Good morning. Happy Thursday. Happy New Years for those who celebrate it.

The Asian/Pacific markets closed mixed. Japan rallied 1.3%, followed by Indonesia (up 0.53%) and New Zealand (up 0.37%). India and Taiwan closed down 1%, and Hong Kong lost 0.64%. Europe is currently mostly up. Russia is up 0.8%, followed by Prague (up 0.68%), Spain (up 0.66%) and Italy (up 0.61%). Greece is down 1.23%. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are down.

Yesterday was an impressive day for the market. After a weak start the indexes rallied relatively hard…then rested during lunch…and then rallied again. Across-the-board gains were registered…the Nas, Dow and small caps led the way.

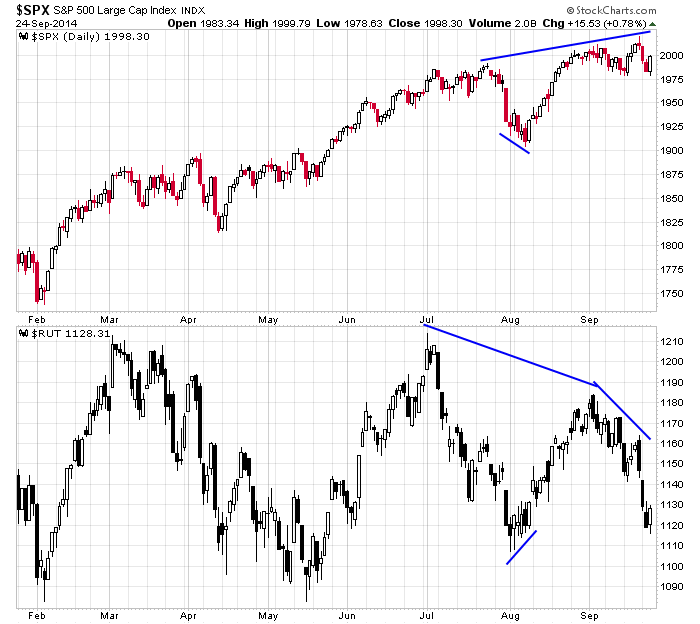

The key going forward is the movement of the small caps and mid caps. The Dow, Nas and S&P would not even be considered in correction or pullback mode. They just hit new highs at the end of last week, and it takes more than three down days to get the bulls attention. The small and mid caps, on the other hand, have been declining all month and are down a couple percent. There is a stark difference between them and the rest of the market.

If the small caps and mid caps can catch a bid, the rest of the market will be free to rally up to new highs again. Simple as that. Failure of the smaller stocks to rally would cap the upside of the entire market. We need evidence investors are willing to take a chance with smaller and riskier companies. Here’s the divergence that needs to right itself.

Stock headlines from barchart.com…

Northrop Grumman (NOC +0.89%) was upgraded to ‘Buy’ from ‘Hold’ at Argus with a $145 price target.

AutoZone (AZO +0.17%) was downgraded to ‘Hold’ from ‘Buy’ at Argus.

Yahoo (YHOO +2.13%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

Comerica (CMA -0.59%) was upgraded to ‘Buy’ from ‘Hold’ at Wunderlich.

Barrick Gold (ABX -1.35%) was upgraded to ‘Overweight’ from ‘Neutral’ at HSBC.

KB Home (KBH -5.30%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

Rexahn Pharmaceuticals (RNN unch) jumped over 10% in after-hours trading after it announced that the FDA has granted Orphan Drug Designation for its drug RX-3117 for the treatment of patients with pancreatic cancer.

Worthington (WOR unch) reported Q1 EPS of 63 cents, right on consensus, although Q1 revenue of $862.4 million was higher than consensus of $857.67 million.

H.B. Fuller (FUL +0.37%) slumped over 10% in after-hours trading after it reported Q3 adjusted EPS of 42 cents, well below consensus of 76 cents as Q3 revenue of $526.8 million was below consensus of $539.54 million.

Boeing (BA +0.94%) was awarded a $102 million government contract for full rate production of the Next Generation Automatic Test System.

Raytheon (RTN +0.47%) was awarded a $251.13 million government contract for the procurement of 231 Tomahawk Block IV All-Up-Round missiles for the U.S. Navy and the United Kingdom.

Jabil Circuit (JBL -0.10%) rose over 3% in after-hours trading after it reported Q4 core EPS of 5 cents, well above consensus of no gain, and then raised its 2015 revenue estimate to $16.5 billion-$18.0 billion, above consensus of $16.35 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Durable Goods

8:30 Initial Jobless Claims

9:45 PMI Services Index Flash

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

1:20 PM Fed’s Lockhart: U.S. Economic Outlook and Monetary Policy

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: SCHL

Notable earnings after today’s close: ARCW, DMND, THO

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 25)”

Leave a Reply

You must be logged in to post a comment.

jason, any way to contact mike to see if he is ok? this is very odd.

complete meltdown…rut leading the way…

my two dead cats-gruesome and awesome are very ashamed of them self

they told me to close of my world futures shorts at the last tick indicator extreme –just now

gruesome and awesome are very senile

dbl bottom area for iwm..let see if it holds

looks like the end of the world is coming..lol

gruesome and awesomes only excuse is that they were working for the big boy instos that wanted to be the only ones to take all the japan old age govt pention funds long only money just put in last week

this looks like the start of the 3rd wave down and their should be little let up in selling presure

until 2nd week oct with inra day move ups best to be hoped for to reset

all world indexes –ftse dax es ,ym ,nq etc have broken y/days lows

yes ic that..looks like dow can go another -300-400 pts

can spx 1971 hold intraday to let me get me reset short again

hopefully a test of spx 1994 area.

es 1976 is an intraday 50% retace

jims,

thats to high

long only margin calls should kick in soon with a target of spx 1930-40

then down to 1900

r u short now? if not what es level are u lookin at…im confused…

im long for a scalp..ym 16913

rut finally firming up

no not short yet –i ment your 1994 area is to high

tick has a upward divergent bias atm

after high noon and europe closes may get a intraday up top

ok, i will keep that in mind..lookin for at least a 38.2retrace level

the hindenberg space ship is burning and crashing–a bad omen

apple has worms

allibarber has 40 theives

rut has death crosses–moving averages

the bears can come out to play

atm i would not consider longs even as a daytrade counter trend scalp

allibarber…that is hilarious…

jims

do u use pit trader piviot points as used by the instos

intraday i find those more reliable than fib no’s

spx y/day low was 1978 and S1 or support 1 just above that 1984 im watching for any insto action

thats if we get out of the 1971 area

es is 1961 s2 -y/day low 1969 and s1 1976

pit trader piviots can be found on redlion or pattern traper

nice..thx i have levels but these are great..

do u subscribe or just get the free stuff.

my pit trader piviots load atomaticly on all world charts for futures and cash at mid nite

NY -new york time on my esignal platform

that saves me having to calculate and load them manually

my tick ind is also loaded onto my esignal platform and i use it on the 5 and 2 minute charts

i did do the pattern trapper couse and its good but for me it gives me to many indicators to look at and when most of the time u have to move as fast as superman ,then it was to much to look at at once

how about a screen shot of you tick chart some time..

dont know how to do that and they are on 2 big t.v monitors with 6 charts on each

and im typing on my laptop whilst watching my charts

basicly my tick would be the same as ur’s

i have a center line at zero and one at lower boundary of 1000 and one at uper boundary 1000

when it goes outside up or lower boundary its at a extreme

i have it on 2 and 5 min charts

i use it also for bullish /bearish divergents to price and also for general character

tryin to plug the hole in the dyke…

what would the insto action look like…”volume” ?

instos put their buy sell orders at the new york pit trader piviots

instos have many tricks and may false break one to get the stops before reversing

the cash piviot can interfer with the futures and visa versa

also u have to have es ,ym and nq pluss cash charts open at once as one can force the other to wait

currently we have been waiting on dow and ym to hit S2–just done

now we may see what direction market wants to go

thx for the insight…i have ym support at 16863…looks as if they front ran it a bit