Good morning. Happy Thursday.

The Asian/Pacific markets closed leaning to the downside. China dropped 1.3% and Hong Kong 0.8%. Japan rallied 0.5%. Europe is currently mixed. Russia is down 1.4%, followed by Norway at 1%. Italy is up 0.6%, followed by Switzerland at 0.5%. Futures here in the States point towards a relatively big gap up open for the cash market. S&P futures here up a couple points, and then at 8:00 est went vertical.

The dollar is up. Oil is up, copper is up. Gold and silver are down.

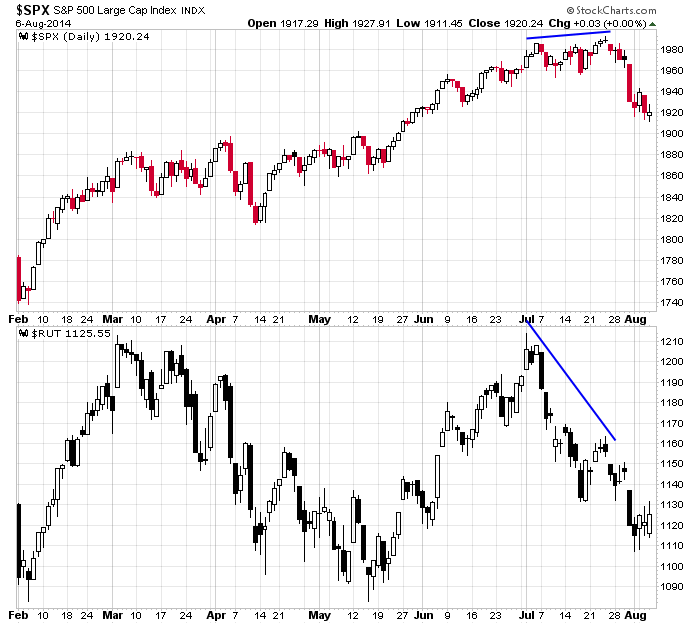

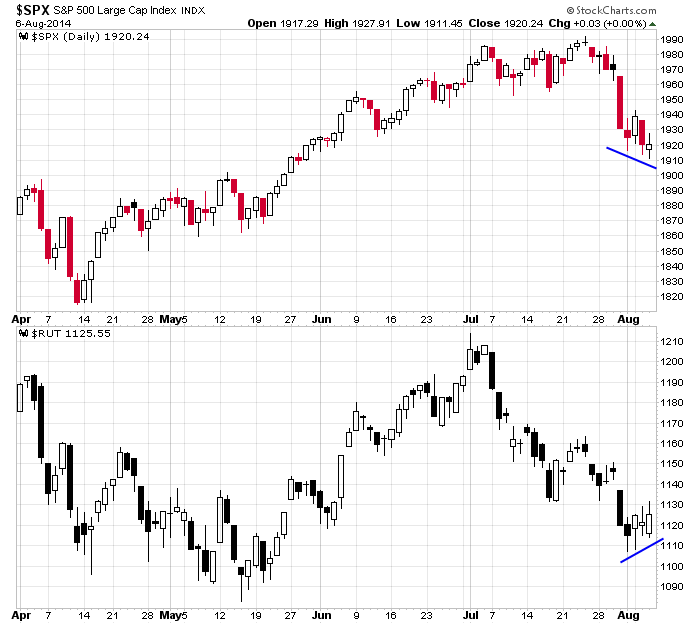

The small caps have been lagging the large caps. We know this…it’s one of the reasons the market turned down two weeks ago.

But over the last couple days, a positive divergence has started to form. The large caps again pushed to a lower low yesterday while the small caps have clearly moved up the last few days. It’s a step. From a technical standpoint this is exactly the kind of clue I’d look for that a bounce was in the works. News from overseas can quickly change this, but absent such news, I lean to the upside right now.

But this upside bias is short term only. If the market wants to rally from here, fine. But it has some proving to do. Set ups need to improve. The technicals need to improve. Military conflicts need to subside. More after the open.

Stock headlines from barchart.com…

Duke Energy (DUK -1.61%) reported Q2 EPS of $1.11, well above consensus of 98 cents.

Carnival Corp. (CCL +0.69%) rose nearly 3% in pre-market trading after BOA/Merril upgraded the stock to ‘Buy’ from ‘Neutral.’

Aetna (AET -0.18%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Esterline (ESL +0.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs who also raised their price target on the stock to $140 from $111.

Energy Transfer Partners (ETP -1.49%) reported Q2 EPS of 79 cents, higher than consensus of 64 cents.

Babcock & Wilcox (BWC -0.35%) sank over 12% in after-hours trading after it reported Q2 adjusted EPS of 44 cents, lower than consensus of 49 cents, and then lowered guidance on fiscal 2014 EPS view to $1.70-$1.85 from $2.00-$2.20, below consensus of $2.12.

Transocean (RIG -1.09%) rose over 2% in after-hours trading after it reported Q2 adjusted EPS of $1.61, well ahead of consensus of $1.12.

CF Industries (CF +1.36%) reported Q2 EPS of $6.10, well below consensus of $6.71.

Envision Healthcare (EVHC -0.62%) reported Q2 adjusted EPS of 28 cents, better than consensus of 25 cents, and then raised guidance on 2014 adjusted EPS view to $1.15-$1.20 from $1.10-$1.15, higher than consensus of $1.13.

CenturyLink (CTL -1.32%) rallied nearly 3% in after-hours trading after it reported Q2 adjusted EPS of 72 cents, higher than consensus of 64 cents.

Prudential (PRU +0.96%) reported Q2 EPS of $2.49, stronger than consensus of $2.35.

21st Century Fox (FOXA +3.29%) climbed over 2% in after-hours trading after it reported Q4 EPS of 42 cents, higher than consensus of 38 cents.

Symantec (SYMC -0.79%) reported Q1 EPS of 45 cents, better than consensus of 42 cents.

Keurig Green Mountain (GMCR +0.33%) fell over 2% in after-hours trading after it reported Q3 EPS of 99 cents, above consensus of 88 cents, and then raised guidance on fiscal 2014 EPS outlook to $3.71-$3.78 from $3.63-$3.73, although that is still below consensus of $3.78.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Chain Store Sales

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

3:00 PM Consumer Credit

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAON, AES, AFSI, AINV, AMCX, ATHM, AUXL, BCE, BDBD, BPI, BR, CBB, CCOI, CECE, CECO, CNQ, CQB, CRIS, CTB, DUK, EAT, FUR, FWLT, GBDC, GDP, GLP, GOLD, GTN, HAR, HII, HIMX, HRC, HSC, HSNI, HZNP, ICE, IDCC, IRC, KERX, LAMR, LEAF, LG, LINE, LMIA, LNCE, LPI, LQDT, LXP, LXRX, MFC, MMS, MNK, MONT, MPEL, MPW, MYL, NCT, NRF, NRG, NVO, NXST, NXTM, OGE, ONE, OWW, PBH, PHMD, POZN, PRIM, QIWI, RDN, RGLD, RSTI, RTK, SABR, SATS, SFUN, SGM, SNI, SPH, SRE, SRPT, SSYS, SUNE, TDC, TGH, THS, TICC, TK, TPH, VNDA, WEN, WIN, WMC, WWAV, ZEUS

Notable earnings after today’s close: AGO, AHT, AIRM, AL, ALIM, ALJ, ALNY, AMRN, AMRS, ANAC, ANET, ASYS, ATLS, AUQ, BCEI, BCOR, BIOL, BNFT, BNNY, BOFI, BPZ, CARA, CBS, CENT, CFN, CLNE, CLVS, CPST, CSC, CUBE, CVT, DAR, DIOD, DMD, DV, EAC, EBS, ECPG, ED, EGOV, ELX, ENOC, FF, FI, FRT, FWM, FXCM, GHDX, GST, GXP, HGR, HTGC, IRG, KTOS, LGF, MASI, MDVN, MED, MELI, MNST, NES, NFG, NOG, NVDA, NWSA, OLED, OPLK, PFMT, PODD, PRO, PSIX, QTWO, RATE, RBCN, RENT, RPTP, RRMS, SCTY, SEM, SFM, SHOR, SLXP, SPPI, SSTK, TEAR, TRNX, TRUE, TUMI, UBNT, UNXL, VOLC, VVUS, WIFI, XOMA, ZNGA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 7)”

Leave a Reply

You must be logged in to post a comment.

vix inverted h & s pattern..more pain coming…

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_24Aug071118_zps574a7adf.jpg

—from chief bear

I issue orders to all bears to capitulate here and take short term profits

thx, already flat…a little long tlt puts.

Hi Jim/ Aussie

Just getting here. Agree with the order to reverse, Chief Bear. They’ve hit my target I posted yesterday at 1905 and 1906.

Will be late tomorrow, also. Hopefully earlier than today.

Have a good night.

depending on what time frame your on you have to wait for a break above 1st lower high,

but on 5 and 2 minute charts it is not far above

unless you are good a counter trend trading

from chief crazy bear