, Good morning.

Don’t use them any longer. Have (or ‘ave) a good day.