Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. China dropped 1.8%, followed by Singapore and India (down 1.2%) and Hong Kong and South Korea (down 0.9%). Europe is also mostly down, but the losses are smaller. Greece is down 2%, followed by Prague (down 1.2%), Austria (down 0.9%) and London, France and Italy (down 0.5% each). Russia is up 1.1%. Futures here in the States point towards a down open for the cash market.

Happy Birthday Leavitt Brothers -> special offer here.

The dollar is down slightly. Oil is down, copper is up. Gold and silver are up.

The market continued its slide yesterday. The Dow, S&P 500 and S&P 400 put in lower lows while the Nas and Russell broke short term support lines in route to dropping to 1-month lows.

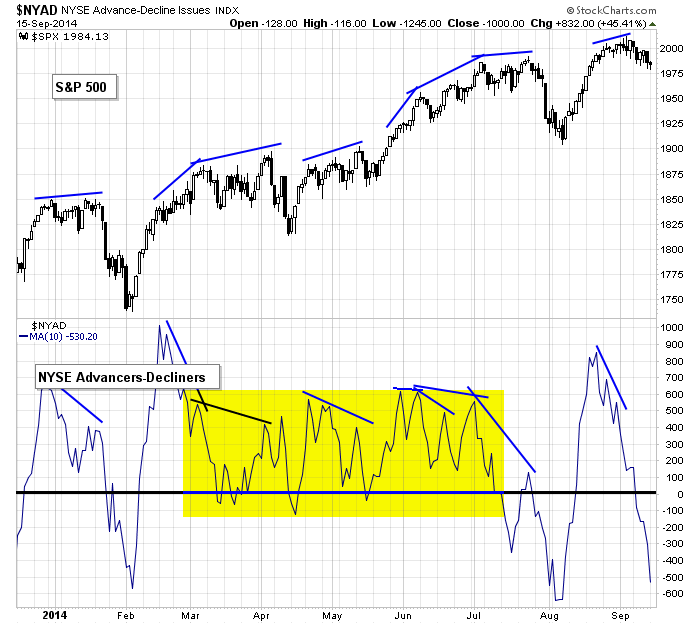

For a couple weeks the indicators have been mixed – some were acting “normal” (how you’d expect them to act during a consolidation period within an uptrend); others were not supportive of an upside breakout. Now most point down, and instead of thinking they can reverse soon, it’d be better to get a full-blown washout. Here’s an example -> the 10-day MA of the NYSE AD line. If the market was strong, the AD line would have found support near 0 and reversed up. That’s what it does within uptrends – oscillates between 0 and a healthy number. But when it dips much below 0, it hints at more weakness than may be present in the index charts. The recent move below 0 told us we were likely to get a mini correction off the high, not just a pause.

Several other indicators point to the same scenario – a mini correction rather than a pause before attempting to move higher.

My bias remains to the downside. If you’re a long-only trader, sit tight and wait. Otherwise the short side can be played with knowledge things can change at tomorrow’s FOMC statement. Also, it looks like Alibaba may pull a Facebook and squeeze every last penny out of Wall St. If so, much more fuel will be added to the recent weakness after BABA goes public. More after the open.

Stock headlines from barchart.com…

Con-way (CNW +0.38%) was downgraded to ‘Neutral’ from ‘Outperform’ at RW Baird.

Arch Coal (ACI -3.05%) and Peabody (BTU -2.22%) were both downgraded to ‘Reduce’ from ‘Neutral’ at Nomura.

TRW Automotive (TRW -0.78%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

AngloGold (AU +1.64%) was upgraded to ‘Overweight’ from ‘Neutral’ at HSBC.

Terex (TEX -6.43%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Cummins (CMI -0.48%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo.

Anglo American (AAUKY +0.84%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Science Application International Corporation (SAIC -0.06%) has been awarded a $423.8 million government bridge contract for maintenance, repair, and operations in New Jersey.

Microsoft (MSFT -0.96%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

Adobe (ADBE -1.00%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

Glenview Capital Management reported a 6.15% passive stake in Fossil (FOSL -2.60%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

7:45 ICSC Retail Store Sales

8:30 Producer Price Index

8:55 Redbook Chain Store Sales

9:00 Treasury International Capital

Notable earnings before today’s open: FDS

Notable earnings after today’s close: ADBE, APOG

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 16)”

Leave a Reply

You must be logged in to post a comment.

the evil quad witches,after tricking the bears with the a/d line and many divergences into loading up with bearish puts,to balance the books of the evil insto market makers,then the quad witches are

going to retire and become angles and work for the bears

i am looking to reverse to the short side as targets have been reached

the markets are still in a strong position for a blow of top,but i doubt it

maybe lower double tops for some indexes

what are you going to short. ym is at resistance now…

closed all long positions but didnt short NQ,YM ,ES, DAX,FTSE,N225,or aussie spi

I scalped short today..flat at the moment. thx for ur response. much appreciated…

Mike, where are u? geez im jones-in for u….