Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan dropped 3%; Australia, India and Korea dropped more than 1%. Europe is currently mostly down. Greece is down 2.2%; Amsterdam and Switzerland are also down noticeably. Russia is up almost 2%; Italy is also doing very well. S&P futures here in the States were down about 15 overnight but are now up about 5.

The dollar is down. Oil is up, copper is flat. Gold and silver are down slightly.

The big news out is Obama has approved air strikes in Iraq. This sent futures plunging in overnight trading, but they bottomed around 4:00 am and have moved up with force since. Oil moved opposite – first surging, then dropping back.

It’s been an up and down week. Big move up Monday followed by an even bigger move down Tuesday. A rally attempt Wednesday that fizzled and then a big move down yesterday. The S&P has taken out its previous day’s low every day, but the Russell has taken out its previous day’s high every day except yesterday. For the week, most of the indexes are posting losses; the Russell is up slightly.

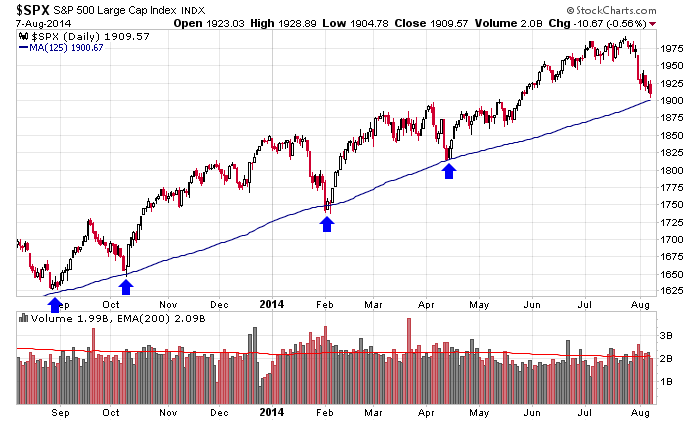

Here’s a long term S&P chart. The index is getting awfully close to a support trendline, a significant moving average, and for what it’s worth, a big, fat, whole number.

Overall my bias remains to the downside. All the indexes are pointing down on their daily charts, and even though an argument can be made that several indicators have reached extreme levels and therefore support a bounce, unless the near term trend actually reverses, a rally is likely to get sold into. Also, up until now it’s been Israel vs. Palestine and Russia vs. Iraq. Now the US is going to strike Iraq – another military conflict that has the ability to induce a big move at any moment. This is not an ideal time for a swing trader to operate. More after the open.

Stock headlines from barchart.com…

Dillard’s (DDS -0.50%) was downgraded to ‘Neutral’ from ‘Buy’ at Buckingham.

Activision Blizzard (ATVI -2.40%) was upgraded to ‘Buy’ from ‘Neutral’ at Longbow.

Ann Inc. (ANN -5.31%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Hibbett Sports (HIBB -1.22%) was downgraded to ‘Underperform’ from ‘Neutral’ at Credit Suisse.

Allergan (AGN -3.30%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Leerink.

Tang Capital reported an 11.4% stake in La Jolla (LJPC -0.10%) .

lululemon (LULU -2.35%) jumped over 5% in after-hours trading after Dow Jones says founder Chip WIlson will sell half his stake to private equity firm Advent for $845 million.

NVIDIA (NVDA -1.02%) reported Q2 EPS of 30 cents, well above consensus of 20 cents, and then was upgraded to ‘Buy’ from ‘Hold’ at Needham.

CSC (CSC -1.24%) reported Q1 EPS of $1.03, higher than consensus of 94 cents.

Gap (GPS -0.67%) climbed ove 4% in after-hours trading after it said it sees Q2 EPS ex-benefits of 68 cents-69 cents with Q2 net sales of $3.98 billion, better than consensus of 66 cents and Q2 sales of $3.96 billion.

Monster Beverage (MNST -1.42%) rose nearly 3% in after-hours trading after it reported Q2 EPS of 81 cents, better than consensus of 75 cents.

News Corp. (NWSA -1.19%) reported Q4 adjusted EPS of 1 cents, below consensus of 3 cents.

CBS (CBS -1.30%) reported Q2 adjusted EPS of 78 cents, higher than consensus of 72 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Productivity and Costs

10:00 Wholesale Trade

Notable earnings before today’s open: BAM, BECN, BID, BPL, CCC, CHH, EBIX, ERF, HMSY, HRG, LXU, MGA, MHR, PDCE, PGEM, PGNX, RDNT, SIRO, SUSP, SUSS, TTI

Notable earnings after today’s close: MDRX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 8)”

Leave a Reply

You must be logged in to post a comment.

News trumps charts.

That said small caps have had a better week every day this week with higher lows and higher highs. The PC is still high. We have either bottomed OR expect a mini crash. I say the market is higher a month from now.

Good morning.

As Jason said, futures plunged on Obama’s speech at 930 pm. They went from unchanged to -7 in a heartbeat — I was watching — and then kept going, eventually bottoming at -15.

I contend they hit another set of Short targets at that low, which also coincided with a major level of support.

There’s some saying that when bullets fly, so does the market, and with the news that our guys fired at some ISIL targets, we got a major response in futures.

As I write, they have moved +23 points from that overnight low level. (Roughly equivalent to 230 Dow points.)

In other words, if you didn’t see the action in the futures and merely opened your charts this morning, you’d go “ho hum, another gap up,” and not be aware of the drama that took place.

What I think it means to us now:

The market showed resilience when it bounced (and where it bounced) at the low between 10 and 1030 this morning.

There is still resistance at multiple layers, the closest being 1919, the next at 1923, 1928 and 1929 (Thurs high) and ultimately 1936.

Just as support levels were sliced thru on the way down, these resistance levels can be just as easily sliced thru on the way up. However, it’s a big task which may not be accomplished til next week.

For today, any pullback we enter should go no lower than 1913-1911.

If last night’s futures low holds, equivalent to SPX 1894, it projects a target of 2034.

I would add: if today’s volume on SPX and NASDAQ is not heavy, or heavier than yesterday or Tuesday (both were down days), I would be very cautious about getting bullishly exuberant. A very simple measure of the strength of either bulls or bears is the volume displayed on up / down days. So assuming today ends green, bulls want to see volume higher than it has been on down days.

A fly in the ointment that I can see at this moment for this move up is that bonds are decidedly bearish.

Hi mike, go figure the puts i bought are for tlt…not reacting like i thought…

that was a nice drop…out early but profitable..

Jim, copy puts for TLT, concur with your thinking, TLT shoulda been negative on this blast upwards. Bonds have been strange last few days. Glad you banked some $$.

Midday look at volume, weak. Can’t argue with a green day, and chewing thru resistance, but whether it carries over into next week, need to see bulls get more involved.