Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Taiwan rallied 1.4%, South Korea 0.6% and Hong Kong and China around 0.4%. Europe is currently mostly down. Greece is up 1.1%, but Russia is down 1.5% followed by France (down 0.8%) and Germany (down 0.4%). Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil is down, copper up. Gold and silver are up.

Janet Yellen will give a speech in Jackson Hole at 10:00am; ECB President Draghi will speak at 4:30pm, 30 min after the close.

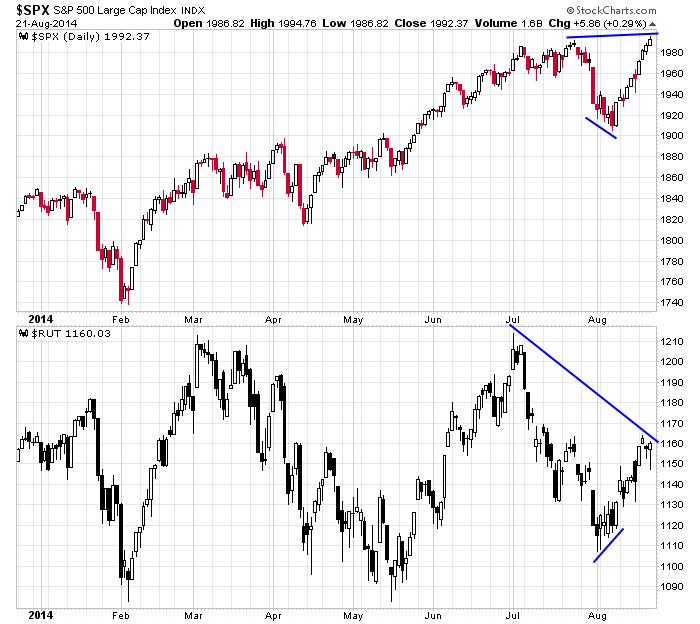

First the Nas hit a new high…then the S&P traded to a new high. But the small caps are nowhere close. Along with a few indicators getting stretched and the indexes in need of a rest having gone vertical the last couple weeks, this is a big reason to be cautious. If the Russell small caps can’t giddy-up and catch up some, the large caps will have limited upside from here.

I looked at a lot of charts yesterday…they look ok. Many are not tradeable…others have gone straight up and don’t have any support or resistance nearby to key off of. In the very near term, I like the market, but I don’t love it. The lack of good set ups is concerning, and Yellen’s speech, even if it’s very dovish, can act as a “sell the news” situation. We’ll see. I’m not placing big bets right now.

Stock headlines from barchart.com…

PG&E (PCG +0.02%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Ann Inc. (ANN +0.54%) reported Q2 EPS of 70 cents, better than consensus of 68 cents.

Foot Locker (FL +0.27%) reported Q2 adjusted EPS of 64 cents, well ahead of consensus of 54 cents.

Nordson (NDSN +0.09%) reported Q3 EPS of $1.21, stronger than consensus of $1.13.

Scansource (SCSC +2.53%) reported Q4 adjusted EPS of 60 cents, better than consensus of 59 cents.

The Fresh Market (TFM -1.68%) rose nearly 5% in after-hours trading after it reported Q2 adjusted EPS of 36 cents, better than consensus of 35 cents.

Marvell (MRVL +0.74%) reported Q2 EPS of 34 cents, well above consensus of 28 cents.

Ross Stores (ROST -0.89%) climbed over 5% in pre-market trading after it reported Q2 EPS of $1.14, higher than consensus of $1.08.

Aeropostale (ARO unch) reported a Q2 EPS ex-charges loss of -46 cents, a smaller loss than consensus of -49 cents.

Salesforce.com (CRM +0.58%) reported Q2 adjusted EPS of 13 cents, higher than consensus of 12 cents.

Brocade (BRCD +0.64%) reported Q3 EPS of 23 cents, better than consensus of 19 cents.

GameStop (GME -2.03%) jumped 10% in after-hours trading after it reported Q2 EPS of 22 cents, higher than consensus of 18 cents.

Intuit (INTU +0.63%) reported an unexpected Q4 adjusted EPS loss of -1 cent, much weaker than consensus of a 7 cent profit, and then lowered guidance on fiscal 2015 EPS to $2.45-$2.50, well below consensus of $3.97.

The Gap (GPS +0.16%) reported Q2 EPS of 75 cents, stronger than consensus of 69 cents, and then raised guidance on fiscal 2014 EPS view to $2.95-$3.00, above consensus of $2.95.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Janet Yellen speech

Notable earnings before today’s open: ANN, FL, HIBB, RY

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 22)”

Leave a Reply

You must be logged in to post a comment.

BKX is the leader…

Can’t avoid saying I agree with Jason.

We had a move down in the futures overnight, and then a rebound, then during regular trading hours, that low has been re-tested which says keep an eye on SPX 1985. If that holds, it projects a trgt right at 2000.

Seems to me they’re just going thru the motions, now that the whipsaws have tapered out. Maybe they’re waiting to hear some yelling from Yellen.

AND it is a Friday in late summer. Tends to make everybody lazy. All I’ll say about that is be lazy til the last hour.

Then come back and see what’s going on. Pros play the close.

If we start a pullback, add “3” to the numbers I gave yesterday and you’ll be close enough.

Volume was higher Thurs for the NYSE over Wed’s trading, lower for the NAS.

Have a good weekend.

You here, Jim? Signs of life.

YES, caught that nice short at 1030 and just watching now…

Good on you. Had an alert go off just before I queried you. Think they’re going for 1993-4. We’ll see. Big boys should be here.

looks like they will wait until tuesday.

They’re for sure not listening to me.

BKX has been a good trigger

See you Monday.