Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 1.3%, followed by Australia (down 1.2%) and Japan (down 0.9%). India rallied 0.6%, and China posted a small gain. Europe is currently mixed. France is up 0.73%, followed by Italy (up 0.68%), Spain (up 0.45%) and Stockholm (up 0.35%). Austria is down 0.65%, followed by Russia (down 0.55%) and Prague (down 0.46%). Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are up. Gold is down, silver is flat.

The market has fallen 3 of 4 days this week, and even if it closed up a little today, it’ll be the biggest down week since the end of July.

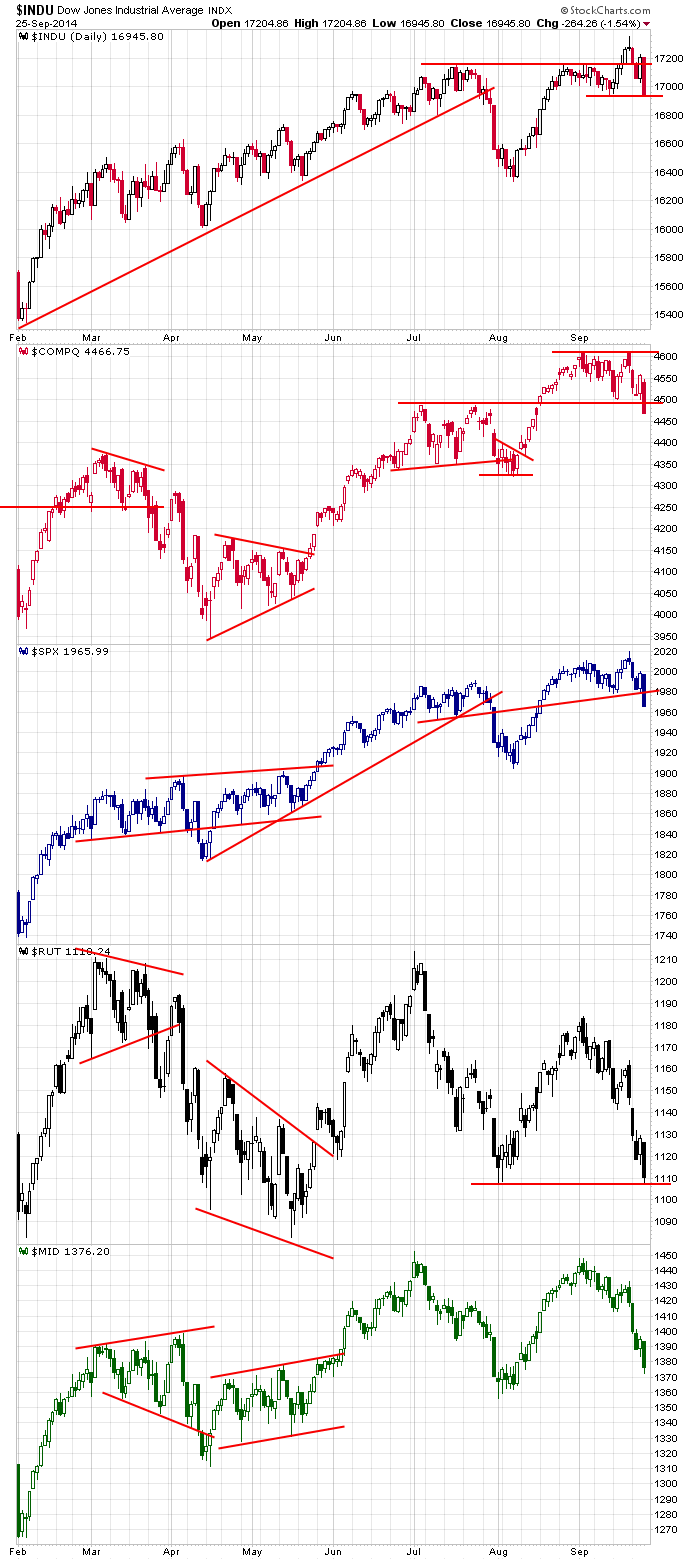

Here are the daily index charts. The Nas and SPX sliced through support levels. The Dow is right behind them. The Russell has traveled all the way back to its early-August low, and the mid caps are headed in the same direction.

Several indicators have fallen to levels low enough to support a reversal; others have room to move. Momentum and sentiment clearly point down.

Although my bias remains to the downside, you have to be more careful entering new shorts. If a stock is just now breaking support, yes it could end up being a good short over time, but in the near term the easy money has been made. There’s enough bearishness out there to support a mini rally. And besides, the long term trend is still up. It takes more than one bad week to change this.

I’m not one for picking targets, but if I had to, 1937 is the number for the SPX. More after the open.

Stock headlines from barchart.com…

BlackBerry (BBRY -6.76%) rose over 4% in pre-market trading after it reported a Q2 EPS loss of -2 cents, a much smaller loss than consensus of -16 cents.

Finish Line (FINL -1.31%) reported Q2 adjusted EPS of 54 cents, weaker than consensus of 60 cents, and then lowered guidance on fiscal 2015 EPS to $1.66, less than consensus of $1.87.

H.B. Fuller (FUL -14.32%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Northrop Grumman (NOC -0.84%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Verint Systems (VRNT -3.14%) are initiated with a ‘Buy’ at Goldman Sachs with a price target of $68.

Philips (PHG -1.75%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

General Dynamics (GD -1.55%) was awarded a $310.77 million government contract modification to a previously awarded contract for additional design agent, planning yard, engineering and technical support for active nuclear submarines.

Lockheed Martin (LMT -0.53%) was awarded $331.41 million government contract modification to a previously awarded contract for the production and support of the F-35 Lightning II Joint Strike Fighter aircraft for the U.S. Marine Corps, U.S. Air Force, U.S. Navy, international partners, and foreign military sales.

Thor Industries (THO -0.90%) reported Q4 EPS of $1.25, better than consensus of $1.23.

Nike (NKE -1.35%) rose over 6% in after-hours trading after it reported Q1 EPS of $1.09, well ahead of consensus of 88 cents.

Moab Capital reported a 7.68% passive stake in Symmetry Medical (SMA +0.51%) .

Micron (MU -1.61%) climbed 6% in after-hours trading after it reported Q4 EPS of 82 cents, higher than consensus of 81 cents.

Earnings and Economic Numbers from seekingalpha.com…

Friday’s economic calendar:

8:30 GDP Q2

8:30 Corporate Profits

9:55 Reuters/UofM Consumer Sentiment

11:30 Results of $13B, 2-Year FRN Auction

12:05 PM Fed’s Mester: Economic Outlook and Monetary Policy

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: BBRY, FINL

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 26)”

Leave a Reply

You must be logged in to post a comment.

My models tell me it is time to go long or be wrong. When my models for finding a bottom are wrong we often get a crash.

i

its quarterly opts ex in some of europe/asia

ftse/dax small range to up side –usa similar -may change after high noon

this would support a 4th wave flat or triangle with with the battle ground the spx 1971-3 as middle control point for that index

it could also just have been a 3 wave structure and now a consolidation–but thats unlikly

as for targets–itra day i dont beleive in them

i have them all preloaded on my charts–ny pit trader piviots and prior horizontal majour and minor sup/res

but i simply observe what price does at those and act accordingly based on trend on 5 and 2 min charts

to do otherwise would give me a bias and intraday thats fatal

however based on tick holding middle grond today –its boring sideways churn

just a churn so far…swappin spit…

i did have one quick short on all indexes just pre cash market and may now go back to sleep

–a big w/end

just to add to one point of Jasons

a long term trend change can occure instantanieous in one circumstance

the exhaustion blow of top and spike high as was the nas 100 and commonly found in commodities tops gold silver oil

no distribution is required for that type of top as the blow of is the distribution and once reached it just colapses

Aussie, u get short on that run up?