Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Singapore rallied 1%, Malaysia 0.8% and Indonesia 0.6%. China was the only big down market; it fell 1%. Europe is currently mostly down. Greece is down 2.3%, followed by Amsterdam (down 0.97%), Norway (down 0.79%) and Russia (down 0.46%). Stockholm is up 0.6%. Futures here is the States point towards a relatively big gap up open for the cash market.

The dollar is flat. Oil and copper are up. Gold and silver are down.

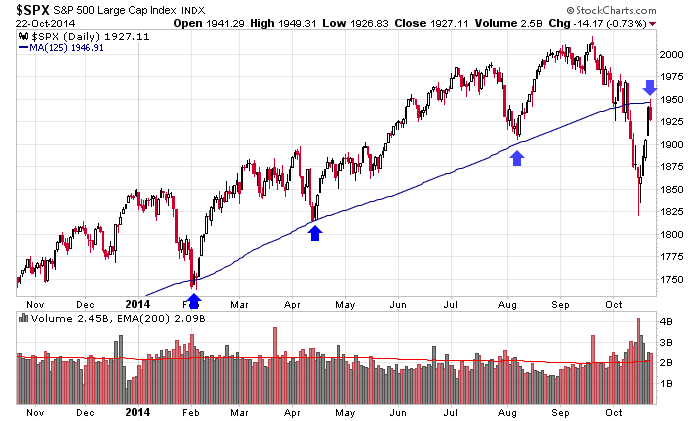

After a 130-point, 1-week rally, the S&P dropped 14 yesterday. That’s a big drop under most circumstances, but considering the market’s increased volatility lately and the huge surge off the recent lows, it’s pretty normal. The market needed to rest and restore its spent energy anyways, and there was nothing overly alarming about the movement. Volume was average, and the intensity behind the move didn’t register as being anything other than normal.

Here’s an update of the S&P 500 daily chart. First the 200-day was taken out (low 1900’s). Then 1925 was taken out (support from earlier this month). Next key level is the 125-day MA which currently checks in at 1947. I’m going to round up to 1950 since it’s a big, fat, whole number.

As I stated yesterday after the close, the next handful of days will be a ‘tell’ regarding the rest of the year. If a pullback is shallow and lacks downside conviction, a year-end rally to new highs is certainly doable. Let’s see what happens. More after the open.

Stock headlines from barchart.com…

Coca-Cola Enterprises (CCE -0.79%) reported Q3 EPS of 92 cents, better than consensus of 88 cents.

Celgene (CELG -0.22%) reported Q3 EPS of 97 cents, higher than consensus of 95 cents.

Precision Castparts (PCP -2.05%) reported Q2 EPS of $3.24, weaker than consensus of $3.32.

Eli Lilly (LLY unch) reported Q3 EPS of 66 cents, below consensus of 67 cents.

O’Reilly Automotive (ORLY -0.97%) gained over 3% in after-hours trading after it reported Q3 EPS of $2.06, stronger than consensus of $1.95, and then raised guidance on fiscal 2014 EPS to$7.19-$7.23, better than consensus of $7.15.

Cheesecake Factory (CAKE -0.34%) slid over 3% in after-hours trading after it reported Q3 EPS of 48 cents, less than consensus of 57 cents, and then lowered guidance on fiscal 2014 EPS to $2.07-$2.11, weaker than consensus of $2.21.

Lam Research (LRCX -1.82%) reported Q1 EPS of 96 cents, better than consensus of 93 cents.

Everest Re (RE +0.07%) reported Q3 EPS of $6.00, well above consensus of $4.79.

C.R. Bard (BCR -0.83%) reported Q3 adjusted EPS of $2.15, stronger than consensus of $2.10, and then raised guidance on fiscal 2014 EPS view to $8.34-$8.38 from $8.25-$8.35, better than consensus of $8.31.

Skechers (SKX +0.92%) reported Q3 EPS of $1.00, higher than consensus of 93 cents.

Plexus (PLXS -2.18%) reported Q4 EPS of 77 cents, below consensus of 78 cents.

Tractor Supply (TSCO -0.26%) jumped over 10% in after-hours trading after it reported Q3 EPS of 55 cents, better than consensus of 50 cents.

AT&T (T -0.35%) dropped 3% in after-hours trading after it reported Q3 adjusted EPS of 63 cents, less than consensus of 64 cents, and then lowered guidance on fiscal 2014 revenue growth view to 3%-4% from 5%.

Albemarle (ALB -2.28%) reported Q3 adjusted EPS of $1.14, higher than consensus of $1.02.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Chicago Fed National Activity Index

9:00 FHFA House Price Index

9:45 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAL, AB, ACAT, AEP, ALK, ALV, ALXN, ARG, ASPS, AVT, BBW, BC, BCC, BHE, BKU, BMS, CAB, CAM, CAT, CCE, CELG, CFX, CHKP, CLI, CMCSA, CMS, CRI, CRS, CS, CSH, CVE, CWEI, DAN, DGX, DLX, DNKN, DO, DPS, EQM, EQT, FAF, GM, GMT, GPI, GRUB, HERO, HUB.B, IMAX, IVC, JAH, JAKK, JBLU, JNS, KKR, LAZ, LLY, LO, LSTR, LTM, LUV, MDP, MHO, MINI, MJN, MMM, MTRN, NLSN, NOK, NUE, NWE, ORI, OSIS, OSTK, OXY, PCP, PENN, PHM, PLD, POT, PRLB, PTEN, QSII, RCI, RCL, RS, RTN, RYL, SIAL, SILC, SJR, SLAB, SONS, SQNS, STC, TDY, TROW, UA, UAL, UFS, UNP, USG, UTEK, WCC, WSO, YNDX, ZMH

Notable earnings after today’s close: ADES, ALGN, ALTR, AMZN, BAS, BJRI, BLDR, BMRN, CB, CBI, CERN, CLMS, CLNE, CNMD, CPWR, CTCT, CYN, DECK, DLB, DV, ECHO, ELY, EW, FET, FII, FLS, FSL, GHL, GIMO, HBHC, HUBG, HWAY, IM, INFA, JNPR, KLAC, LOGM, LSCC, MSFT, MTSN, MXIM, MXWL, N, NCR, NTGR, OLN, P, PACB, PCCC, PDFS, PEB, PFG, PFPT, POL, QLIK, RMD, RUBI, RVBD, SHOR, SIVB, SPNC, SRCL, SWFT, SWN, SYNA, VMI, VRSN, WOOF, WRB, WRE, WRI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 23)”

Leave a Reply

You must be logged in to post a comment.

How are you measuring a move’s intensity?

“the intensity behind the move didn’t register as being anything other than normal.”

I watch the intraday action closely. Is the buying/selling relentless? Are there counter moves? Does it seem like larger players with huge accounts are going to work? I don’t look at indicators for this. I study the intraday tape.

es says:

October 23, 2014 at 8:14 am

Aussie, thank you for your very perceptive insights. . . Es

thanks es

according to mr gann with the squareing of price and time at spx 1950 on today the 33 day from top

according to mr elliot that a wave 2 up can hit dow 16700 spx 1950 nas 100 4000

and with all markets being at intraday piviot highs on cash

dow 16719 spx 1949.50

nas100 4000.16

and according to gambler hoyle i am short at the throw over of those and the equivilent on

the ftse,dax aussie xjo and n225

this of course is on my gamblers trading plan and trade management

its all based on the gamblers trading plan and a disciplined trade managment system..I had a realization that the market is nothing more than gambling. On that day I began to grow and mature as a trader. The key is a trade management system…

Good to see Jason bullish

🙂 been bullish since last Wednesday.

shorted the ym 16690 and put a cover at 16669…geez that just blew thru it…