Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

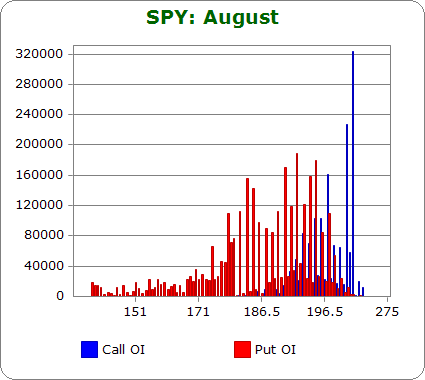

SPY (closed 193.83)

Puts out-number calls 2.4-to-1.0…about the same as June.

Call OI is highest between 193 & 197 and then there are two big spikes at 200 and 205.

Put OI is highest between 180 and 197.

There’s overlap in the 193-197 range, and as long as SPY closes in the range, most options will expire worthless. However, with put OI being heavier within the range, a close near the top is needed for max pain. Somewhere around 196 is ideal. Today’s close was at 193.83 – that’s good, but it’s a little below ideal. A move up is needed.

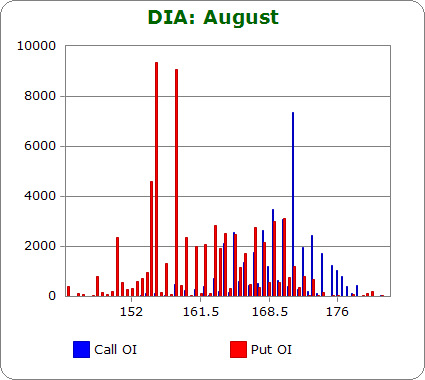

DIA (closed 165.52)

Puts out-number calls 1.7-to-1.0….about the same as June.

Call OI is highest at 171, and a couple strikes above and below this level have moderate OI.

Put OI is highest at 157 and 159 and then is steady up to 170.

Put and call volume for DIA is very low, so the numbers don’t mean much. Nevertheless, there’s a little overlap in the low 170’s. Today’s close was at 165.52, which is below ideal. A move up to the top of the high-OI put range is needed to cause max pain.

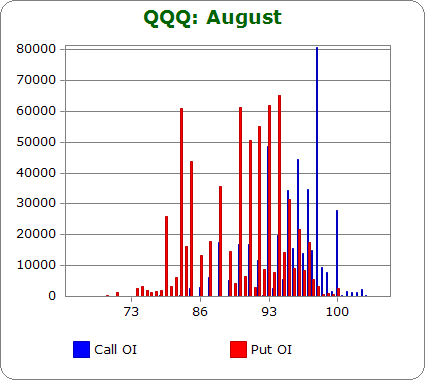

QQQ (closed 95.47)

Puts out-number calls 1.9-to-1.0…more bearish that previous months.

Call OI is highest at 93, between 95 and 98 and at 100.

Put OI is highest at 83, 85, 88 and between 90 and 94.

There’s overlap in the 93-94 area, so a close there would cause max pain. Today’s close was at 95.47 – a little higher than ideal, but still at a very good level. If the market traded flat the rest of the week, a lot of pain would be felt by option buyers. But per the QQQ numbers, a slight move down is needed for max pain.

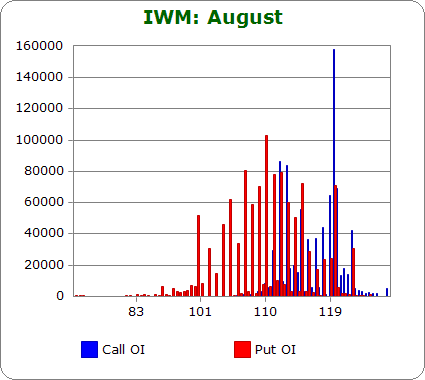

IWM (closed 113.20)

Puts out-number calls 1.8-to-1.0…less bearish than June.

Call OI is highest at 112, 113, 115, 119 and 120.

Put OI is highest at 100, between 105 and 115 and at 120.

The biggest overlap zone falls between 112 and 115, so a close somewhere in there will cause the most pain. Today’s close was at 113.20 – exactly where it needs to be. A little move up or down the next four days is fine – as long as the market doesn’t move too far, max pain will be felt by IWM option buyers.

Overall Conclusion: The results of the above analysis are mixed but fairly close. SPY says move up; QQQ says slight move down; IWM says no move is needed. If the invisible hand of the market moves to cause the most number of call and put buyers to lose, I can say the move has already taken place. No move is needed the rest of the week – flat trading would be perfect.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Good Morning Jason,

would it be possible to see/view your post about returning from Costa Rica? interested on the good and the no so good from that country. Unfortunately I misplaced your email where you explained your stay in that country.

Thank you!

Esther