Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Hong Kong dropped almost 2%, followed by Indonesia (down 1%), Taiwan and India (down 0.8%) and Australia (down 0.6%). Europe currently leans to the downside. Greece is down 2.75%, but no other market has moved more than 0.5%. Spain, Austria and Prague are also down. Futures here in the States point towards a down open for the cash market.

Join Leavitt Brothers for only $15…here

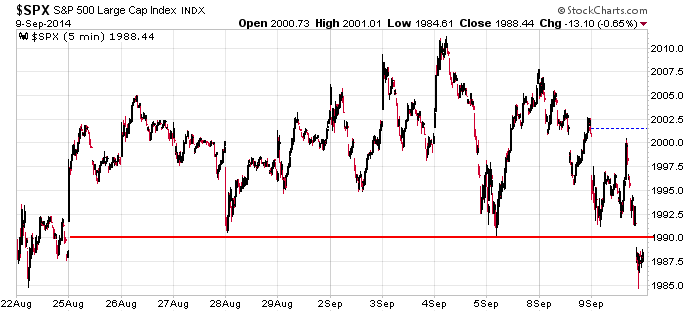

Here’s an update of the S&P intraday chart. The index broke through 10-day support, so I had to back the chart up an extra two days. The move doesn’t guarantee anything, but it does increase the odds the market breaks out from its recent funk. Penetrating support either induces selling, or it’s a trap – one that will lure more bears to the table before launching upward. Don’t think that’s in the cards? It’s happened a lot. It drops just enough to get active traders stacked on one side, then springs to the other side.

Whether the market is on edge and about to plunge or getting close to making a run back to its highs doesn’t change the fact that the current environment is not a good one for swing trading. Lots of gaps, lots of sudden reversals, very little follow through, very few good set ups. There’s a time to trade and a time to sit tight, and right now a swing trader is better off waiting. Better times are ahead, so preserving capital for better opportunities would be wise. More after the open.

Stock headlines from barchart.com…

Huntsman (HUN -1.43%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

eBay (EBAY -2.77%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

L Brands (LB -0.72%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Tiffany (TIF -0.92%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Hartford Financial (HIG -0.49%) was upgraded to ‘Outperform’ from ‘Market Perform’ at FBR Capital.

Twitter (TWTR -2.67%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Billionaire activist investor Carl Icahn raised his stake in Gannett (GCI -3.11%) to 8.48% from 6.63%.

Urban Outfitters (URBN -0.46%) fell nearly 3% in after-hour trading after the company said that Q3 Same-Store-Ssales thus far are low single-digit negative.

Lazard Asset Management reported a 7.05% passive stake in Orbitz (OWW -1.21%) .

SAIC (SAIC -0.50%) reported Q2 EPS of 70 cents, better than consensus of 68 cents.

Piper Jaffray believes Apple’s (AAPL -0.38%) new product launches met expectations and keeps its ‘Overweight’ rating on Apple with a $120 price target.

Pershing Square Capital Management reported a 9.7% stake in Allergan (AGN -0.49%) and sent a letter to Allergan’s Board of Directors.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Wholesale Trade

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

Notable earnings before today’s open: MANU, VRA

Notable earnings after today’s close: FIVE, MW, RH, SIGM, WTSL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 10)”

Leave a Reply

You must be logged in to post a comment.

Going long on 9/10 seems foolish given the terrorists love of 9/11. I am guessing (engineers actually calculate when they guess) that the middle of next week will provide a buying op.