Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. India rallied 1.8%, followed by Japan (up 1.1%), Taiwan (up 0.5%) and China and Indonesia (up 0.4%). Hong Kong dropped 0.85%, and South Korea dropped 0.7%. Europe is currently mostly up. Germany and Prague are both up more than 0.8%, followed by Spain and Amsterdam (up 0.7%) and Austria and France (up 0.65%). Greece is down 1.6%. Futures in the States point towards a moderate gap up open for the cash market.

Happy Birthday Leavitt Brothers -> special offer here.

The dollar is up. Oil and copper are down. Gold and silver are down.

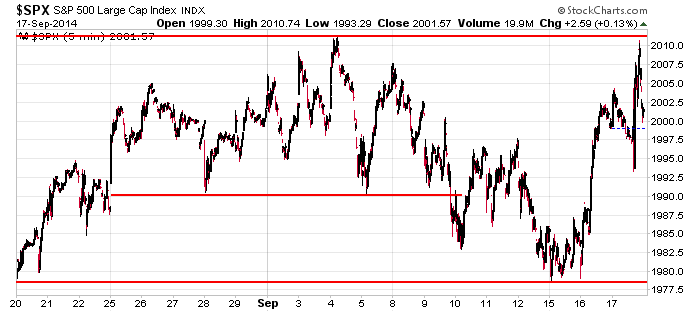

For a couple days it looked like the market was going to leg up…on two consecutive days the indexes dropped but then rallied to close up and near their highs. Then it looked like the market was going to continue down…all the indexes took out support levels and fell to 1-month lows. Then we got a big move Tuesday and an up day yesterday that closed well off its highs. The market can’t make up its mind. I changed my near term bias to ‘up’ on Tuesday, but it’s not a strong bias. There’s support below and resistance above and virtually no momentum.

Here’s the intraday S&P chart. Lots of gaps, lots of sudden reversal, a complete lack of smooth trading…not a time to go all in.

Stock headlines from barchart.com…

Kohl’s (KSS +0.67%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Rite Aid (RAD +3.59%) reported Q2 EPS of 13 cents, more than double consensus of 6 cents, but then lowered guidance on fiscal 2015 EPS view to 22 cents-33 cents, weaker than consensus of 34 cents.

DuPont (DD +5.20%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

ArcelorMittal (MT +2.14%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Citigroup keeps its ‘Buy’ rating on FedEx (FDX +3.27%) and raises its price target on the stock to $180 from $170.

Monsanto (MON -0.20%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Peabody (BTU -1.94%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

IHS Inc. (IHS -0.56%) reported Q3 adjusted EPS of $1.49, stronger than consensus of $1.44.

Clarcor (CLC -0.22%) reported Q3 adjusted EPS of 83 cents, better than consensus of 78 cents, and then raised guidance on fiscal 2014 adjusted EPS to $2.92-$2.98, well above consensus of $2.82.

Credit Suisse initiated InterOil (IOC -0.96%) with an ‘Outperform’ and a $71 price target.

Pier 1 Imports (PIR +0.91%) slid over 9% in after-hours trading after it reported Q2 EPS of 10 cents, weaker than consensus of 14 cents.

United Natural Foods (UNFI +0.68%) rose 3% in after-hours trading after it reported Q4 EPS of 67 cents, higher than consensus of 65 cents, and then raised guidance on fiscal 2015 GAAP EPS to $2.88-$3.01, above consensus of $2.88.

Herman Miller (MLHR +1.61%) climbed 2% in after-hours trading after it reported Q1 adjusted EPS of 47 cents, right on consensus, although Q1 revenue of $509.7 million was better than consensus of $505.27 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Housing Starts

8:30 Initial Jobless Claims

10:00 Philly Fed Business Outlook

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: CAG, IHS, RAD

Notable earnings after today’s close: ORCL, RHT, TIBX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 18)”

Leave a Reply

You must be logged in to post a comment.

Lets see, i believe mike,(i hope is well) posted spx to 2017 and then 2030..Mike where are u?