Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Indonesia, China and Taiwan led to the downside; South Korea led to the upside. Europe is currently down across the board. Russia is down 3% followed by Greece, Prague, Switzerland, Amsterdam, France, Germany, Italy and Spain, which are also posting decent losses. Futures here in the States point towards a relatively big gap down open for the cash market.

The dollar is flat. Oil is up 1.42, and copper is down. Gold is up slightly, silver is down.

When you wake up in the morning and see Russia down 3% and oil futures up $1.42, you know something has escalated in Eastern Europe. In this case it was Ukrainian fighter jet being shot down by a Russian plane.

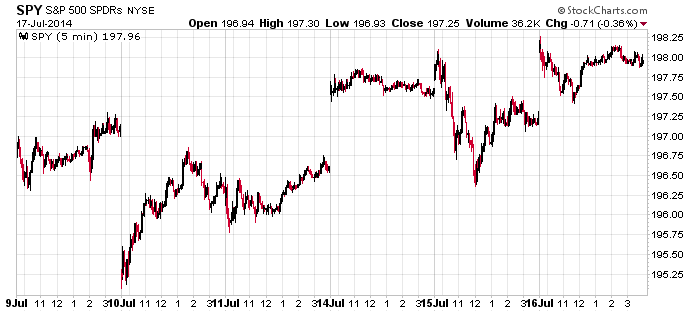

So following yesterday’s big gap up, we’ll get a big gap down today. In fact we’ve gotten a lot of big gaps lately. Check that, we’ve gotten a lot of extremely big gap opens lately. Volatility has been very low, and the intraday ranges very small. We’re getting gaps that are bigger than the recent ranges.

Here’s the SPY over the last six days to show the gaps.

My stance on the market remains the same. I like the market long term, and unless something major happens in the world, the indexes are likely to hit new highs again – including the Russell, which has been lagging. But in the near term, things are iffy – they’ve been iffy for a couple weeks. Breadth indicators have not supported more upside, the divergence between the small and big caps is concerning and there hasn’t been many good set ups to play anyways. I’ve been in conservative mode for two weeks – partly because of the market, partly because of moving back to the States – and am happy for it. Other than a quick trade here and there, the best course of action for swing traders has been to lay low.

Stock headlines from barchart.com…

Mattel (MAT +0.23%) reported Q2 EPS of 3 cents, well below consensus of 18 cents.

Morgan Stanley (MS +1.56%) reported Q2 EPS of 60 cents, better than consensus of 56 cents.

AutoNation (AN +0.07%) reported Q2 EPS of 83 cents, weaker than consensus of 87 cents.

Sherwin-Williams (SHW -0.29%) reported Q2 EPS of $2.94, higher than consensus of $2.93.

Snap-On (SNA +0.48%) reported Q2 EPA of $1.80, stronger than consensus of $1.68.

KeyCorp (KEY -1.32%) reported Q2 EPS of 29 cents, above consensus of 26 cents.

Fifth Third Bancorp (FITB -0.92%) reported Q2 EPS of 43 cents, right on expectations.

UnitedHealth Group (UNH -0.17%) reported Q2 EPS of $1.42, higher than consensus of $1.26.

Danaher (DHR +0.33%) reported Q2 EPS of 93 cents, below consensus of 94 cents.

eBay (EBAY -0.22%) climbed over 1% in pre-market trading after it reported Q2 EPS of 69 cents, better than consensus of 68 cents.

Yum! Brands (YUM -0.57%) dropped over 2% in after-hours trading after it reported Q2 EPS of 73 cents, lower than consensus of 74 cents.

SanDisk (SNDK +2.15%) slid over 9% in after-hours trading after it reported Q2 adjusted EPS of $1.41, better than consensus of $1.39, but then lowered guidance on Q3 revenue to $1.675 billion-$1.725 billion, below consensus of $1.74 billion.

Las Vegas Sands (LVS -0.57%) fell 3% in after-hours trading after it reported Q2 adjusted EPS of 85 cents, below consensus of 90 cents.

Plexus (PLXS +0.21%) rose over 3% in after-hours trading after it reported Q3 adjusted EPS of 74 cents, higher than consensus of 72 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Housing Starts

8:30 Initial Jobless Claims

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

1:35 PM Fed’s Bullard: U.S. Economic Outlook and Monetary Policy

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ADS, AN, BAX, BHI, BX, CP, CY, DHR, DOV, FCFS, FCS, FITB, GWW, HLSS, KEY, MAT, MS, MTB, NEO, NTCT, NVS, ORB, PM, PPG, PVTB, SAP, SHW, SNA, SON, SYNT, TSM, TZOO, UNH, UTEK, WBS, WSO

Notable earnings after today’s close: AMD, ASBC, ATHN, BGS, CE, COF, CPHD, CYT, EFII, GOOG, GRT, IBM, PBCT, SLB, STX, SWKS, SYK, VMI, WAL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 17)”

Leave a Reply

You must be logged in to post a comment.

All that Jason said, ditto.

I mentioned just yesterday how da boyz have a quiet session starting at lunch time, then run it up overnight. Well, yesterday and last night were the opposite. They ran it up during the day only to have it come down pretty heavily overnight. World news definitely affects the market. The overnight low was just 3 points higher than Tuesday’s low. That low, down to 1963 or thereabouts, needs to hold.

Breaking it, as I said Mon and Tues, we stair step lower to the 1940s. Whether 1940s holds, can’t say.

Tomorrow is OPEX and 4 pm today the SPX July options cease trading.

If I am not be able to post tomorrow morning, I’ll post later in the day.

Futures were – 13.25 and have since risen to -7.00 at 9:10.

SPX needs to rise above 1973-74. And of course, any pullback that descends below it, needs to bounce and stay above 1970. If 1970 is broken, 1967 will be tested and the results of that test will give you a direction for the day.

Bonds are bearish

MSFT says they’ll cut 18 k jobs and Beige Book says labor market shows improvement? Just sayin’

buying action from the get go…now spx 15m sold of the 10ema. got a funny feeling spx test the 1974 again…

looks like it wants to make a higher high today…

hmmm, vix had a moment there…10.80 for the 3rd time.

Very strange day. Bonds are/have been bearish from their open.

The bulls made a definite statement 20 minutes ago.

Lots of resistance: same old 1974 level.

So we’ve got our markers: low at 1130 and 1974.

Been and will be preoccupied with a speech I’m giving tonight.

Will try to check in now and then.

when i saw them run the stops at the 10am high on dia and then the vix shot up…i had a feeling that this was a pump and dump…2nd -1100 tick at 1200 est

My stance on the market. Sell gap ups Buy gap downs.

Sell enough puts you will get stocks.. Sell enough calls you will get dry powder.

i count on the 5m chart (7) -1000 ticks today…i haven’t seen that in a long time…