Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed mostly up. Japan rallied 1.6%, followed by Hong Kong and China (up 0.6%) and New Zealand (up 0.5%). Europe currently leans to the upside. Greece is up 2%, followed by Prague (up 0.8%) and London (up 0.6%). Russia is down 1.25%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

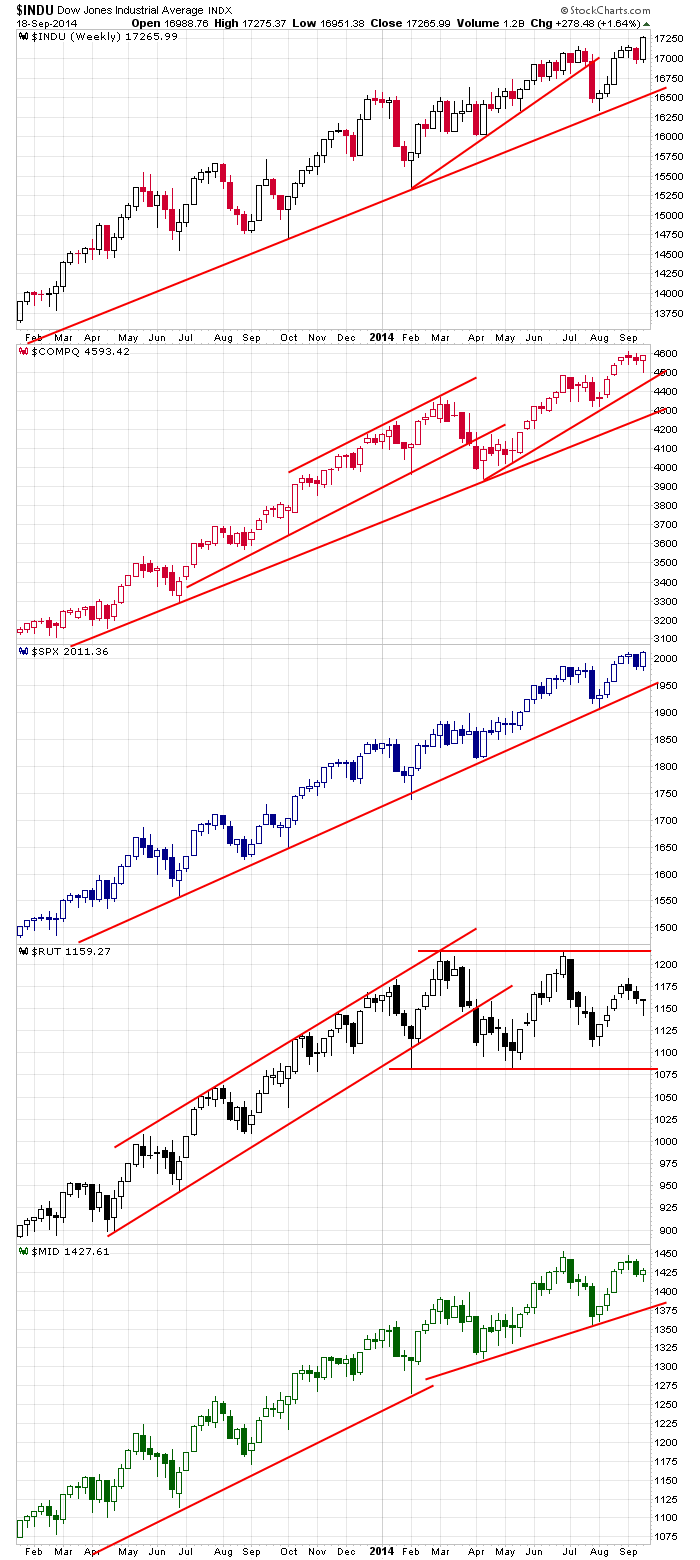

It’s been a good week. The Russell small caps are flat; the other indexes are up. The Dow and SPX have hit new highs; the Nas is very close. Here are the weekly charts. The Russell remains in a big, fat range. The Dow, Nas, SPX and MID are in solid long term up trends.

Options expire today.

The people of Scotland have voted “no,” so the country will remain part of the UK.

Alibaba (BABA) goes public today at $68 per share. It’ll be the biggest IPO since Facebook went public and one of the biggest IPOs in history. It should do well, and that hints at some pretty good underlying health. When small companies go public with market caps in the $1-$5 billion range, its nice, but big institutions thirst for much bigger companies they can take multi-billion dollar positions in. BABA represents that opportunity, so for many this is a chance to put a lot of money to work in a fast growing tech company.

The quality of trading set ups has improved this week.

Many breadth indicators have improved.

But next week the market will enter what is historically the weakest 2-week period of the year.

My bias remains to the upside, but it’s not a strong bias. More after the open.

Stock headlines from barchart.com…

Alibaba (BABA) was initiated with a ‘Buy’ at Cantor with a price target of $90.

Universal Health (UHS +0.80%) will replace Peabody (BTU -4.93%) in the S&P 500 as of today’s close.

United Rentals (URI +0.90%) will replace Graham Holdings (GH)C in the S&P 500 as of today’s close.

MGM Resorts (MGM +2.41%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Deutsche Telekom (DTEGY +1.14%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

Concur (CNQR +0.31%) jumped 20% in after-hours trading after SAP acquired the company for $129 a share or $7.4 billion.

Home Depot (HD +0.95%) raised guidance on fiscal 2015 EPS view to $4.54 from $4.52, higher than consensus of $4.50.

Restoration Hardware (RH -0.49%) was initiated with a ‘Buy’ at CRT Capital with a price target of $90.

Molycorp (MCP -13.82%) rose over 6% in after-hours trading after Oaktree Capital reported a 9.1% passive stake in the company.

Red Hat (RHT -0.69%) reported Q2 EPS of 41 cents, better than consensus of 38 cents.

Oracle (ORCL +1.00%) reported Q1 adjusted EPS of 62 cents, weaker than consensus of 64 cents, and then Oracle CEO Larry Ellison stepped down from his post and was named executive chair of the board and Chief Technology Officer (CTO).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Atlanta Fed’s Business Inflation Expectations

10:00 Leading Indicators

Notable earnings before today’s open: none

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 19)”

Leave a Reply

You must be logged in to post a comment.

Jason,

I signed up yesterday for the $15 special and gave my credit card info, etc. but hear nothing.

What happens next, please?

Regards,

Ricahrd (Martin)

Richard…I don’t see a membership for you. Give it another shot.

the quad witches have now turned into pure angles and will now support the bears

japan says its massive big pension funds have all week been moving out of their world wide bond

possitions into world equities thus causing a spike top in the bull

all the bulls are now falling over dead from consumption and obesity

they are being consumed by hungry bears

their will be no more bull for 10 years

just like long only pension funds to buy at the top

go the quad angles

aussie, gorged bulls..hungry bears…hmmm. u short yet?

Hi jims,

short from early asia time

closed YM,NQ,ES,FTSE,DAX ,N225 ,shorts at last tick extreme about 1am NY TIME

still holding some longer term shorts in different account

may go intra day short very soom,with this little abc move ,providing it does not move above

most recent L High