Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan led with a 0.9% gain, but no other index moved up much. South Korea dropped 1.4% followed by Hong Kong (down 0.7%) and China (down 0.4%). Europe is currently up across-the-board. Italy, Spain, Austria, Russia and Greece are up more than 1%. France (up 0.9%) and Germany (up 0.6%) are also doing well. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

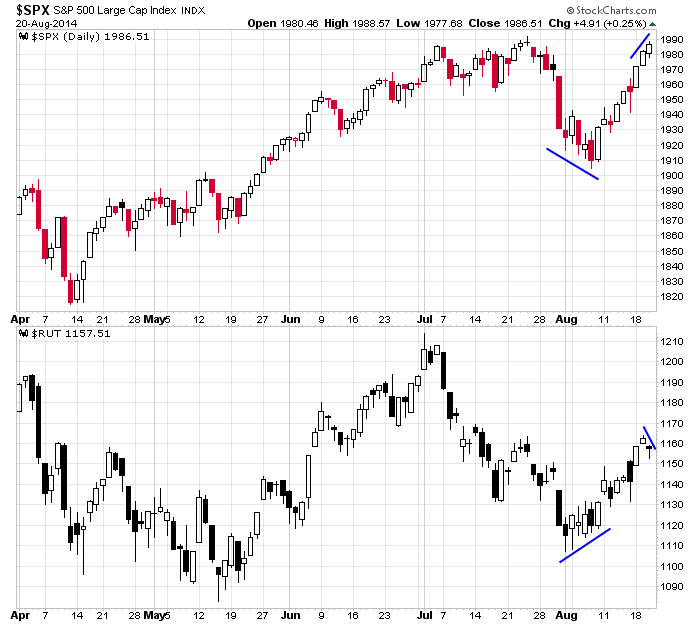

Thanks to a nearly-vertical move the last 2+ weeks, the Nas is at a new high. The S&P is only 3 points from an all-time high. The Dow and mid caps follow, and then the Russell pulls up the rear. Instead of getting a dead-cat bounce within a downtrend, we’ve gotten a pretty forceful move up which has completely negated the bearish sentiment that built up. My overall bias remains to the upside, although I recognize a couple risks.

The extent of the move is unsustainable, so a rest is due.

A couple indicators are getting extended and probably don’t have much more than a day or two left before they too need to correct.

A few other indicators haven’t supported the market’s recent strength.

The small and large caps are starting to diverge. (see below).

And with the Jackson Hole Summit starting, there’s the potential for a quick move. I like the market, but things are getting a little extended in the near term. More after the open.

Stock headlines from barchart.com…

Hormel Foods ({=HRL reported Q3 EPS of 51 cents, higher than consensus of 48 cents.

Patterson Cos. (PDCO +0.10%) reported Q1 EPS of 50 cents, right on expectations.

Dollar Tree (DLTR +0.53%) reported Q2 EPS of 61 cents, weaker than consensus of 64 cents.

Sears Holdings (SHLD +1.27%) reported a Q2 EPS loss of -$5.39, a much wider loss than consensus of -$2.63.

Bon-Ton Stores (BONT -1.20%) reported a Q2 EPS loss of -$1.86, a larger loss than consensus of -$1.54.

Madison Square Garden (MSG +3.44%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Baird raised its price target on Lowe’s (LOW +1.57%) to $60 from $57 and kept its ‘Outperform’ rating on the stock.

Sally Beauty (SBH +0.98%) rose nearly 2% in after-hours trading after the company authorized a new $1.0 billion share repurchase program.

American Eagle (AEO +11.99%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

L Brands (LB -0.38%) reported Q2 EPS of 63 cents, better than consensus of 62 cents.

CACI (CACI +0.23%) reported Q4 EPS of $1.49, stronger than consensus of $1.43.

Synopsys (SNPS +0.51%) reported Q3 EPS of 65 cents, higher than consensus of 60 cents.

Hewlett-Packard (HPQ -1.01%) reported Q3 adjusted EPS of 89 cents, right on consensus, although Q3 revenue of $27.6 billion was better than consensus of $27.01 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:45 PMI Manufacturing Index Flash

10:00 Existing Home Sales

10:00 Philly Fed Business Outlook

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: BKE, BONT, CYBX, DLTR, HRL, NM, PDCO, PERY, PLCE, SHLD, SMRT, SSI, TTC, WUBA

Notable earnings after today’s close: ARAY, ARO, AVNW, BRCD, CRM, GME, GPS, INTU, MENT, MRVL, NDSN, NWY, QUNR, ROST, TFM, TUES

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 21)”

Leave a Reply

You must be logged in to post a comment.

I am very worried for the bulls

after world central banks goose the markets for jackson unwholely

where will that leave the deserted bulls

some world markets have made new histerical exhaustion highs

some are at lower high wave 2’s

What Jason says, “ditto” for me.

As usual, I wrote this prior to reading Jason’s report, you’ll see some duplication.

If you look at a chart from the recent bottom on August 7, you don’t need a trained eye to see that we have come very far, very fast. 97+ ES (SPX futures) points in two weeks. Put technically, “straight up.” Unsustainable trajectory.

There’s a pullback coming, so expect it. It can be fast and vicious or slow and insidious. Either way, we’re due for one.

Overnight, they hit the target projected by the low following the release of the FOMC minutes, SPX equivalent 1990.

Today, the first level I expect a pullback to is about 1984-5 SPX. If that holds, we’ll move up to mid 1990s. If 1983 breaks, we should move lower to 1977. If they bounce it there, they will target high 1990s

If 1974 breaks, we will move down to mid 1940s.

Futures were +4.50 at their high, now +3.25

Bonds are bullish, just barely so. Opened a bit more bullish than presently.

Yesterday’s volume on NYSE and NAS was even less than Tuesday’s.

bonds doing well…

wow, uc vix pop…

Looks like new intraday high for SPX, sellers were waiting. VIX went ballistic both directions.

bulls are wanting more…

looks like it takes very little buy volume to move the price up…

gm mike. ive got friends wanting to start buying into the market…hmmmm

Tell your friends to wait for a big down day. Then, when it happens be sure and ask them if they want to buy the next day.

good idea..thx

I will never understand people who want to buy at the top. How many people buy gas after it has gone up 50cents?

to me its a subtle sign…

“The small and large caps are starting to diverge”

It seems that has been the case all year. Typically at the end of a rally or as in 1998 before a big crash which I believe is unlikely..

In my opinion the market is not over valued. The yield curve is steep. Inflation is low. Seems like a good time to buy the dips.

yes, that would be the strategy

I thought I would drop you a note I found while researching the market.

Friday, 8/22/14 is exactly 2000 days from the 666 low on the S&P from 3/6/09. (It’s also exactly 3x the 3/6/9)

If you don’t believe me, Google the words calendar calculator and enter 3/6/09 to 8/22/14. It’s 2000 days.

Funny, the S&P is going to hit exactly 2000 later today. (It’s also exactly 3x the 3/6/9 low)

Also, just so happens that Jackson Hole is going down.

Coincidence, I think not.

The market will crash after it hits 2000.

Good trading to you. Happy shorting.

I could bore you with the significance of this date for an hour, but you get the point.

This is all a fix. The big boys like numerology.