Good morning. Happy Tuesday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the upside. China led with a 1.4% gain followed by Japan (up 1.2%). Taiwan dropped 1.2%. Europe is currently mixed. Prague is leading with a 0.9% gain, followed by Italy (up 0.7%) and Greece (up 0.6%). There are no big losers. Futures here in the States point towards a flat-to-up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

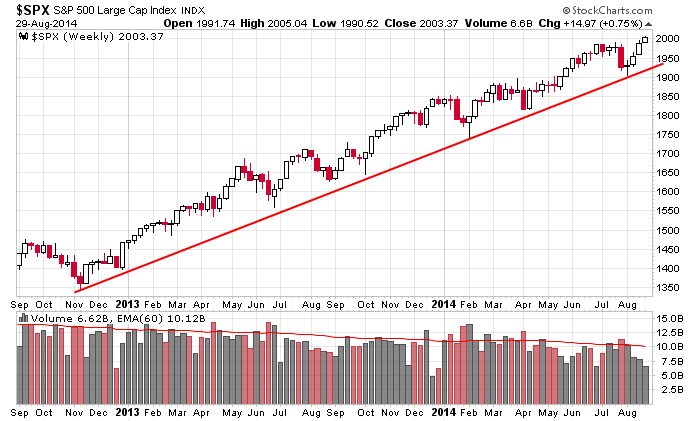

Here’s the S&P 500 weekly chart. Yes volume has declined the last couple weeks, but otherwise what’s not to like? This is why I keep saying the bulls deserve the benefit of the doubt…because they’ve been in control of the intermediate and long term for so long…and up trends don’t change very quickly.

But breadth has been weakish. Even though a couple indexes are at new highs, new highs among individual stocks has been lacking. This can’t last. The bullish percent charts are also much lower than they’ve been going back a couple months. So there seems to be less participation. The indexes are doing great, but beneath the surface there’s a lack of broad-based participation. Something has to give. Oh, and the small caps have also not kept up, thanks to a big July drop.

I like the the market overall. The trend is up…the quality of set-ups has improved…but weak breadth has lingered, and I wonder if/when it’ll pull the market down (assuming it doesn’t improve). I guess you can say I’m cautiously bullish. That means I’m long but not all in, and I would not be surprised if the market corrected soon if the technicals don’t improve. More after the open.

Stock headlines from barchart.com…

Northrop Grumman (NOC +0.27%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

Tesla (TSLA +2.21%) and Cabot Oil & Gas (COG +0.51%) were both upgraded to ‘Buy’ from ‘Hold’ at Stifel.

CNBC reports that Dollar General (DG -0.33%) will raise its offer for Family Dollar (FDO unch) to $80 a share or $9.1 billion.

AutoZone (AZO +0.01%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Flowserve (FLS -0.13%) was initiated with an ‘Overweight’ at Barclays with a price target of $85.

Finisar (FNSR +1.80%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Progressive (PGR +0.44%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Boeing (BA -0.24%) was awarded a $234.7 milion contract for the production and delivery of 24 AH-6I aircraft to Saudi Arabia.

Amphenol (APH -0.37%) jumped 10% in after-hours trading after it acquired Casco Automotive Group for $450 million.

David Voyticky reported a 5.2% passive stake in Miller Energy (MILL +2.78%) .

RA Capital reported a 9.9% passive stake in Wafergen Biosystems (WGBS -1.10%) .

Larry Feinberg reported a 6.4% passive stake in Metabolix (MBLX +1.47%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Gallup US Consumer Spending Measure

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

11:00 Global Manufacturing PMI

1:00 PM Gallup US ECI

Notable earnings before today’s open: CONN

Notable earnings after today’s close: AVNW, GWRE, PIKE, PRGN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 2)”

Leave a Reply

You must be logged in to post a comment.

prediction covered both ways

Your comment implies you’re either all in on the long side or all in on the short side, and there’s no gray area. This just isn’t the case. Within a trend you can be all in or based on whatever you look at, you can be partially in because the risk/rewards are less favorable.

Gm, Committment of traders (cot)

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_28Sep020916_zps4e14d003.jpg

Good hunting all see you later…Root canal day..yahoooooo

Futures traded quietly yesterday til 1 pm eastern.

Overnight they reached a target at +4.75 and have backed off a little since then. Still positive.

Today is deja vu all over again.

I expect a pullback to SPX 1999-2001. There are multiple levels of support below that as well.

Today being actually the 4th day of a 4 day weekend for the big boys who are reluctant to leave their

digs on the Hamptons, we might see today being a real yawner.

News doesn’t pick up til Thurs, and it’ll be with a bang. Friday will be the monthly jobs / unemployment

report. If you have errands to do, get ’em done today.

At 920 futures are +2.75.

Bonds bullish.

And as Jason says, breadth (and volume) has be lame. However, price is what matters, and it’s a risin’ so go

with the flow.