Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed with a lean to the downside. Hong Kong dropped 1.9%, and Australia dropped 0.9%. India, Korea and Taiwan posted small losses. Japan rallied 0.5%, followed by China (up 0.43%) and Malaysia (up 0.32%). Europe is currently mostly down. Greece is down 2.36%, followed by Spain (down 1%), Italy (down 0.9%), Austria (down 0.7%) and Germany and France (down 0.5%). Prague is up 0.94%. Futures here in the States point towards a big gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold is up slightly, silver is down.

Last week the market posted its biggest down week since July. It dropped big Monday, Tuesday and Thursday and rallied Wednesday and Friday. Everyday was a trend day. Once the momentum built, there were no reversals – just steady movement in one direction. The S&P and Nas broke down from consolidation patterns, and the Russell dropped all the way to a previous low.

Several indicators have moved far enough to extremes to support a bounce (AD line and AD volume lines have fallen to low levels, new lows have spiked, the TICK down, etc.) but a few others haven’t (bullish percent charts are not oversold yet). The market could continue Friday’s bounce, but many indicators would have to immediately reverse to support the attempt.

Headlines seem to be more bullish than they should be. MarketWatch is anticipating great employment numbers Friday. CNBC.com had a story about how good Q4 could be. I’d feel better about the upside if major news outlets weren’t so bullish.

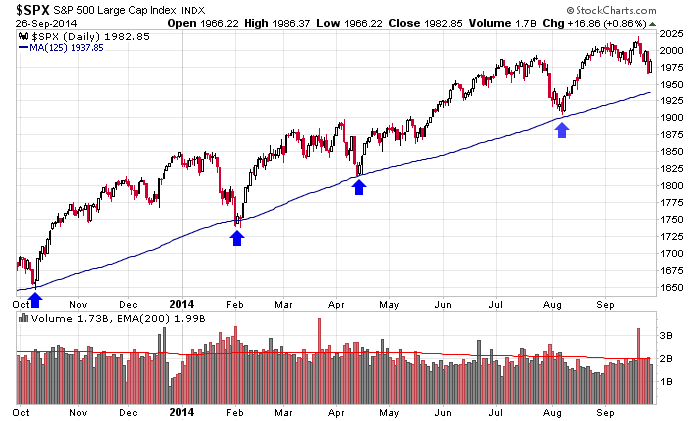

My target for the S&P 500 remains at the 125-day MA per the chart below. That level has brought buyers to the market many times, so until it’s rendered irrelevant, let’s keep an eye on it.

Bias remains to the downside until the bulls retake control. More after the open.

Stock headlines from barchart.com…

Ferrellgas Partners LP (FGP +1.44%) reported a Q4 EPS loss of -58 cents, wider than consensus of a -31 cent loss.

Mattel (MAT -1.25%) was downgraded to ‘Neutral’ from ‘Buy’ at MKM Partners.

Baidu (BIDU +0.68%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

FedEx (FDX +1.67%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Cowen.

Rent-A-Center (RCII +0.03%) was upgraded to ‘Buy’ from ‘Hold’ at KeyBanc.

Janus Capital (JNS +43.02%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Morgan Stanley.

Encana (ECA +0.86%) acquires Athlon Energy (ATHL +2.61%) for $58.50 per share or $5.93 billion.

Nike (NKE +12.23%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Allianz (AZSEY -6.14%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

The U.S. Navy awarded Raytheon (RTN +1.33%) a $251 million contract to procure Tomahawk Block IV tactical cruise missiles for fiscal year 2014 with an option for 2015 for the U.S. Navy and for the U.K. Royal Navy.

HealthCor Management reported a 4.0% stake in Allscripts (MDRX +1.04%) .

Point72 Asset reported a 5.1% passive stake in Stage Stores (SSI +1.95%) .

Meritage Group reported a 5.0% passive stake in Sally Beauty Supply (SBH +0.47%) .

Alimera Sciences (ALIM -3.90%) soared over 25% in after-hours trading after it announced that the FDA has approved its Iluvien drug for the treatment of diabetic macular edema.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Personal Income and Outlays

10:00 Pending Home Sales

10:30 Dallas Fed Manufacturing Outlook

3:00 PM Farm Prices

Notable earnings before today’s open: CALM, CMN, FGP

Notable earnings after today’s close: CTAS, SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 29)”

Leave a Reply

You must be logged in to post a comment.

must say…good buying down here…3***+1k tick so far

what happened to todays email–it didnt arrive

intraday the trends are easy and we are in a abc correction of some sort that is about to end

longer than a day

1– its a wave 2 abc of wave 3 down with 3 of 3 about to start down

2–we go to new highs here

3- its wave 4 of 1 down and wave 5 down about to start

went short in asia trade all indexes today and closed just before open

had a very short term short at high noon but flat now and am undecided yet

didnt take wave c of this correction up today