Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong rallied 2.3%, followed by China (up 1%), Singapore (up 0.6%), Taiwan (up 0.5%) and India and Indonesia (up 0.44%). Europe is currently posting relatively big, across-the-board gains. Russia is up 2.8%, followed by Italy (up 1.75%), Austria (up 1.3%), Germany (up 1.2%), Spain and France (up 1.1%) and Switzerland (up 1%). Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper is down. Gold is up, silver down.

The reason for the strength in Europe and the bid under the futures here in the States is there has been some sort of resolution between the Russia/Ukraine conflict…but the two sides haven’t agreed on exactly what they’ve agreed on. Have they agreed on a cease-fire? Have they agreed on a truce? Have they simply agreed to keep talking and resolve the conflict? It’s not clear, but Europe at least likes the prospects because stocks are enjoying a very strong day.

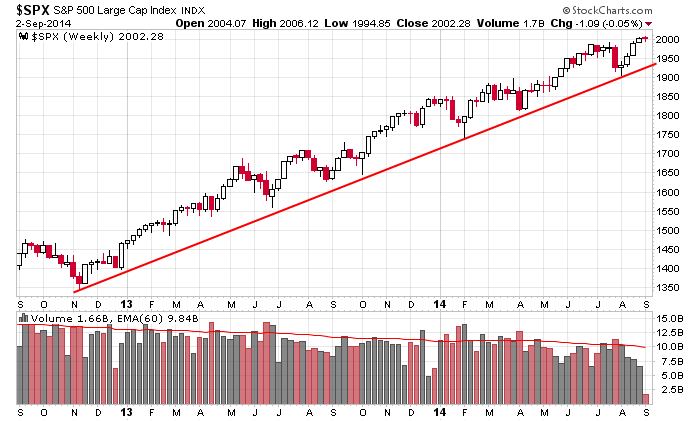

Yesterday the Nasdaq, Nas 100 and Russell 2000 hit new higher highs and closed at higher highs. The S&P 500 hit a new all-time high and then closed down slightly. As long as the futures don’t drop the next hour, the indexes will open at new highs again. Long term you cannot argue with the trend. It’s steady and consistent and is as good as they get. In the near term there are a few concerns. New highs haven’t kept up (although they did pop yesterday) and the bullish percent charts have also lagged. Breadth has been weaker on this most recent leg up than other rallies, so while the indexes are carried higher by few stocks, some stocks are not participating. I still like the market – I’ve been bullish since the bottom in early-August – but there are a few technical concerns to keep in mind.

Unless you are a slick short term trader, you are best off trading in the direction of the trend. Within the trend you either are all-in or partially in or even mostly on the sidelines waiting…but you’ll be long or looking to get long. And here is the overall trend. Keep it simple.

Stock headlines from barchart.com…

Kohl’s (KSS +0.54%) was upgraded to ‘Buy’ from ‘Hold’ at Maxim.

According to DigiTimes, Samsung (SSNLF -1.67%) has offered price cuts for its 7 and 10-inch tablets while Lenovo (LNVGY +3.11%) has reduced the price for its 8 and 10-inch entry level tablets.

Bank of America (BAC +1.12%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

American Tower (AMT +0.18%) Was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Cinemark (CNK +1.30%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

C.H. Robinson (CHRW +0.16%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

Toll Brothers (TOL +0.11%) reported Q3 EPS of 53 cents, higher than consensus of 45 cents.

Helen of Troy (HELE +1.60%) fell over 9% in after-hours trading after it lowered guidance on its fiscal 2015 revenue estimate, ex-Healthy Directions, to $1.275 billion-$1.30 billion, below consensus of $1.39 billion.

A Capital Management reported an 18.1% passive stake in Achillion (ACHN +6.05%) .

Concur Technologies (CNQR +0.57%) jumped over 14% in after-hours trading after Bloomberg reported that the company has explored selling itself and is said to have approached SAP and Oracle to gauge interest.

Eminence Capital reported a 5.1% passive stake in Zynga (ZNGA +4.15%) .

Crown Castle International (CCI +0.03%) rose over 1% in after-hours trading after it announced that it received a favorable private letter from the Internal Revenue Service with respect to Crown Castle’s real property and rents from real property, respectively, under the rules governing real estate investment trusts, or REITS.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:00 MBA Mortgage Applications

7:45 ICSC Retail Store Sales

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:55 Redbook Chain Store Sales

10:00 Factory Orders

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: EGAN, GIII, NAV, TOL

Notable earnings after today’s close: ABM, AVAV, BV, CBK, DDC, HRB, MTRX, PVH

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 3)”

Leave a Reply

You must be logged in to post a comment.

Days like today are almost always followed by a top the next day.

Sell today and go away.