Good morning from Colorado where our 18-month excursion ends and another begins. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. China rallied 1.8%, followed by India (up 0.95%), Taiwan (0.7%) and Indonesia (up 0.6%). Singapore dropped 0.8%. Europe is currently mixed. France is up 0.8%, followed by Italy (up 0.7%) and Norway and Sweden (up 0.6%). Swtizerland is down 0.8% and Greece is down 0.6%. Futrues here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil is down, copper up. Gold is down, silver up.

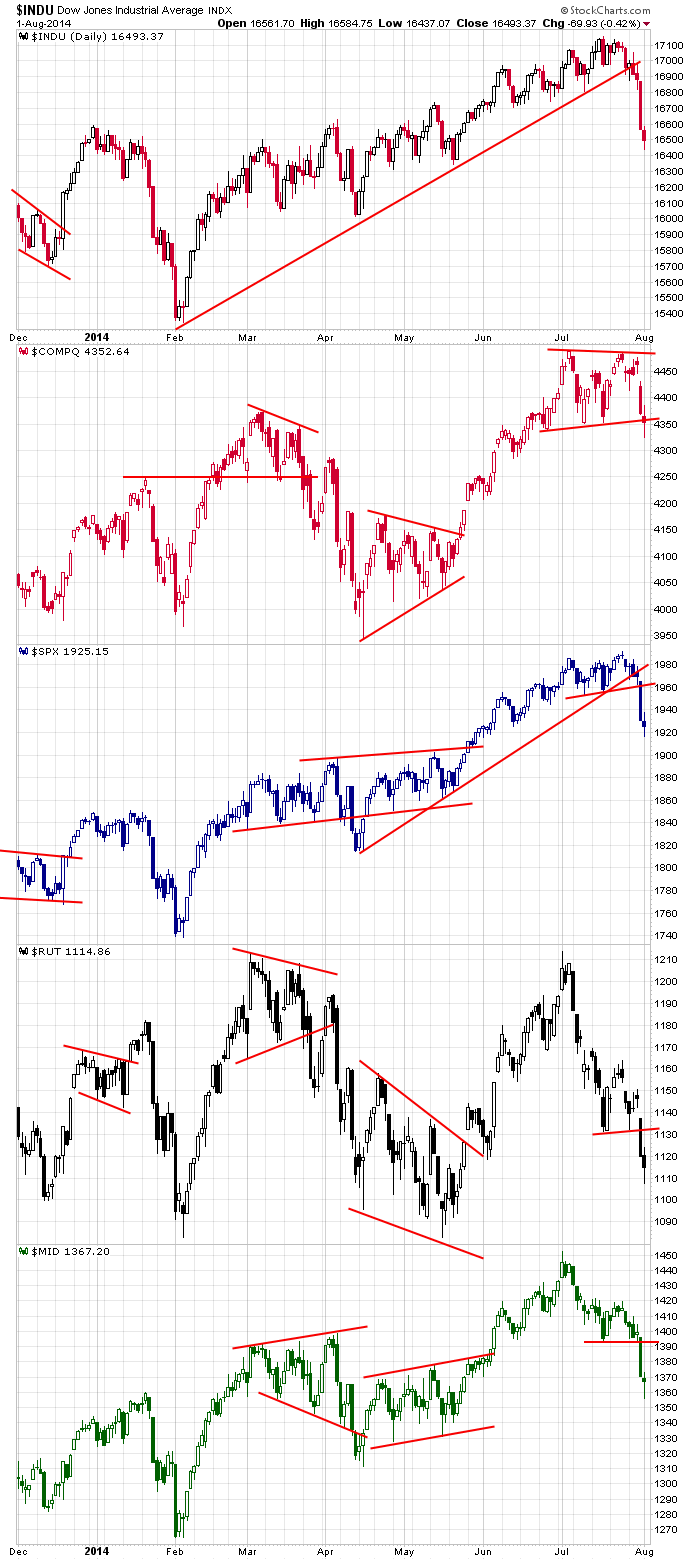

The market got hit hard last Thursday and then followed through a little Friday before closing off its lows. Here are the daily charts. The Russell small caps and S&P mid caps, which had already been in short term downtrends, continued down. The Dow and S&P 500 took out multi-month uptrend lines. The Nas is clinging to support of a consolidation pattern.

From a trading standpoint the market is in no-man’s land, so there isn’t much for a swing trader to do. It’s too late to chase stocks to the downside, and aggressively buying for anything but a quick bounce is out too. If you’re a slick short term trader who can navigate the short term waves, go for it. But for swing traders, the best entry will be either shorting a bounce that lacks energy and force or waiting for a complete washout to the downside to go long. Going long or short now constitutes playing in the middle.

Market turns always frustrate everyone. The market moves up and down – many head fakes in both directions – to try and make sure the least number of investors participate in the next move. That’s the market’s MO. It’s normal, so accept it. Don’t fight the market…position yourself to profit from its movement. The game is never to fight the entity you cannot control…it’s to simply see what it’s doing and trade in the direction of its flow. And if you don’t know what it’s doing, that’s fine. Sit tight until it becomes more obvious.

Stock headlines from barchart.com…

Loews (L +0.28%) reported Q2 EPS of 79 cents, higher than consensus of 67 cents.

Michael Kors Holdings (KORS +0.43%) reported Q1 EPS of 91 cents, well above consensus of 81 cents.

Cardinal Health (CAH +1.00%) reported Q4 EPS of 83 cents, better than consensus of 81 cents.

Alere (ALR -0.12%) reported Q2 adjusted EPS of 42 cents, well below consensus of 58 cents.

Henry Schein (HSIC +0.98%) reported Q2 EPS $1.35, better than consensus of $1.33.

T-Mobile (TMUS +1.46%) was upgraded to ‘Overweight’ from ‘Equal-Weight’ at Evercore.

Berkshire raises its passive stake in VeriSign (VRSN -1.57%) to to 10.4% from 8.0%.

Transocean (RIG +0.25%) and Diamond Offshore (DO +1.13%) were both downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank.

U.S. Steel (X -0.15%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Noble Corp. (NE -0.92%) and Ensco (ESV +0.55%) were both downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Alcatel-Lucent (ALU -1.75%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Gallup US Consumer Spending Measure

12:30 TD Ameritrade IMX

Notable earnings before today’s open: ALR, ANIP, BSFT, BWP, CAH, CNA, HSIC, I, ISIS, KORS, L, LGND, MFA, RLGY, SNH, TNP, TREX

Notable earnings after today’s close: ACLS, ACXM, AEIS, AIG, ANV, APL, AREX, BRS, CAR, CHGG, CKEC, CKP, CNQR, CRK, CUTR, DRC, ECOM, ELNK, ENH, EOX, EPAM, GTAT, ININ, IRWD, JMBA, KAMN, KONA, LF, LLNW, LMNS, MCEP, MDR, MRO, MWA, NLS, OGS, OTTR, PHH, PL, PLOW, PXD, QLYS, REGI, ROSE, RP, RTEC, SALE, SNHY, THC, TNET, TNET, TSRA, TXRH, VNO, VNR, VVC, WAGE, Y

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 4)”

Leave a Reply

You must be logged in to post a comment.

I don’t want to say it TOO loud but my calculations tell me we have hit bottom. At least short term.

Good words from Jason, we are in the middle now.

A little analysis:

Bulls made a stand at about SPX 1916 Friday (multiple times in the premarket with futures, then during reg trading hours with SPX.) Friday afternoon’s close was less than impressive, leaking below an area that should have been support, but at last night’s futures open, they gapped up 2.25 points and futures were positive all night, reaching a high of +8.50.

Resistance did not change from what was posted Fri: 1940 resistance starts and 1945 would break that layer (the lowest of 3) and would set the right technical tone for bullish traders.

That’s it in a nutshell, whichever layer breaks is where we’re going: 1916 below, 1945 above. Wide range. And it’s Monday.

At 920, futures +5.25. Bonds bearish.