Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. South Korea dropped 1.4%, and Hong Kong dropped 1.3%. Japan and Singapore also did poorly. Australia, New Zealand and Taiwan did well to the upside. Europe is currently mostly down. Greece is up 1.1%, but Stockholm is down 0.95%, followed by Norway (down 0.67%), France and London (down 0.62%) and Amsterdam (down 0.52%). Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are flat.

We entered this week with a lot of ifs – if X and Y and Z, then the market could rally – but nothing of the ifs have happened. The AD and AD volume lines continue to move down, the bullish percent charts continue down, volatility remains high, the PC ratio is moving up, new highs are nowhere to be found while new lows print at a healthy rate. The bears are in control. Period. And since we’ve already reached washout levels on several indicators and have not bounced, we have to entertain the possibility a change in character is underway.

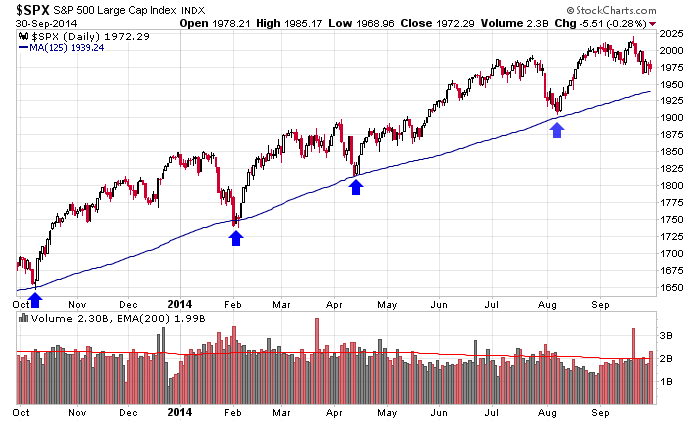

My first downside target is SPX 1939 – that’s the 125-day MA, a significant level the last year.

After that I’m eyeing 1900 even. Besides it being close to the August low, it’s a big, fat, whole number.

On the way up I tell trader to not over-analyze…just buy breakouts and pullbacks and stop being in a state of denial. I’ll say the same thing on the way down. Go with the trend and stop making “yeah but” excuses. More after the open.

Stock headlines from barchart.com…

Dean Foods (DF +0.61%) was downgraded to ‘Hold’ from ‘Buy’ at BB&T.

Panera Bread (PNRA +2.51%) was upgraded to ‘Buy’ from ‘Hold’ at Wunderlich.

Tyson Foods (TSN +1.34%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Janus Capital (JNS -1.09%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

eBay (EBAY +7.54%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Allergan (AGN -0.84%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Freeport McMoRan (FCX +0.77%) was initiated with a ‘Buy’ at Brean Capital with a price target of $39.

Lockheed Martin (LMT +0.78%) was awarded a $246.61 million modification to a previously awarded government contract to develop, test, and certify two Drag Chute Systems for the Low Rate Initial Production Lot VII F-35 Lightning II Joint Strike Fighter aircraft.

Tekmira (TKMR +2.22%) surged 20%, Hemispherx BioPharma (HEB unch) climbed 15%, NewLink Genetics (NLNK -7.11%) jumped 14%, and BioCryst (BCRX -6.77%) rose over 10% in after-hours trading after the CDC confirmed that an individual traveling from Liberia has been diagnosed with the Ebola virus in the U.S.

NRG Energy (NRG +0.23%) was upgraded to ‘Strong Buy’ from ‘Buy’ at ISI Group.

Dynegy (DYN -1.54%) and Exelon (EXC -0.06%) were both upgraded to ‘Buy’ from ‘Hold’ at ISI Group.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Petroleum Inventories

11:00 Global Manufacturing PMI

Notable earnings before today’s open: AYI, AZZ

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 1)”

Leave a Reply

You must be logged in to post a comment.

My numbers say it is time to get long.

pc at 1.12…hmmmm

slow grind up

chief bears -teddy gucinder and grizelly bear are knocking on ur door

and wont go away till they huff and puff ur house down

im going along for the ride

cash targets for today dow–S3–16863 SPX –S3– 1949

futures—ym support 3 16755—ES== S3 –1937

cant seem to get above 10am(est) low

ive got ym 16775 and es 1940. thx for the heads up

dow met target

the dow cash is the weakest and hit spot on its support 3 piviot at 16863

this stalled out all other indexes–ym es nq and their relative cash cousins

at between S2 AND S3 piviots

even stalled out dax and ftse

i am flat now the world as a impulsive down is too hard to play the counter trend up scalps

i’ll wait for the next lower high to reload short

did u ever reload that short…

bkx is a trigger… its slowly grinding up