Good morning. Happy Thursday.

The Asian/Pacific markets closed down across-the-board. Japan and Indonesia dropped more than 2%; Hong Kong and Singapore dropped more than 1%. Europe is currently trading mostly down. Russia is down 1.7%, followed by Norway (down 1.6%) and Italy and Prague (down 0.9%). Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil is getting hit hard (down 1.83) and copper is down. Gold and silver are down.

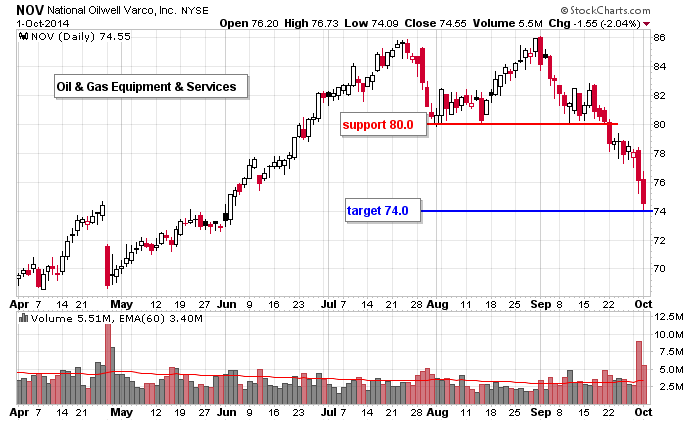

The market got hit hard yesterday…sellers remain in control. The big story overnight is oil. It’s been trending down for three months and overnight it broke down from a descending triangle pattern.

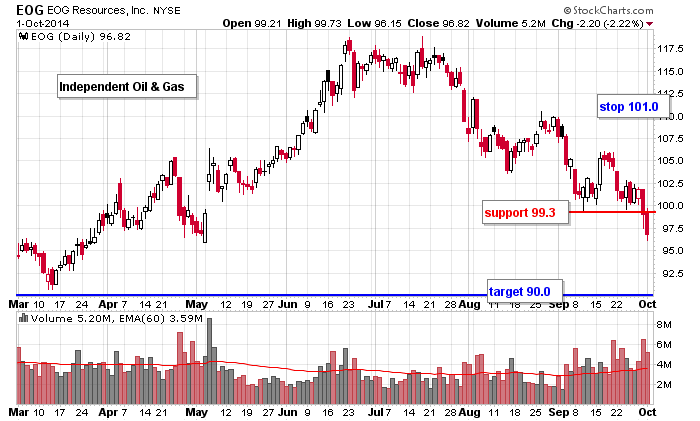

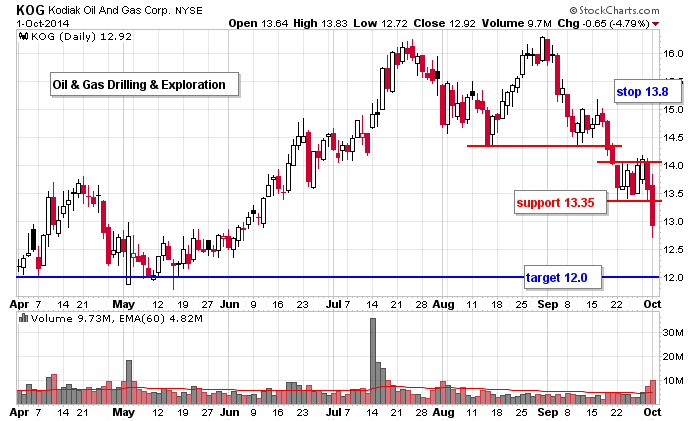

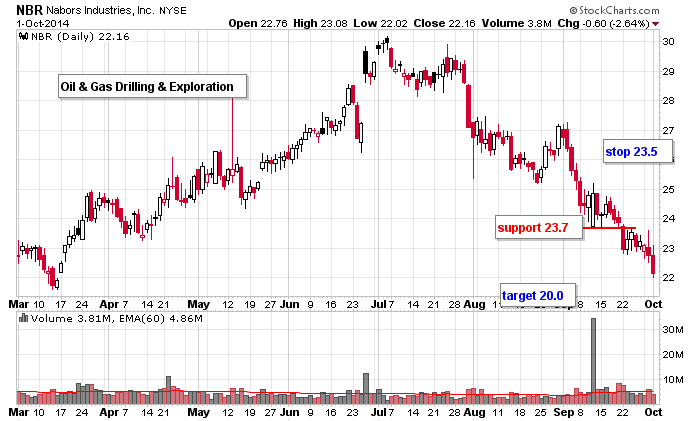

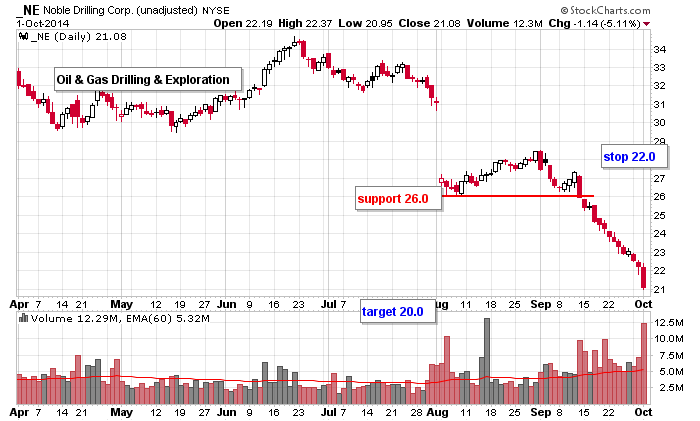

This comes as no surprise to Leavitt Brothers members. We have a handful of oil shorts on our trading list. Here are the set ups which are currently live.

The trend is down. Bounces will happen, but until the bulls definitely retake control, sellers are in control.

Tomorrow morning, 60 minutes before the open, the latest employment figures get released.

Stock headlines from barchart.com…

McCormick & Co. (MKC -1.93%) reported Q3 EPS of 95 cents, better than consensus of 81 cents.

Constellation Brands (STZ -2.18%) reported Q2 EPS of $1.11, weaker than consensus of $1.16.

Global Payments (GPN -1.56%) reported Q1 cash EPS of $1.22, higher than consensus of $1.14.

Darden (DRI -0.99%) says it sees Q2 EPS in the upper end of 26 cents-28 cents, better than consensus of 26 cents.

Autodesk (ADSK +1.02%) was upgraded to ‘Neutral’ from ‘Sell’ at Citigroup.

Citigroup keeps its ‘Buy’ rating on Apple (AAPL -1.56%) and raised its price target on the stock to $120 from $110 citing higher than expected iPhone 6 pricing.

Intuit (INTU -2.20%) was downgraded to ‘Underweight’ from ‘Equal-Weight’ at Evercore.

Barrick Gold (ABX +0.61%) was upgraded to ‘Hold’ from ‘Sell’ at Canaccord.

Bank of America (BAC -1.35%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Deutsche Bank reiterated its ‘Buy’ ratinng on CME Group (CME -0.70%) and raised its price target on the shares to $95 from $85.

Northrop Grumman (NOC -2.84%) has been awarded a $306.13 million government contract for logistics support of the Global Hawk fielded weapon system.

ICS Opportunities reported a 5.2% passive stake in Penn Virginia (PVA -4.64%) .

Marathon Petroleum (MPC -2.63%) was initiated with a ‘Top Pick’ at RBC Capital with a price target of $115.

Valero (VLO -1.45%) was initiated with an ‘Outperform’ at RBC Capital with a price target of $66.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 Challenger Job-Cut Report

8:30 Gallup US Payroll to Population

8:30 Initial Jobless Claims

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

8:00 PM Fed’s Bullard: U.S. Monetary Policy

Notable earnings before today’s open: ATU, GPN, MKC, STZ

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 2)”

Leave a Reply

You must be logged in to post a comment.

target spx 1960-4

then 666

wow the sign of Lucifer…

nice jump start for the day

spx 666 was just the march 2009 low

then we go to the godly number of infinite zero

1200 pt drop…that a cliff dive

Jason

Great read!

I still say for the market we have seen the bottom.. Get long of be wrong

heckova battle here…adv got back to even…

not for long

here we are spx 1939..125ma…

massive european selling of everything,inc their usa holdings gave us many tick ind extreams into their 11.30 am ny time close

this was on ecb dragoni refusal to do QE thus putting their banks and world banks at risk

yes we hit one of Jasons targets and have bounced

we should get a spike high even up to spx 1970 on tomorrows jobs report but then a strong reversal to at least spx 1900 before we hit zero

of course i dont follow what could be,only the intraday what is

nice…thx

Russell the bear has been working for the fed

it has told the fed that it better start buying its index futures

the stupid fed believes everything russell says

you must be friends with russell the bear?