Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan dropped 2%, followed by South Korea (down 0.77%) and China (down 0.72%). Singapore and New Zealand both rallied 0.68%, and India moved up 0.55%. Europe is currently posting solid, across-the-board gains. Greece is up more than 4%, Austria, Norway and Italy are up more than 2%, Spain, Belgium, Amsterdam, Stockholm, Prague, London, Germany and France are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is up. Oil and copper are up. Gold is up a little, silver down.

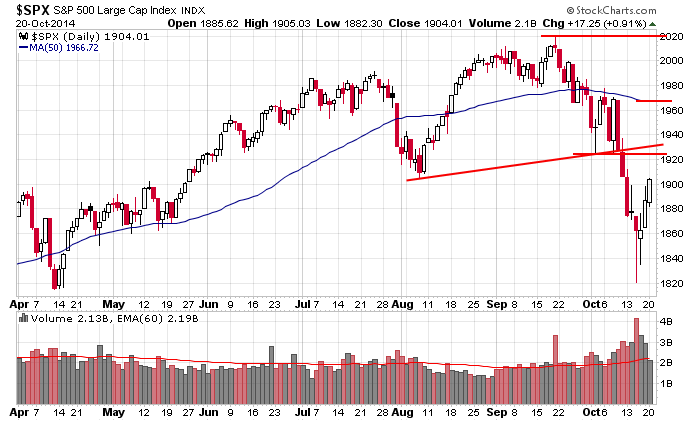

The market posted solid gains yesterday on declining volume. The S&P is now about 85 points off its low but still about 30 points from a previous support level, 60 points from its 50-day MA and 115 from its high. The index is in no-man’s land and doesn’t have strong support or resistance nearby. And given the market’s volatility, it wouldn’t take much for the S&P to move 50 points in either direction in a relatively short period of time. Here’s the daily S&P chart with these key levels marked.

Apple had earnings yesterday after the close. The stock moved up $2.09 during the day and is up about $2.50 right now in premarket trading after beating estimates. This will put the stock about $1.75 from its all-time high.

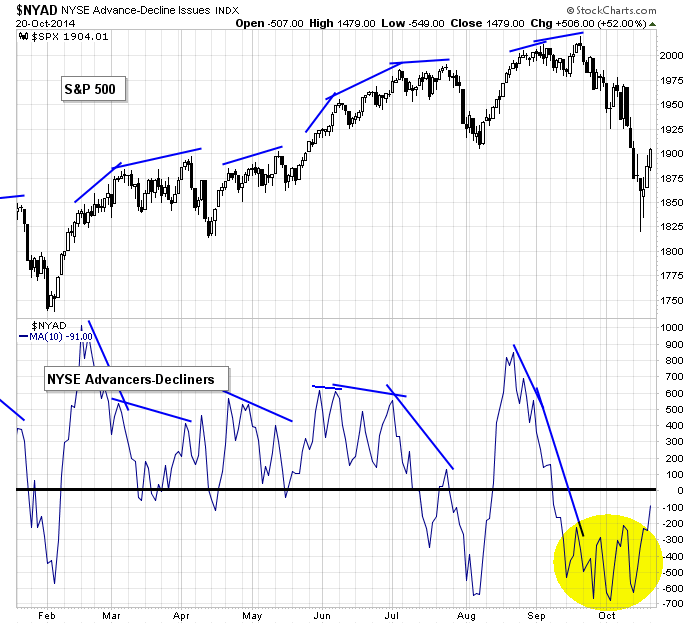

Several indicators are either in position to support a continuation of the move up or are already moving in the bulls’ direction. The 10-day of the NYSE AD line is one. Yesterday it broke out of a 1-month base and is now at its highest level since the second week of September. If the line can get above 0 and stay there, the rally has a good chance of continuing. But if it peters out soon and reverses down, the market is likely to do the same.

Stock headlines from barchart.com…

Lockheed Martin (LMT -0.40%) reported Q3 EPS of $2.76, higher than consensus of $2.72.

Harley-Davidson (HOG -0.43%) reported Q3 EPS of 69 bents, better than consensus of 59 cents.

The Travelers Cos. (TRV -0.04%) reported Q3 EPS of $2.61, well above consensus of $2.26.

Verizon (VZ +0.85%) reported Q3 EPS of 89 cents, less than consensus of 90 cents.

Brown & Brown (BRO +0.75%) reported Q3 EPS of 47 cents, right on consensus, although Q3 revenue of $421.3 million was slightly less than consensus of $425.4 million.

SAB Capital Advisors reported a 5.1% passive stake in Men’s Wearhouse (MW +0.65%) .

Celanese (CE +2.13%) reported Q3 adjusted EPS of $1.61, much better than consensus $1.44, and then raised guiadance on fiscal 2014 adjusted EPS view to $5.55-$5.65, well above consensus of $5.33.

Texas Instruments (TXN +1.69%) gained 3% in after-hours trading ater it reported Q3 EPS of 76 cents, better than consensus of 71 cents.

Apple (AAPL +2.14%) climbed more than 2% in after-hours trading after it reported Q4 EPS of $1.42, well ahead of consensus of $1.31.

Rent-A-Center (RCII +0.25%) reported Q3 EPS of 48 cents, higher than consensus of 47 cents, although Q3 revenue of $769.5 million was below consensus of $773.32 million.

Illumina (ILMN -0.27%) rose more than 7% in after-hours trading after it reported Q3 adjusted EPS of 77 cents, much higher than consensus of 56 cents, and then raised guidance on fiscal 2014 EPS view to $2.63-$2.65, well ahead of consensus of $2.30.

Cadence Design (CDNS +0.73%) reported Q3 adjusted EPS of 26 cents, better than consensus of 24 cents.

Werner (WERN +1.22%) reported Q3 EPS of 36 cents, right on consensus, although Q3 revenue of $551.96 million was higher than consensus of $542.95 million.

Chipotle (CMG +1.76%) reported Q3 EPS of $4.15, well above consensus of $3.84.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:55 Redbook Chain Store Sales

10:00 Existing Home Sales

Notable earnings before today’s open: ABG, AOS, APOL, ARMH, ATI, CP, CSL, EAT, GPK, HOG, ITW, KMB, KO, LMT, LPT, LXK, MAN, MCD, OMC, PNR, RAI, RF, SAH, SBNY, SNV, TRV, UTX, VZ, WAT, XRS

Notable earnings after today’s close: ABAX, ACC, ACE, BGS, BRCM, CBST, CLS, CNI, CREE, DFS, DTLK, EFII, ETFC, ETH, EXAC, FBC, FTI, FULT, HA, IBKR, IEX, IRBT, ISRG, MANH, NBR, QDEL, RHI, SIX, SMCI, SONC, UIS, VASC, VMW, WCN, YHOO, ZIXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 21)”

Leave a Reply

You must be logged in to post a comment.

I love this blog.

ditto

dow holding down the program…

everything is right as rain now…rally into the new year