Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly up. China, Hong Kong and Singapore led with gains in the 0.6% – 0.9% range. Europe is currently up across-the-board. Russia is up 1%; Germany, France, Amsterdam, Stockholm and Spain are also doing well. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are down.

Coming off a big up day last Friday the market has rallied 3 of 4 days this week, and as of now has its biggest weekly gain in six weeks. Things get tougher from here. Volume has been light and one-by-one the indexes will bump up against overhead resistance.

Many breadth indicators have reversed to support the market’s recent strength. The AD line and AD volume line are above 0, new highs have expanded, new lows have contracted, the ATR is now pointing down and the bullish percent indexes are in the process of curling up.

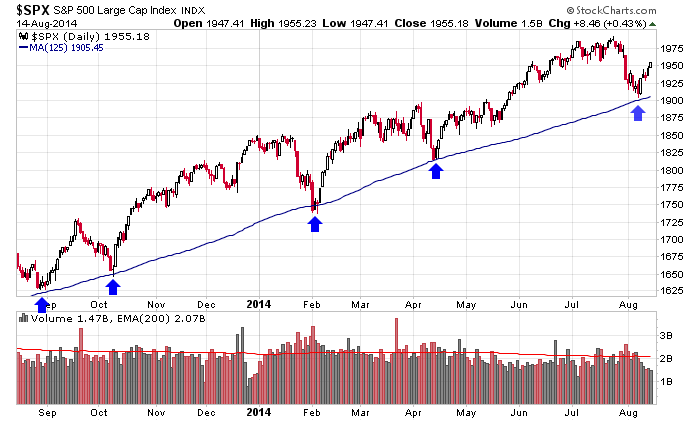

Despite all that’s going on in the world, the recent move off the high doesn’t look any different than other corrections. Here’s the daily S&P 500 chart.

I’m not all in, but my up bias remains. More after the open.

Stock headlines from barchart.com…

Ultra Petroleum (UPL +2.89%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Perrigo (PRGO) was upgraded to ‘Buy’ from ‘Neutral’ at B. Riley with a price target of $180.

bebe stores (BEBE +1.42%) were downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

DaVita (DVA +0.94%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Starwood (HOT +0.50%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Barclays.

SuperValu (SVU +0.52%) says its computer network experienced a criminal intrusion.

Mallinckrodt (MNK +1.82%) will replace Rowan Companies (RDC -0.82%) in S&P 500 as of the close of trading on August 18.

Gannett (GCI +0.06%) climbed 6% in after-hours trading after billionare activist investor Carl Icahn reported a 6.63% stake in the company.

Monster Beverage (MNST +0.70%) surged over 20% in after-hours trading after Coca-Cola reported a 16.7% stake in the company.

Berkshire Hathaway reported a 6.0% passive stake in Dow Chemical (DOW -0.70%) .

Autodesk (ADSK +0.88%) rose 6% in after-hours trading after it reported Q2 EPS of 35 cents, stronger than consensus of 29 cents.

Agilent (A +1.53%) reported Q3 EPS of 78 cents, higher than consensus of 74 cents.

Nordstrom (JWN +0.84%) dropped over 3% in after-hours trading after it reported Q2 EPS of 95 cents, right on consensus, but reported Q2 revenue of $3.3 billion, less than consensus of $3.39 billion.

Applied Materials (AMAT +0.86%) reported Q3 adjusted EPS of 28 cents, better than consensus of 27 cents.

J.C. Penney (JCP +4.17%) rallied over 3% in after-hours trading after it reported a Q2 adjusted EPS loss of -75 cents, a smaller loss than consensus pf -93 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Producer Price Index-FD

8:30 Empire State Mfg Survey

9:00 Treasury International Capital

9:15 Industrial Production

9:55 Reuters/UofM Consumer Sentiment

10:00 E-Commerce Retail Sales

Notable earnings before today’s open: EL, JD

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 15)”

Leave a Reply

You must be logged in to post a comment.

Nothing would surprise me today.

I compared the SPX Futures with the SPX itself.

Yesterday, the futures broke resistance.

However, as Aussie says, 1948 is the 50% but to get to the full failure level of SPX, we really need to break 1957.80. I believe traders pay attention to the ES (the SPX futures) because they’re “cleaner” but just want to point out the difference between the two. I may confuse, but the intent is to be clear.

All that may be immaterial today, however. Futures are up and acting bullishly after the 830 report (PPI). Just keep an eye on SPX 1958 and be aware.

Today being OPEX, I hesitate to say what they’ll do.

I will say this, based on the way futures operate.

Having broken that resistance, we are due for a pullback. To be very technical, which is how da boyz operate, we could drop as low as 1928-1920 over the course of the next few days and still be in a bullish market. In fact, if that happens, it’s a perfect entry point (although it won’t feel like it at the time).

Futures went to +6.00 overnight, are +4.5 at 908 am.

Volume was low on NYSE and NAS yesterday.

Bonds bearish.

Have a good weekend.

the bears are getting excited and watching

from cheif waiting to pounce bear

Hear ya, Aussie. Took a short off the opening high, but stopped out at breakeven on the reversal. Watching and waiting for it, too, a short is in the future.

gm all, im short the 10am high….

lookin at the es block trades and most are on the bid…small numbers on the ask…

rog, that short looked good til the 1015 reversal. This is where stalking is the name of the game.

boom

im flat. crap too early…

…. but your instincts are correct. The market wears us down. When you approach this as a hunter, stalking his prey, you’re in the right mindset. However, I don’t recommend drinking beer while waiting (LOL).

Break. Back around noon.

grabbed a small long dia call out at 15m 10ma

Jim, didn’t see your comment til after I posted mine. Yeah, long is counter-trend, so take your profit and get out. They can go either way from here, so be cautious. Reason why I’m taking another break.

Looking in. Ok, have seen it. Back later.

had my fun

a large tick extreme is usually a reversal for a while

14 spx points plus dow and nq points

it was europe closing fun time

usa starts trading after high noon

german dax dropped 200 points for a outside day