Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. China rallied 0.9%; Taiwan dropped 1.1%, followed by New Zealand (down 0.7%) and Malaysia (down 0.6%). Europe is currently mixed. Russia is up 1.35%, Norway 0.66%, Stockholm 0.5%. There are no big down markets. Futures here in the States point towards a flat open for the cash market.

Join Leavitt Brothers for only $15…here

The dollar is down slightly. Oil is up a small amount, copper down. Gold and silver are down.

I’ve seen some nice improvements the last two days. The small caps have done much better (the Russell is up on the week while the S&P is down 10 points), the indexes have rallied intraday, forming long lower wicks on their daily charts and I’m seeing much better set-ups than the previous couple weeks. In the near term I’d still consider the market to be in a funk…pretty much a 3-week consolidation period, but barring something major happening in the world, odds favor a move up. The odds aren’t strong, but that’s the way they lean right now.

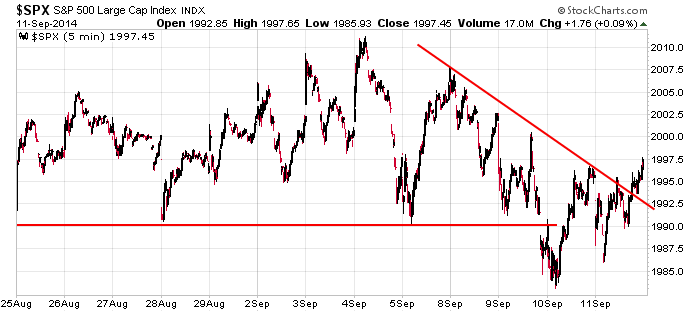

Here’s the SPX intraday chart from yesterday. The last two days the index was weak early in the day, and both times it rallied and closed up and near its highs. Sellers have been unable to maintain control when given the opportunity…and the bulls have stepped up when their backs were against the wall. Baby steps. Right now slight advantage goes to the bulls.

The #1 reason the market may be in the beginning stages of a rally is because it hasn’t fallen yet. When what is logically supposed to happen doesn’t happen, look for a move in the opposite direction. With all the stuff going on in the world – not to mention much lower energy stocks – the market should have dropped. But it hasn’t yet…so the slight bit of weakness we’ve had may be a trap. The bears need to be very careful here. More after the open.

Stock headlines from barchart.com…

T-Mobile (TMUS -0.23%) was upgraded to ‘Buy’ from ‘Hold’ at Argus.

Genuine Parts (GPC -0.31%) was upgraded to ‘Buy’ from ‘Hold’ at BB&T with a price target of $100.

Darden Restaurants (DRI +1.09%) reported Q1 EPS of 32 cents, right on expectations.

Netflix (NFLX -0.58%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Barclays.

Hertz (HTZ +0.18%) rose over 7% in after-hours trading after it said it reached agreement-in-principle with activist investor Carl Icahn to add three directors to the company’s board.

Acuity Brands (AYI +0.38%) was initiated with an ‘Outperform’ at Cowen with a price target of $142.

General Dynamics (GD -0.63%) was awarded a $234.23 million government contract for design agent, planning yard, engineering and technical support for active nuclear submarines.

Gabelli reported a 8.46% stake in Bolt Technology (BOLT +0.05%) .

Ulta Salon (ULTA +0.72%) jumped over 10% in after-hours trading after it reported Q2 EPS of 94 cents, well above consensus of 83 cents.

Conversant (CNVR +0.15%) surged over 30% in after-hours trading after Alliance Data (ADS -2.45%) said it will acquire the company for $35 per share, or $2.3 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Retail Sales

8:30 Import/Export Prices

9:55 Reuters/UofM Consumer Sentiment

10:00 Business Inventories

Notable earnings before today’s open: DRI, NTWK

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 12)”

Leave a Reply

You must be logged in to post a comment.

the rounding top in many a index is not a good sign

but still anything can happen for next weeks quad witches

– tick most of the day..relentless selling…

the tick is probably my no one indicator

my teacher taught me to cover up price and drawn a chart just based on what the tick indicator was doing

after a lot of practice -it works

but when you take price and tick together on the 2 minute and 5 minute charts you get all the divergences etc and get a good idea whats coming

I want a 3% or more decline before I want to go long. Not much could get me to short. The wind is too strong going down.