Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. India dropped 1.1%, followed by Japan (down 0.7%) and Taiwan (down 0.6%). Indonesia rallied 0.7%, and Hong Kong moved up 0.5%. Europe is down across-the-board. Greece is down 2.25%, followed by (Norway down 1.6%), Spain (down 1.5%), Switzerland and Stockholm (down 1.4%) and France (down 1%). Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

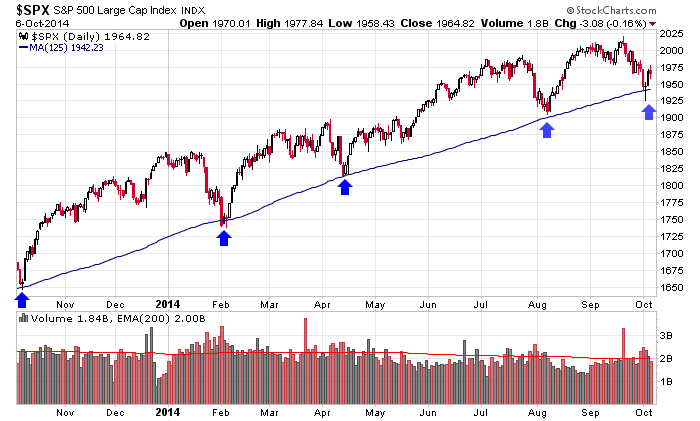

I have today billed as a somewhat important day. The market V-bottomed last Thursday and then followed through Friday, but the first move off a low level is the easy move. With too many traders stacked on one side of the market, it’s not hard for the market to jump a couple percent in a couple days. But getting follow through a few days later, after the initial short covering pressure has been used up, is much harder and much more important. If we can get follow through now, it’ll be a sign institutions are coming to the market, and there’ll be greater odds of higher prices in the near and intermediate term.

If the market is going to follow through today, it’s going to have to earn it. Markets in Asian were mostly down, and Europe is posting pretty stiff losses right now thanks to German industrial production experiencing its biggest drop since 2009.

This support moving average remains in place, but I want to see a bounce off it. I don’t want to see price linger just above it. The absence of a robust rally is a warning in my eyes.

Stock headlines from barchart.com…

Deere (DE +0.83%) was downgraded to ‘Underperform’ from ‘Neutral’ at BofA/Merrill Lynch.

U.S. Bancorp (USB -0.31%) was downgraded to ‘Market Perform’ from ‘Strong Buy’ at Raymond James.

Hibbett Sports (HIBB +0.60%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Dick’s Sporting Goods (DKS -1.64%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

MGM Resorts (MGM +0.23%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank with a price target of $30.

Las Vegas Sands (LVS +0.69%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Dunkin’ Brands (DNKN +1.06%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Keurig Green Mountain (GMCR +0.17%) was initiated with a ‘Buy’ at Goldman Sachs with a prce targey of $166.

Amazon.com (AMZN -0.17%) slid 1% in pre-market trading after the European Union said it is investigating whether the company unfairly shifted profits to Luxembourg to lower its taxes.

Zillow (Z -2.48%) fell nearly 2% in pre-market trading after the biggest U.S. website for real estate agents and prospective home buyers said it had 82.81 million unique users in September, down from 86.29 million in August and 88.84 million in July.

Adobe (ADBE -1.07%) said it expects fiscal 2015 adjusted EPS of approximately $2.00, below consensus of $2.07.

Gabelli reported a 8.95% stake in Annie’s (BNNY unch) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $27B, 3-Year Note Auction

3:00 PM Consumer Credit

Notable earnings before today’s open: none

Notable earnings after today’s close: LNDC, MG, YUM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 7)”

Leave a Reply

You must be logged in to post a comment.

aussie, is the world comin to an end? lol

can we reach spx 666 in a day

if so we better hurry up

i suspect what we are seeing is a series of 1 -2 moves lower

a one move down to excite the bears

then a littler 2 move up to calm the bulls before their demise

looks like the boyz want to test ym s3 166.45