Good morning. Happy Wednesday.

The Asian/Pacific markets closed up across-the-board. Australia, India and Hong Kong rallied more than 1%. Korea and Singapore also did very well. Europe is currently mostly up. Russia and Greece are up more than 1%. Austria, Belgium, London and Stockholm are also posting decent gains. Futures here in the States point towards a small gap up open for the cash market.

The dollar is down slightly. Oil is down, copper is up. Gold and silver are flat.

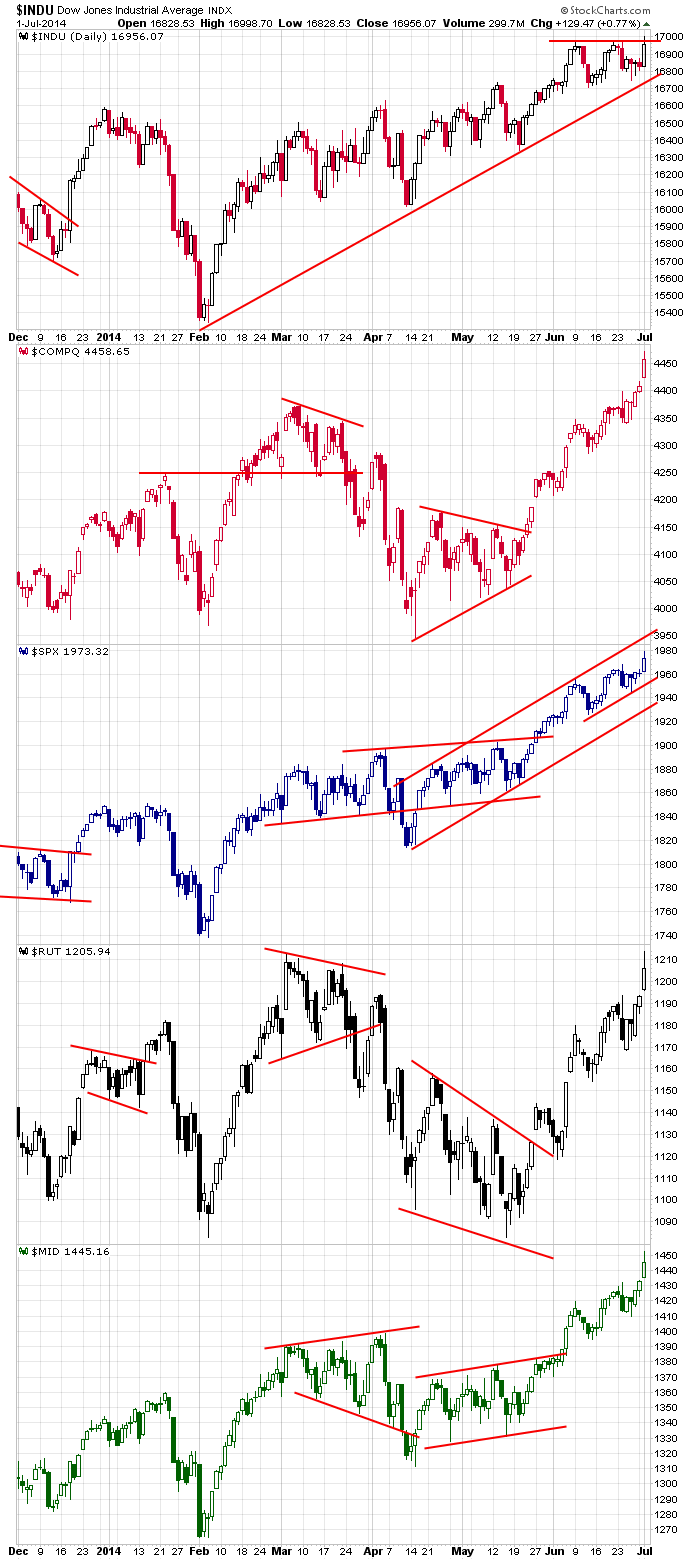

Big breakout day for the market. Several indexes hit all-time highs…only the Nas and Nas 100, which have rallied 10% the last two months and have been leading, are below their dot com bubble highs. The bears continue picking tops, and they continue being wrong. I don’t get it. There a lot of money to be made within a trend, that missing an exact turning point isn’t a big deal…there’s always time to jump in and grab a bunch of points in the middle. Oh well. I’m not going to complain. As long as the bears remain non-believers, the market will continue higher.

Here are the indexes I closely follow…

There are technical warnings in the form of the AD line and AD volume line not matching the market’s highs. Also the put/call ratio has bottomed and moved up. Still the trend is up, and when this is the case, you’re either very long, partially long or on the sidelines. No sense being short.

Before tomorrow’s open we get the latest employment numbers. Traders/investors may initiate or close positions at the open, but then Wall St. will get very quiet very fast. The market is closed Friday.

Don’t over-analyze. He who thinks too much loses. The trend is up. Period. Unless you’re running a multi-billion dollar hedge fund, you probably can get flat in less than a minute, so you don’t need to call tops. More after the open.

Stock headlines from barchart.com…

Oracle (ORCL +0.59%) was upgraded to ‘Overweight’ from ‘Neutral’ at Atlantic Equities.

Credit Suisse downgraded Hormel Foods (HRL -0.32%) to ‘Neutral’ from ‘Outperform’ citing valuation.

Men’s Wearhouse (MW +0.99%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Beazer Homes (BZH +1.10%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

Greenbrier (GBX +0.19%) reported Q3 EPS of $1.03, well above consensus of 74 cents, and then raised guidance on fiscal 2014 EPS ex-items to $2.98-$3.08, above consensus of $2.61.

Barclays downgraded the U.S. Major Pharmaceuticals sector to ‘Neutral’ from ‘Positive’ citing valuations.

Bristol-Myers (BMY -0.80%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Barclays.

Harley-Davidson (HOG +0.69%) fell 1% in pre-market trading after Ramond James lowered its recommendation on the stock to ‘Market Perform’ from ‘Strong Buy.’

Bank of America (BAC +1.50%) rose 1% in pre-market trading after Deutsche Bank upgraded its recommendation on the stock to ‘Buy’ from ‘Hold.’

Luxor Capital reported a 9.9% stake in RCS Capital (RCAP +4.57%) .

Pandora (P +0.34%) slipped over 1% in after-hours traqding after Google acquireed music streaming service Songza.

CBOE Holdings (CBOE -0.47%) reported June trading volume totaled 100.18 million contracts with average daily volume of 4.77 million contracts, up +3% m/m but down -11% y/y.

Aisling Capital reported a 5.5% passive stake in Lombard Medical (EVAR -0.97%) .

Berkshire Hathaway lowered its stake in Graham Holdings (GHC +0.58%) to 1.72% from 27.7%.

A. Schulman (SHLM +2.14%) reported Q3 adjusted EPS of 74 cents, better than consensus of 66 cents, and then raised guidance on fiscal 2014 adjusted EPS view to $2.31-$2.36, higher than consensus of $2.27.

Paychex (PAYX +1.37%) reported Q4 EPS of 40 cents, right on consensus, although Q4 revenue of $617.2 million was slightly below consensus of $617.35 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

7:30 Challenger Job-Cut Report

8:15 ADP Jobs Report

8:30 Gallup US Payroll to Population

8:30 Gallup U.S. Job Creation Index

10:00 Factory Orders

10:30 EIA Petroleum Inventories

11:00 Janet Yellen speech

Notable earnings before today’s open: GBX, STZ

Notable earnings after today’s close: SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 2)”

Leave a Reply

You must be logged in to post a comment.

“There are technical warnings” Great point. I run several models and all of them gave strong sell signals last night. Picking tops is just very hard to do. The one indicator which keep me from going short is the high PC ratio. Unless the PC ratio is in the .5-.7 area I will be long or on the sidelines.

Daddy Paul:

What is the full name for the “PC ratio” as I can’t grasp the initials. Thanks, Es De

put/call ratio

like bottom fishing bulls ,then the bears have a right to top fish fat complacent ,obeastly ,growtesk,

belly flopping big bull

personally i like to daytrade tops as they are usually volitile and only get seriously short when hope is gone and the fat bull is at the abatour’s and ready for the eating

i am only watching atm

but time is coming and the end of the world ,while postpond is fast aproaching

cheif watching bear