Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed with a lean to the upside. Indonesia rallied 1.1%, followed by Hong Kong and South Korea (up 1% each), Singapore and Taiwan (up 0.7% each) and India and China (up 0.5% each). New Zealand dropped 0.9%, and Australia dropped 0.6%. Europe is currently mostly up. Austria is up 1.4%, followed by Italy (up 1.2%), Greece and Spain (up 1% each), Stockholm (up 0.8%), France and Belgium (up 0.7% each) and Norway (up 0.6%). Futures here in the States point towards a flat open for the cash market.

Happy Birthday Leavitt Brothers -> special offer here.

The dollar is flat. Oil and copper are down. Gold is flat, silver is down.

It’s possible yesterday was a reversal day, that yesterday’s low was the bottom for this most recent correction. But because of the market’s tendency to do well the day before and day of an FOMC meeting, we’ll need to see buying interest beyond today and tomorrow.

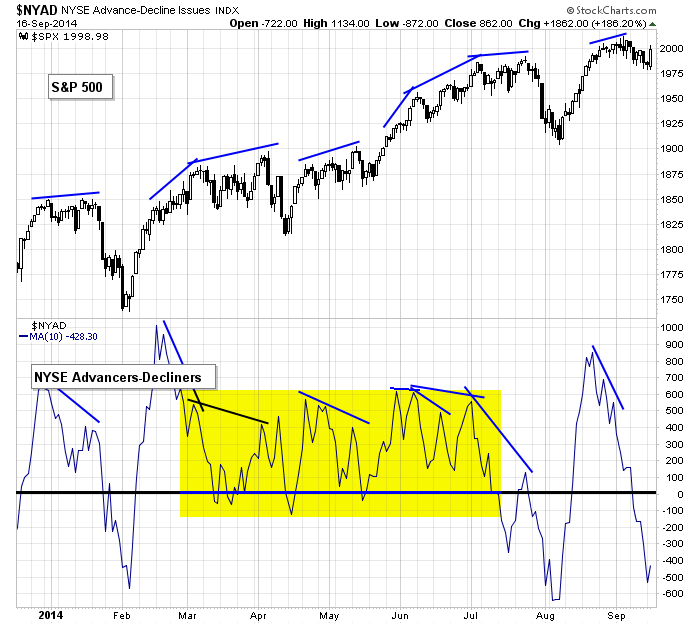

Some indicators, such as the 10-day of the NYSE AD line, dropped to a low level and are now curling up. This would support the market if it wanted to begin a new uptrend.

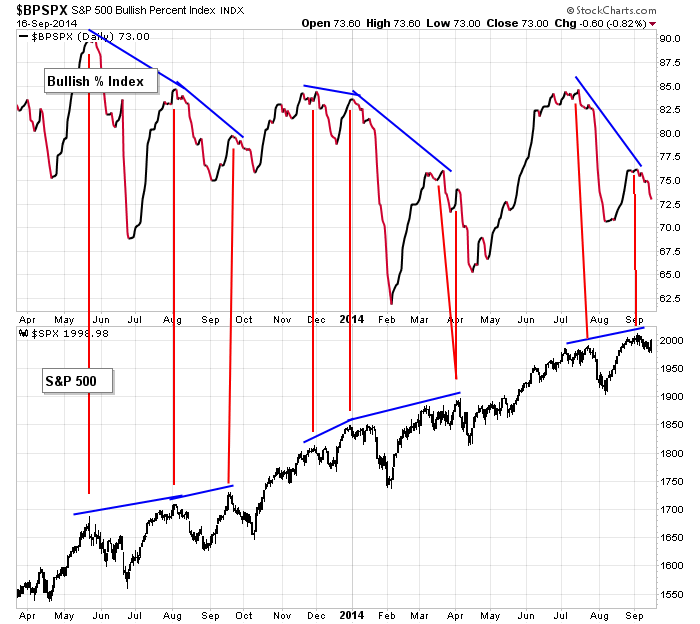

Other indicators, such as the SPX bullish percent index, aren’t ready to support a move up.

There are lots of cross-currents…the near term is not clear. And of course with today’s Fed meeting, anything goes, although the Fed rarely disrupts what’s in place…but with yesterday’s strong move up, I can’t say anything is in place in the near term anyways. Am I talking in circles? Maybe. But that just means the market isn’t obvious right now. More after the open.

Stock headlines from barchart.com…

Lennar (LEN -0.25%) reported Q3 EPS of 78 cents, higher than consensus of 67 cents.

AB InBev (BUD +0.01%) was upgraded to ‘Hold’ from ‘Sell’ at Societe Generale.

Cigna (CI +1.88%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna.

Kellogg (K +0.22%) was downgraded to ‘Hold’ from ‘Buy’ at Societe Generale.

DaVita (DVA +0.42%) was downgraded to ‘Hold’ from ‘Buy’ at KeyBanc.

BHP Billiton (BHP +1.33%) was downgraded to ‘Underperform’ from ‘Neutral’ at Exane BNP Paribas.

General Mills (GIS unch) reported Q1 EPS of 61 cents, less than consensus of 69 cents, and then the stock was downgraded to ‘Sell’ from ‘Hold’ at Societe Generale.

Under Armour (UA +0.83%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

NASA awarded a $6.8 billion contract to Boeing (BA +0.80%) and SpaceX, of which Boeing will receive $4.2 billion, and SpaceX will receive $2.6 billion, for the commercial flight of astronauts to the International Space Station.

L Brands (LB +1.48%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Apogee Enterprises (APOG +1.76%) jumped over 5% in after-hours trading after it reported Q2 EPS of 57 cents, well above consensus of 34 cents, and then raised guidance on fiscal 2015 EPS to $1.62-$1.72, higher than consensus of $1.44.

Adobe (ADBE +0.65%) fell 4% in after-hours trading after it reported Q3 adjusted EPS of 28 cents, better than consensus of 26 cents, but Q3 revenue of $1.005 billion was below consensus of $1.02 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

8:30 Current Account

10:00 NAHB Housing Market Index

11:00 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:30 PM Chairman Press Conference

Notable earnings before today’s open: CBRL, FDX, GIS, LEN

Notable earnings after today’s close: CLC, MLHR, PIR, UNFI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 17)”

Leave a Reply

You must be logged in to post a comment.

I think Jason was right yesterday… We need a washout.

Tops have fast spikes up and down

its all part of the trend change going on

next 10 years will be great for swing traders on the short side

atm its a daytraders delight