Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. India and Indonesia led; Taiwan lagged. Europe is currently mostly posting solid gains. Germany, France, London, Austria, Amsterdam, Italy, Spain and Stockholm are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

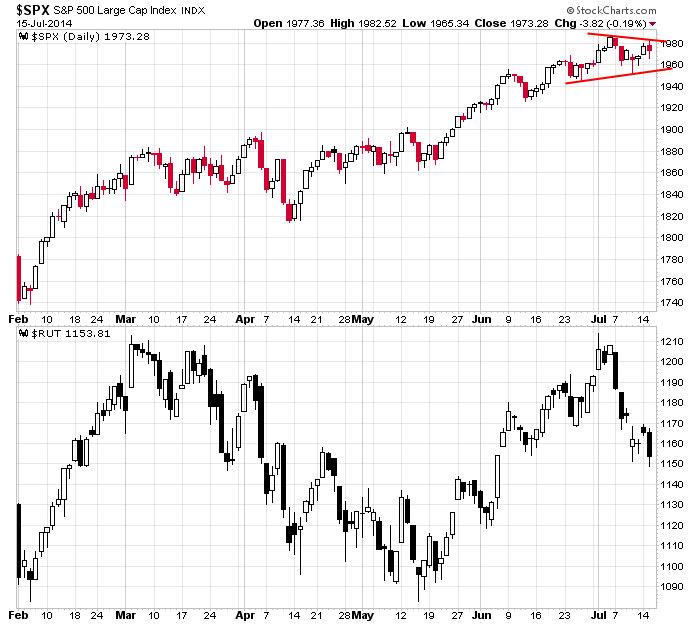

The battle right now is right here between the large caps and small caps. The SPX looks great – steady trend, all dips getting bought, currently consolidating. RUT got rejected by its previous all-time high and is now moving down with a little force. The disparity between these two cannot last much longer.

The indicators are in the small caps’ camp.

The quality and quantity of good trading set ups are also in the camp of those looking for more downside.

The wild card right now is earnings. If we suddenly get some good surprises, the market market can move up quickly.

Intel had earnings yesterday. The company raised Q3 and year-over-year guidance and said the worst is over the PC industry. The stock is up better than 5% premarket.

I will continue my MO. I like the market overall, but in the near term there are enough cross-currents to keep me in conservative mode.

Stock headlines from barchart.com…

St. Jude Medical (STJ -1.91%) reported Q2 adjusted EPS of $1.02, better than consensus of $1.00.

US Bancorp (USB +0.58%) reported Q2 EPS of 78 cents, higher than consensus of 77 cents.

Textron (TXT -0.49%) reported Q2 EPS of 51 cents, higher than consensus of 46 cents.

Bank of America (BAC +1.54%) reported Q2 EPS of 41 cents, better than consensus of 29 cents.

Blackrock (BLK +0.15%) reporteed Q2 EPS of $4.89, stronger than consensus of $4.46.

International Game Technology (IGT unch) jumped almost 10% in pre-market trading after Gtech SpA agreed to buy the company for $4.7 billion.

Apple (AAPL -1.17%) and IBM (IBM -0.72%) both rose nearly 2% in after-hours trading after both companies announced an exclusive partnership that teams the market-leading strengths of each company to transform enterprise mobility through a new class of business apps that will bring IBM’s big data and analytics capabilities to iPhone and iPad.

AAR (AIR -1.69%) reported Q4 EPS of 43 cents, better than consensus of 41 cents.

Yahoo (YHOO -0.25%) slid 2% in after-hours trading after it reported Q2 EPS of 37 cents, below consensus of 38 cents, and then said it sees Q3 revenue ex-items $1.02 billion-$1.06 billion, weaker than consensus of $1.10 billion.

Hershey (HSY -0.35%) raised wholesale prices approximately 8% across the company’s instant consumable, multi-pack, packaged candy and grocery lines effective today.

CSX (CSX +0.39%) reported Q2 EPS of 53 cents, higher than consensus of 52 cents, although Q2 revenue of $3.2 billion was slightly less than consensus of $3.25.

Intel (INTC +0.70%) rose 5% in after-hours trading after it reported Q2 EPS of 55 cents, better than consensus of 52 cents, and then said it sees Q3 revenue of $14.4 billion, plus or minus $500 million, higher than consensus of $14.02 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Producer Price Index

9:00 Treasury International Capital

9:15 Industrial Production

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 NAHB Housing Market Index

10:00 Yellen delivers semi-annual monetary policy testimony

10:30 EIA Petroleum Inventories

12:00 PM Fed’s Fisher: Monetary Policy

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: ABT, ASML, BAC, BLK, FRC, IGTE, MTG, NTRS, PNC, SCHW, STJ, TXT, USB

Notable earnings after today’s close: EBAY, EPB, EWBC, HAWK, KMI, KMP, LVS, PLXS, RLI, SCSS, SNDK, URI, YUM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 16)”

Leave a Reply

You must be logged in to post a comment.

This is interesting what da boyz are doing. We have some good movement early in the day, but it tapers off around 130, then overnight they move up to reach their target. Just an observation. If the futures hold their gains, we’ll open with a gap up near y’day’s morning high.

As you can read, I keep expecting a pullback, but we’re getting only small ones so far.

What I expect based on y’day’s low is that they have set their sights on a target of 1989. As always, don’t expect a beeline for it. There surely could be a pullback today, and if there is, as long as Tuesday’s low is held within a point or two, 1989 is the target.

Yellen testifies at 10, Fisher at noon, and Beige Book at 2. Take nothing for granted when those events happen, especially Yellen and Beige Book.

Futures were + all night, peaked at +9.75 after the 830 reports. AT 915, they are +8.50.

Starting to report this item: Bonds show bullish for stocks, although have melted in enthusiasm.

“RUT got rejected by its previous all-time high and is now moving down with a little force. The disparity between these two cannot last much longer. ”

An understatement! My RUT model showed a clear buy signal Yesterday. The NASDAQ is close to showing a sell signal.

YUCK.