Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Indonesia, New Zealand and South Korea moved down; Japan, Singapore, Taiwan and Australia moved up. Europe currently leans to the downside. Greece is down 1.5%, followed by Spain and Norway (down 0.5%) and Stockholm (down 0.4%). Russia is up 0.8%. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is up, copper down. Gold is up, silver down.

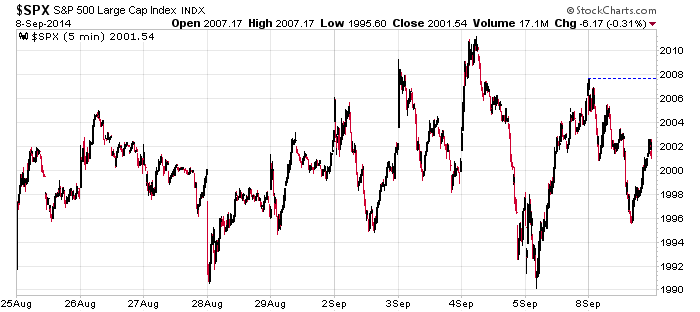

This is the S&P over the last 10 days. Hence why I’ve been saying the near term was iffy. Lots of ups and downs, lots of sudden reversals, no follow through, no directional move lasts more than a day or two.

It’s okay though. The market doesn’t always have to be doing something. It’s normal and healthy for it to go through periods where it chops and churns and makes no overall progress. When you consider the time of year (Aug and Sep tend to be weak) and all the stuff going on in the world (Eastern Europe, Middle East, Iraq), I’d consider it to be a good performance for the S&P to sit in a range and rest after having rallied 100.

Have patience. One of the keys to trading is being able to sit tight when there aren’t many great opportunities.

Stock headlines from barchart.com…

Ralph Lauren (RL -0.23%) was upgraded to ‘Strong Buy’ from ‘Buy’ at ISI Group.

Total (TOT -2.26%) was upgraded to ‘Neutral’ from ‘Underperform’ at BofA/Merrill.

HD Supply (HDS -0.83%) reported Q2 adjusted EPS of 51 cents, better than consensus of 47 cents.

Leidos (LDOS -0.89%) reported Q2 EPS of 61 cents, less than consensus of 62 cents, and then lowered guidance on fiscal 2015 EPS view to $2.10-$2.30 from $2.35-$2.55, well below consensus of $2.47.

Dick’s Sporting Goods (DKS -0.46%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo.

The U.S. airline sector, which includes United Continental (UAL +0.79%), Delta Air Lines (DAL -0.46%) and American Airlines (AAL +1.00%), were initiated with an ‘Overweight’ at Credit Suisse.

D.R. Horton (DHI +0.75%) and Lennar (LEN +0.44%) were both upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan.

Annie’s (BNNY -1.12%) surged over 30% in after-hours trading after General Mills (GIS -0.58%) said it will buy the company for $46 per share in cash or about $820 million.

Pep Boys (PBY +1.97%) dropped over 6% in after-hours trading afte rit reported Q2 EPS of 0 cents with items, well below consensus of 16 cents.

CHC Group (HELI -1.89%) reported a Q1 EPS loss of -46 cents, less than consensus of -47 cents.

Casey’s General Stores (CASY -0.54%) rose over 3% in after-hours trading after it reported Q1 EPS of $1.43, well above consensus of $1.24.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

10:00 Daniel Tarullo testifies before Senate Banking Committee

1:00 PM Results of $13B, 3-Year Note Auction

Notable earnings before today’s open: BKS, FRAN, HDS, JW.A, LAYN, LDOS, TITN

Notable earnings after today’s close: IRET, KKD, PANW, PIKE, PPHM, SAIC, SPA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 9)”

Leave a Reply

You must be logged in to post a comment.

“One of the keys to trading is being able to sit tight when there aren’t many great opportunities. ”

Amen!

the quad witches are at work with the NQ 100 at another outside day

some say we are suppose to be in a blow of trend

from Jasons chart i see a broadening jaws of death terminal patter from august 25,but terminal for what

intraday i see wider range broadening pattern days–good for daytraders

from the scalper of fat bulls daytrading bear

the true colours of the bear are showing with some well positioned selling to the unsuspecting bulls

i have reversed now and am a unsuspecting bull

ditto

i have a spx wave 6 to 2017

http://i1085.photobucket.com/albums/j423/jimmaya810/ScreenHunter_29Sep091539_zps439a9624.jpg