Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan rallied 2.6%; Hong Kong, Australia, South Korea and Taiwan rallied more than 1%. Europe currently leans to the upside. Stockholm, Switzerland, Belgium and Norway are leading. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are down.

Heck of a run the market is on. First everyone wanted to short a rally, now they’re hoping for a pullback to get long. There’s a saying on Wall St: strong markets don’t let you in; weak markets don’t let you out. This past week has been a great example of a market that hasn’t let people in. The S&P is up 120 in less than five days, and there haven’t been a whole lotta buying opportunities for those waiting for a dip. I never mapped out a long term plan. I just simply said last Wednesday the risk/reward for going short was no longer favorable, and my near-term bias was to the upside. Then my plan was to take a wait-and-see approach. I wanted to see what the indicators did when the market bounced. I wanted to see how much force and energy was behind the move. We have our answer.

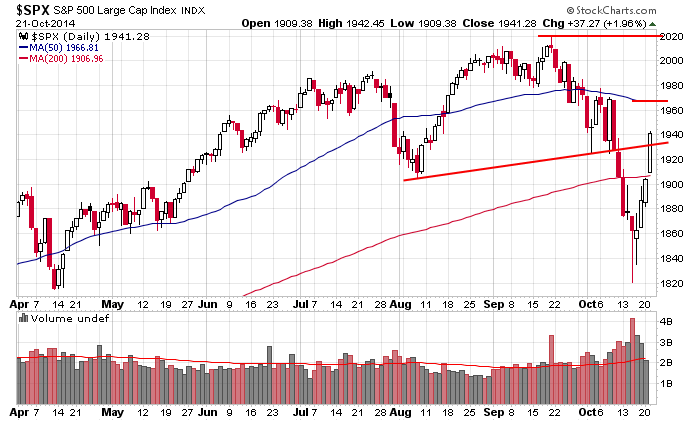

Here’s an update of the S&P daily chart. The index surged past the 200-day. I don’t look at it often, but others do, so it’s good to keep an eye on. The low from two weeks ago and a trend line connecting the lows have also been taken out. Next up is the 50-day, currently sitting at 1967 – about 26 points above yesterday’s close.

In one week the market has gone from being too over-sold to go short to being too over-bought to buy. Too many stocks have gone vertical, and until things calm down and rest, I don’t think it’s wise to chase on the long side. More after the open.

Stock headlines from barchart.com…

VMware (VMW +0.60%) dropped nearly 2% in pre-market trading after reported Q3 EPS of 87 cents, higher than consensus of 83 cents, but then lowered guidance for Q4 sales to $1.67 billion to $1.171 billion, below consensus of $1.71 billion.

Boeing (BA +2.26%) reported Q3 EPS of $2.14, well ahead of consensus of $1.97.

Ingersoll-Rand PLC (IR +2.08%) reported Q3 EPS of $1.10, stronger than consensus of $1.03.

Stanley Black & Decker (SWK +1.93%) reported Q3 EPS of $1.55, better than consensus of $1.44.

Northrop Grumman (NOC +1.17%) reported Q3 EPS of $2.26, higher than consensus of $2.13.

Nabors Industries (NBR +4.36%) reported Q3 ex-items EPS of 39 cents, better than consensus of 36 cents.

Unisys (UIS +1.41%) reported Q3 adjusted EPS of $1.30, more than twice consensus of 60 cents.

Six Flags (SIX +3.92%) reported Q3 EPS ex-items of $1.56, higher than consensus of $1.50.

E-Trade (EFTC) reported Q3 EPS of 29 cents, better than consensus of 22 cents.

FMC Technologies (FTI +3.56%) reported Q3 EPS of 72 cents, less than consensus of 74 cents.

Intuitive Surgical (ISRG +2.17%) gained over 2% in after-hours trading after it reported adjusted Q3 EPS of $3.92, stronger than consensus of $3.80.

Discover (DFS +2.68%) reported Q3 EPS of $1.37, higher than consensus of $1.34.

Yahoo (YHOO +2.29%) climbed over 2% in after-hours trading after it reported Q3 EPS of 52 cents, much better than consensus of 30 cents.

Broadcom (BRCM +2.84%) jumped 6% in after-hours trading after it reported Q3 adjusted EPS of 91 cents, well above consensus of 84 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Consumer Price Index

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: ABB, ABT, ANGI, APH, BA, BABY, BEAV, BIIB, BPOP, BSX, DOW, EMC, EVR, FDML, FNB, GD, GNTX, GRA, HCBK, ICLR, IPG, IR, KNX, LL, MDCO, MKTX, NOC, NSC, NTRS, NYCB, OC, PII, R, SEIC, SLGN, SPG, SWK, TMO, TUP, USB, WIT, WRLD, XRX

Notable earnings after today’s close: ACTG, ALB, ALGT, AWH, BCR, BDN, CA, CAKE, CLB, CLGX, CLW, CTXS, CVA, EEFT, EFX, EGHT, FTK, FTNT, GGG, IBKC, INFN, LEG, LHO, LOGI, LRCX, MKSI, MKTO, MLNX, MSA, NOW, NXPI, ORLY, OTEX, PLCM, PLXS, RE, RJF, SCSS, SFG, SGMO, SHLM, SKX, SLG, SLM, SUSQ, T, TAL, TCBI, TER, TILE, TMK, TSCO, TYL, USTR, VAR, WFT, YELP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 22)”

Leave a Reply

You must be logged in to post a comment.

My calculations predict a modest pullback today… Go long or be wrong.

i hope ur calcs pan out

short with dia puts

rut laggin

out of my puts and ym short..on the -1000tick

crap too early..way too early..

long a few dia calls

sold them at the ym 15m 10ma

child dead cat ,son of my other 2 senile deadcats–grusome and awesome ,states he was responsible for the 4 day bounce

he is very proud of himself and says [ ”see now what a deadcat is like in a bear market”]

but he states he is not responsible for continuing it past the mandatory 1 to 4 days bounce

after that its up to the bulls or the bears

i dont beleive child deadcat and think it was all the doing of naughty japan primne minister ARBE

that stated last friday that the massive japan govt pension funds were now free to do what eveer they liked

previously they could only buy japan and europe/usa bonds

this was in line with dispiocable central banks world wide idea to manipulate markets via plunge protection teams in each country

long live free and fair markets where T/A works and down with manipulated markets

the 1-4 day counter trend did some damage to the technicals

the dow which stopped at 16650 can still have been the top of a wave 4 of larger wave 1 down

but the obserd spx and nas 100 went much to far and can only be a wave 2 corrective ater miraculloiusly finishing large wave 1

their targets would be spx 1980 and nas 100 at 4000

if those are broken upside would be new highs

thx for the insight…much appreciated…with your analysis my trading has been high perct. in the right direction.

whilst it is possible the up is over —today could have just been a consolidation in the up

it was exhaustive and today may have just had a rest

Aussie, thank you for your very perceptive insights. . . Es