Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia and India posted solid gains; the other markets were little changed. Europe is currently mostly down. Greece is up 2.9%, but Germany, France, Amsterdam, Italy, Spain, Norway and Prague are down moderately. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are up.

So we got a big up day Friday and some follow through yesterday, but most of the follow through was in the form of an opening gap because intraday gains were given back by the close. I’ll take the gains – they’re better than nothing – but it would have been nice to see a stronger close.

With many of the indicators having moved to extreme levels, there is a lot of support for a tradeable bounce. We’ve also gotten some improvement from individual stocks – not great improvement, but enough that we have some decent patterns to play with. Absent negative news, the path of least resistance is up.

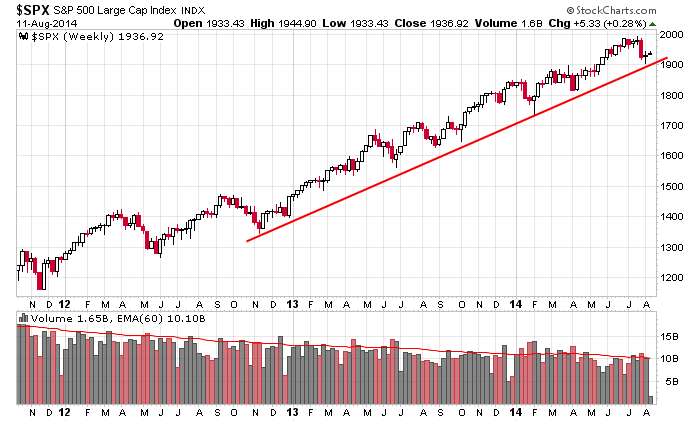

So far what has taken place (regarding the recent correction) is no different than what we’ve gotten in the past.

The SPX weekly has successfully tested a trendline that goes back nearly two years.

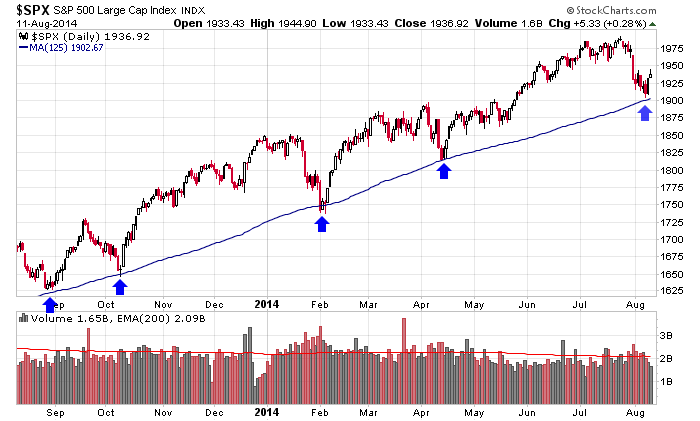

And the daily has successfully tested a significant MA which has acted as support.

One of these times these key levels will not hold. Maybe it will be this time, but until it happens, going all in on the short side would not be wise. The bounce we’re currently getting will go a long way hinting at the market’s true strength. More after the open.

Stock headlines from barchart.com…

Dean Foods (DF -3.86%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Stryker (SYK -0.33%) was upgraded to ‘Buy’ from ‘Hold’ at Needham.

Citigroup added shares of First Solar (FSLR +1.98%) and Foot Locker (FT +0.55%) to its Focus List.

Towers Watson (TW +1.65%) reported Q4 adjusted EPS of $1.34, higher than consensus of $1.25.

Flowers Foods (FLO +0.35%) reported Q2 EPS of 21 cents, weaker than consensus of 24 cents, and then cut its fiscal 2014 EPS view to to 92 cents-98 cents from 98 cents-$1.05, below consensus of $1.02.

Abercrombie & Fitch (ANF +0.39%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel with a price target of $50.

Paulson & Co. reported a 10.1% passive stake in Cobalt (CIE +2.46%) .

MasTec (MTZ +4.50%) fell nearly 4% in after-hours trading after it reported Q2 adjusted EPS of 40 cents, right on consensus, but then lowered guidance on fiscal 2014 adjusted EPS to $1.55-$1.58, well below consensus of $1.82.

Convergys (CVG +1.62%) reported Q2 adjusted EPS of 34 cents, better than consensus of 32 cents.

Caesar’s (CZR +2.32%) reported a Q2 EPS losss of -$3.24, over double consensus of a -$1.19 loss.

Ventas (VTR +0.35%) reported Q2 normalized FFO of $1.12, higher than consensus of $1.09.

Nuance (NUAN +1.06%) tumbled 9% in after-hours trading after it reported Q3 EPS of 27 cents, right on consensus, but then lowered guidance on fiscal 2014 EPS to $1.03-$1.08, below consensus of $1.13.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $27B, 3-Year Note Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: AER, ARRY, CNCE, CST, FLO, IDRA, INSY, KATE, NOAH, PETX, OTC:RTRX, SOL, TW, USAC, VAL

Notable earnings after today’s close: CHMI, CREE, EPAY, FMI, FOSL, FTD, HMIN, JDSU, JKHY, KING, MYGN, OTC:OPWR, PE, PRSS, SYNC, TCX, URS, VSAT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 12)”

Leave a Reply

You must be logged in to post a comment.

Jason, the S&P trendline goes back to Oct11, so even more powerful.

Jason’s charts showing the 2 yr trendline and NA, and specifically where SPX bounced, is the same support I’ve been talking about the last few days. If we break that low, it could become ugly, so for now let’s ignore it, okay?

Yesterday the bulls chewed into the resistance, getting to SPX 1944.8 before giving up for the day. Not a particularly bullish sign. Volume was below average. It was below Friday’s “below average volume” as well.

We are still under the influence of the resistance I cited yesterday: SPX 1942 up to 1953-54. If that resistance is not taken out, a target in the 1870s looms.

There is support at 1920 down thru 1913-14. If it breaks, we’re probably looking at 1870.

Nearer term: the move from the overnight high has created resistance at 1933-1935.

Bonds at the moment are bullish.

Might be late tomorrow as well.

look like spx 1926.50 area is coming..15m 100-200 ma

tlt looks like crap…only problem for the short theory

Roger that, bonds have been consistently bullish (for SPX) ever since I began watching today. More so now. I think that we get to 1926-27 before closing bell, and 1920 either overnight or tomorrow.

slow going..im short iwm. she went to the 61.8 retrace.

Dunno, Jim. They’re making a liar out of me. Clearly won’t get to 1926 before the bell, absent a huge down draft.

im going flat on all my shorts..