Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 1.5%, and Japan fell 1.2%. Hong Kong, Australia, Taiwan and Singapore also dropped noticeably. Europe is currently mostly down, but losses aren’t as big as they’ve been. Austria and Belgium are posting the biggest losses, followed by Norway, Switzerland, Russia and Germany. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

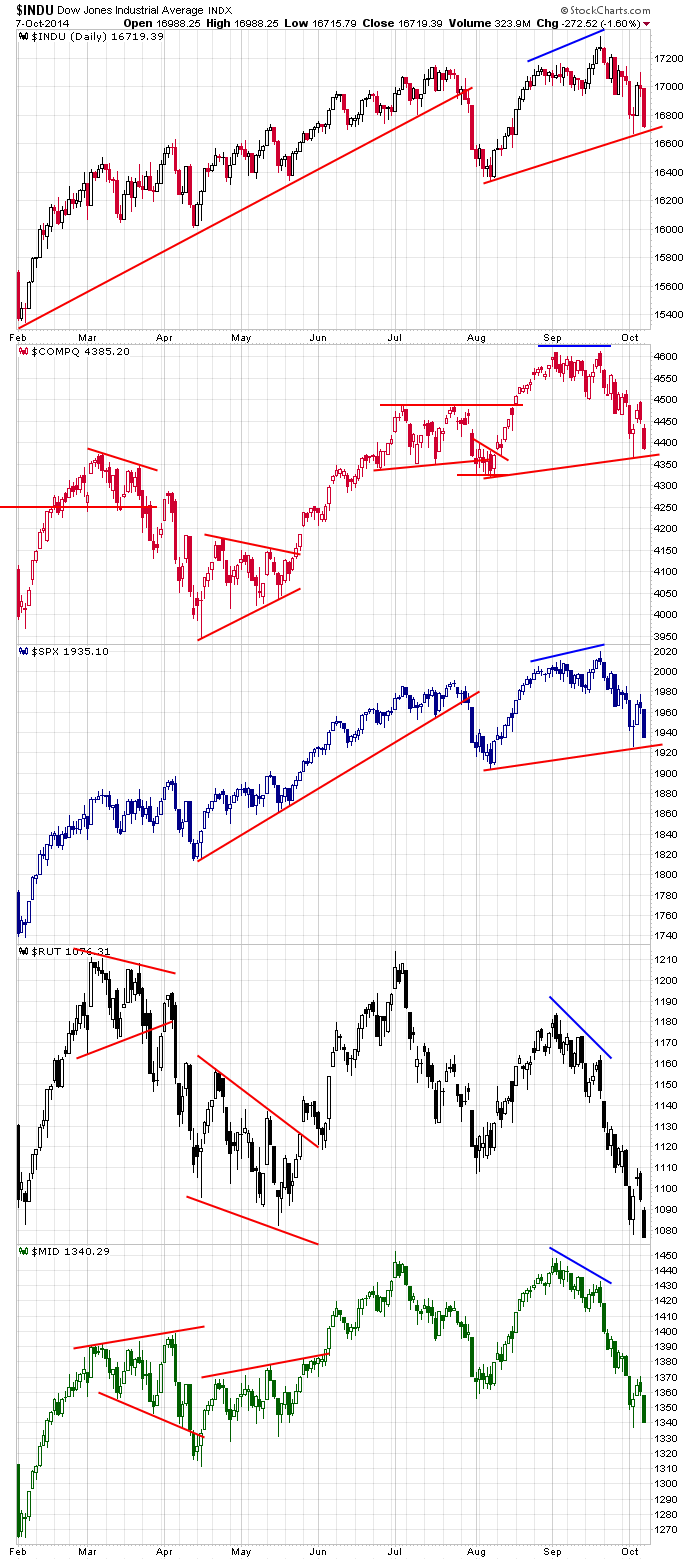

Here are the dailies. The Russell is at a new low. The mid caps aren’t far behind. The Dow, Nas and SPX are almost identically sitting at support.

The market could only muster a 2-day bounce off the lows – not exactly indicative of brewing strength.

Low index levels could not induce much buying. Indicator prints at extreme levels couldn’t motivate much buying either. This pullback has been different than previous pullbacks, so it would not be wise to assume this is normal correction within an uptrend. Structural and character changes are taking place, and unless we get a lower low by the Dow, Nas and SPX which turns out to be a bear trap, the trend will remain down.

My first SPX target (1940) has been hit. Next up is 1900 even. If it’s hit, the market may truly be in trouble. More after the open.

Stock headlines from barchart.com…

Costco Wholesale (COST -0.74%) reported Q4 EPS of $1.58, better than consensus of $1.52.

McKesson (MCK -1.51%) was initiated with a ‘Buy’ at Citigroup with a price target of $235.

RPM (RPM -2.37%) reported Q1 EPS of 73 cents, weaker than consensus of 79 cents.

EOG Resources (EOG -1.56%) was upgraded to ‘Outperform’ from ‘Neutral’ at Macquarie.

Juniper (JNPR -1.71%) was downgraded to ‘Neutral’ from ‘Buy’ at MKM Partners.

National Oilwell Varco (NOV +0.20%) was downgraded to ‘Neutral’ from ‘Overweight’ at HSBC.

Ryland Group (RYL -1.33%) was downgraded to ‘Underweight’ from ‘Hold’ at KeyBanc.

Bloomberg reports that Symantec (SYMC -1.36%) is in advanced talks to split the company in two.

TheStreet (TST +1.38%) jumped 5% in after-hours trading after it announced it signed a definitive agreement to acquire Management Diagnostics for $21 million.

Allergan (AGN +1.68%) rose over 2% and Valeant (VRX -2.48%) climbed nearly 4% in after-hours trading after Dow Jones reported that Valeant is planning to boost its bid for Allergan.

Walter Energy (WLT -7.18%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Yum! Brands (YUM -2.31%) reported Q3 EPS ex-items of 87 cents, weaker than consensus of 89 cents and said its Q3 China same-store-sales plunged -14%.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Fed’s Evans: U.S. Economy

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM FOMC minutes

Notable earnings before today’s open: COST, HAWK, MON, RPM

Notable earnings after today’s close: AA, ARCW, EOPN, RT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 8)”

Leave a Reply

You must be logged in to post a comment.

No way I would short here.

market action has indeed been weird

a series of 1 and 2’s

interday impulsive down followed by corrective 2 but not taking out previous lower high

as if instos dont want any shorts or longs in the market

this could led to a crash like 1987 almost identical

but today may or may not be a small up

earning season aproaches and usually a up first 2 weeks but now ..??

apple could be now a conary and live in a coal mine

so could ftse or dax for the usa markets

aussie, looks ur right 1-2 days up

i remember 1987 very well

ups and downs were very wild for a while

didnt know much about t/a analysis then

i through caution to the wind –gold was going wild

i wanted more profits

greed took over -i ignored the warning signs as did many

then that 2-3 day crash

The Fed story is not over, more low rates . Suspect more bias toward owning stocks, But watch the EU today more volatility as we watch the EU go under.