Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. India moved up 1.1% followed by China (up 0.6%) and Australia (up 0.4%). Taiwan dropped 0.7%, and Korea fell 0.5%. Europe is currently mostly up. Germany (up 1.5%), France (up 1.2%), Spain (up 1.1%), Amsterdam (up 1.1%), Switzerland (up 1%), Stockholm (up 0.9%) and Italy (up 0.8%) are all doing very well. Greece is down 1.4%. Futures here in the States point towards a relatively big gap up open for the cash market.

The dollar is up slightly. Oil is down, copper is up. Gold and silver are down.

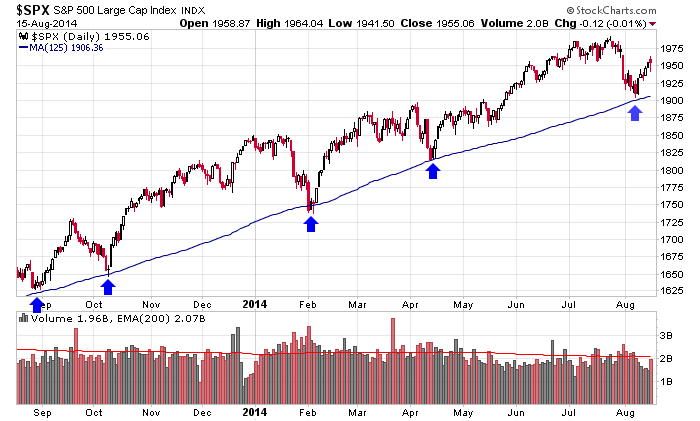

I’ve now been in the bulls’ camp for about two weeks, and all I can say is: so far, so good. Many indicators reached extreme levels and reversed. A positive divergence formed between the small and large caps. Charts of individual stocks have improved. There’s overhead resistance to deal with, and last Friday’s quick drop reminds us of the world we live in…but given everything going on, the market has done just fine. All long term trendlines remained in place, so despite the hiccup, the bulls deserved the benefit of the doubt. There’s still work to be done. The Nas is doing great – it’s close to a new high – but the other indexes have lots of overhead resistance to chip away at. But as I said, so far, so good.

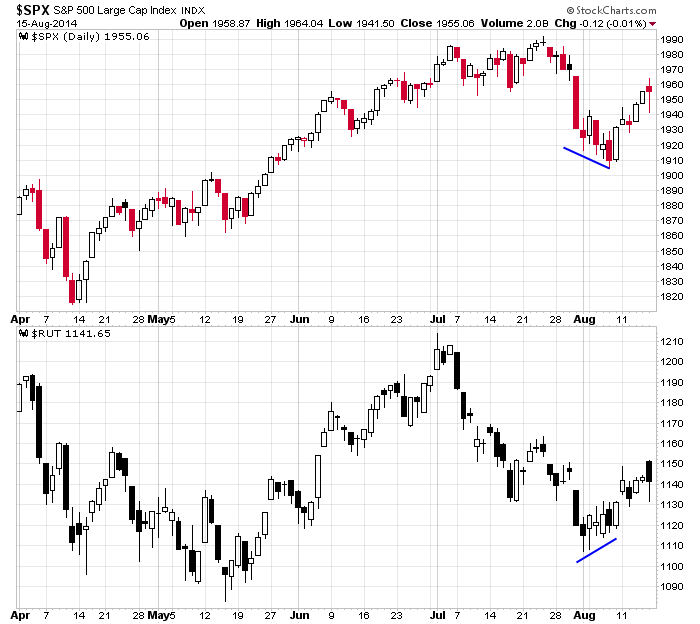

I posted this chart on Aug 6 when I switched my bias to the long side.

And this was posted the next day to remind everyone what that long term trend was.

I don’t trust my ability to figure out what is going to happen…so I’m stuck following the charts, looking for clues, following the footsteps of big funds and relying on some good old fashion experience. This has served me well. And it’s also much more relaxing…because I don’t charge myself with the task of solving a mystery. To me trading is a big game of follow the leader…and I’m not the leader. I could go on, but I won’t. I’m happy the bears exist because they add fuel to the fire when the market moves up.

Stock headlines from barchart.com…

Hewlett-Packard (HPQ -1.46%) was upgraded to ‘Buy’ from ‘Neutral’ at Monness Crespi.

Credit Suisse rates Union Pacific (UNP +0.26%) as an ‘Outperform” and recommends building positions in the company as it raises its price target on the stock to $119 from $115.

RenaissanceRe (RNR +0.49%) was downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank.

WellCare (WCG -0.35%) was downgraded to ‘Neutral’ from ‘Outperform’ at Wedbush.

General Electric (GE -0.93%) was reinstated with an ‘Outperform’ at Credit Suisse with a price target of $30.

CNBC reports that Dollar General (DG -0.73%) offered to buy Family Dollar Stores ({=FDO for $78.50 a share.

Monster Beverage (MNST +30.48%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies due to valuation.

Raytheon (RTN +0.04%) was awarded a $109.1 million government contract for engineering services for the Patriot System Tracking Radar.

Becker Drapkin reported a 6.4% stake in Fuel Systems (FSYS +0.76%) .

Whale Rock Capital reported a 5.2% passive stake in Textura (TXTR +3.04%) .

SAB Capital Advisors reported a 6.4% passive stake in Colony Financial (CLNY +1.09%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 NAHB Housing Market Index

Notable earnings before today’s open: CMGE, FSYS, JKS

Notable earnings after today’s close: FN, JMEI, PWRD, URBN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 18)”

Leave a Reply

You must be logged in to post a comment.

Jason has said this before, and he was right then, too. Trading is a game of follow the leader, and we’re not the leader. They show us what they’re doing, and we get onboard.

Friday’s low appears to be as much of a retracement as we’re going to get. Assuming that low holds, it projects a target at SPX 1975. And don’t forget, we have another low from overnight on Aug 6-7 which projects a target of 2030.

Futures are up huge at 9 am, +11. Were up almost +12. Does not preclude the possibility for a pullback between now and 4 pm. I hope for one.

If we do pull back today, could go to SPX 1954 or as low as 1950.

Below that and this nice up leg is broken for the time being.

Bonds are bullish.

Enjoy the ride.

gm mike,,,geez oh pete…a +1000 tick right out of the gate

gm Jim. Yeah, hi tix all right.

i wonder what the bears are doing?

Yeah, not a good day to be furry.

the bears are waiting for the bulls to fatern up around the 1970 ish or higher

whilst they daytrade as worried bulls

worried about their europe bulls that have lost their heads and cant seem to reach the top again–german dax and the euro

from worried bull

Aussie, are you a worried bull now?

im confused on this verbiage…