Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Taiwan dropped 2% and Japan 1%. India gained 0.7%. Europe is currently mostly up. Greece is down 1.4%, Russian 1.2% and Italy 0.7%. Switzerland, France and Belgium are doing well. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is up slightly, copper is down. Gold and silver are down.

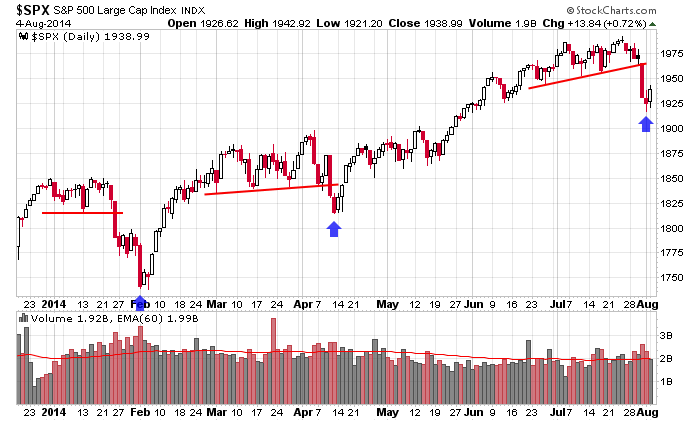

After breaking support last week, we got the beginning of a bounce yesterday. The bounce can peter out and last week’s low can be taken out…or continue moving up. If the market moves up, everyone will gauge the energy and force behind the move…does it come with volume, are dips being bought relentlessly, or does it seem like there’s a lack of participation (i.e. the market drifts up due to less selling, not lots of buying). In the past, bounces have kept going…literally. The market would move up day after day after day, and pretty soon the short term downtrend was neutralized. Here’s a chart going back to last December. When the market started up in February, many assumed the move would fizzle out and new lows would follow. It didn’t happen. The break down in April was short-lived, and in that case too, the market moved up enough to frustrate the bears before consolidating and hitting a new high. I’m not predicting the same price action right now. I’m just pointing out the long term trend is still up, and V bottoms are more common than most would admit.

If you’re a swing trader, you trade when the coast is relatively clear…which is most of the time, but it’s not how I’d describe the environment right now.

Stock headlines from barchart.com…

Emerson Electric (EMR +0.93%) reported Q3 EPS of $1.03, below consensus of $1.06.

Archer-Daniels Midland (ADM +0.82%) reported Q2 EPS of 77 cents, higher than consensus of 76 cents.

CVS Caremark (CVS +1.15%) reported Q2 EPS of $1.13, better than consensus of $1.10.

Bristow Group (BRS +1.48%) reported Q1 adjusted EPS of $1.32, better than consensus of $1.08.

Dresser-Rand (DRC +0.12%) reported Q2 EPS of 38 cents, weaker than consensus of 40 cents.

Avis Budget (CAR +1.98%) rose over 4% in after-hours trading after it reported Q2 EPS ex-items of 68 cents, higher than consensus of 61 cents.

Thor Industries (THO +1.54%) reported preliminary Q4 revenue of $1.04 billion, below consensus of $1.1 billion.

The Column Group reports 20.1% stake in Immune Design (IMDZ -1.17%) .

Cubic (CUB -0.75%) reported Q3 EPS of 45 cents, well below consensus of 75 cents.

McDermott (MDR +0.97%) reported a Q2 EPS loss of -5 cents, better than consensus of a -17 cent loss.

Tenet ({=THC reported Q2 continuing operations EPS of 17 cents, well above consensus of 1 cent.

Alleghany (Y +0.15%) reported Q2 EPS of $9.06, well ahead of consensus of $8.00.

Texas Roadhouse (TXRH -0.08%) reported Q2 EPS of 33 cents, right on consensus, although Q2 revenue of $395.4 million was slightly better than consensus of $394.29 million.

Pioneer Natural Resources (PXD +2.75%) reported Q2 EPS of $1.35, better than consensus of $1.28.

Kaman (KAMN +0.20%) reported Q2 EPS of 60 cents, right on consensus, although Q2 revenue of $459.1 million was below consensus of $471.25 million.

AIG (AIG +1.17%) gained over 2% in after-hours trading after it reported Q2 EPS of $1.25, well above consensus of $1.05, and then announced an additional share repurchase authorization of $2 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

9:00 PMI Services Index

10:00 Factory Orders

10:00 ISM Non-Manufacturing Index

11:00 Global Composite PMI

11:00 Global Services PMI

Notable earnings before today’s open: ACM, ACT, ADM, AEE, AKRX, ALLT, AME, AMSC, ANSS, ARCC, ARCO, ARQL, BCRX, BLMN, CIE, CLDT, CNK, COH, CRZO, CVC, CVS, DWRE, EMR, END, ENZY, EXH, EXLP, EXPD, FE, FUN, GLDD, GTIV, GTXI, HCLP, HCP, HEP, IART, IFF, IIVI, INFI, IT, KWK, LIN, LPX, MDU, MGM, MMP, MSI, MWW, MZOR, NILE, NNN, [[NTi]], NVDQ, NWN, ODP, OXF, OZM, PMC, RBA, REGN, RHP, RIGL, RTI, SCMP, SCOR, SMG, SNSS, SPAR, STE, TDG, VMC, VSI, VTG, WLK, WNR, ZBRA, ZTS

Notable earnings after today’s close: AMTG, APEI, ARC, ATSG, ATVI, AVNR, AWR, AXLL, BIO, BKH, BMR, CHUY, CLR, CRTO, CSU, DAVE, DIS, DPM, DRYS, ENPH, EOG, FANG, FEYE, FRGI, FSLR, FTR, FUEL, GMED, GRPN, HCI, HGR, HT, ITRI, JAZZ, JCOM, KAR, LBTYA, MCHX, MITT, MODN, MPO, MRCY, NSTG, NYMT, OAS, OKE, OKS, ORA, ORIG, PBPB, PEGA, PNNT, PRAA, PZZA, QUAD, REXX, RLD, RST, RSYS, SGMS, SGY, SKT, SMCI, TDW, TMHC, TPC, TRMB, TTWO, UNTD, WBMD, WES, WGP, WMGI, WTR, XEC, Z, ZAGG, ZGNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 5)”

Leave a Reply

You must be logged in to post a comment.

That 1940 -1945 resistance got tested at the end of the day, and it withstood the test. The overnight futures responded bearishly to a secondary layer (and new) of resistance. That layer begins around 1932, goes to 1934-35.

New day, same story.

Resistance 1940-45, support 1916 (down to roughly 1898-99.)

As I said yesterday, taking out “1945 would break that layer (the lowest of 3) and would set the right technical tone for bullish traders.” Still true, and of course, the opposite is true: if that layer holds, especially after being tested, the tone is bearish.

Therefore, watch the levels. Let the market tell you what its nature is.

Futures were +1.25 to – 9.75 from which we’ve rebounded to the point that we’re -6.75 at 855 am.

Bonds are fairly-solidly bullish, more so than when they first opened.

gm mike, long dia calls 4th wave complete. 5th wave spx to 47-48.

well, something better change very soon or im pullin the plug on it…

Hey, Jim. Just returned from an errand.

This is that no man’s land that Jason was talking about. I know the feeling that you and Daddy Paul want to be long, but only if you can catch it at or close to the bottom. Here in the “between” area, there’s not much breathing room.

That “sphincter alert” you mentioned is calibrated properly, it is innate good trading sense, telling you to pull the ejection handle.

wow, that was a nice jerk the rug from under the feet affect…thx mike

Gonna run into serious resistance starting about 1921-2 SPX for about 5-6 points. The budding upleg’s survival depends on taking it out.

“we got the beginning of a bounce yesterday.”

Right on. Small caps leading PC ratio sky high.

I would say gingerly be long or be wrong.

the problem is my “sphincter alert” is beginning to go off….lol

the carry trade has been funding via the euro

the euro has been dropping and close to the 132 target

most carry trade liquidations in equities world wide may be very close to a bottom

a short cover rally may be soon as bears love to eat only fat bulls

a lower high of spx 1970 ish would be ideal