Good morning. Happy Friday. Happy Halloween.

The Asian/Pacific markets closed with big gains today. Japan rallied nearly 5%, followed by Hong Kong, China, Singapore, India and Taiwan, which each rallied 1% or more. Europe is currently posting big, across-the-board gains. Belgium, Germany and France are up more than 2%; London, Spain, Italy, Austria, Amsterdam, Stockholm, Switzerland, Prague, Russia and Greece are up more than 1%. Futures here in the States point towards a big gap up open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are down big.

Strong markets don’t let you in. That was my first thought this morning when I woke to S&P futures being up more than 20 points. The market has gone vertical for 2+ weeks, and anyone waiting for a rest or a correction to enter is still waiting.

The Bank of Japan unexpectedly eased their monetary policy. The yen dropped, the dollar jumped, and the Nikkei surged almost 5%.

Also contributing, Russia and Ukraine have signed an agreement covering the flow of gas into Ukraine through the winter.

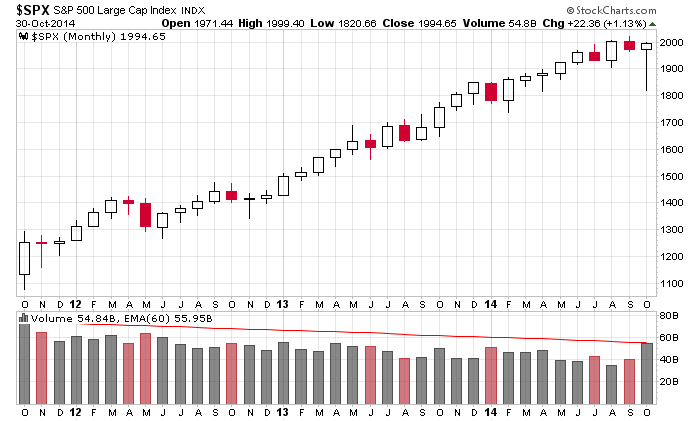

You don’t see months like October 2014 very often. A 160-point drop followed by a nearly-200 point rally (which is where the index will be at today’s open). Here’s the monthly chart. It’s easily the biggest candle in years, and probably the longest bottom tail I’ve seen in my 15 years as a trader.

What can I say? I switched my bias to ‘up’ on Wednesday, October 15 and have reiterated this every day since. But I’m under-invested. After the first several days of the rally, I starting thinking the move had legs and new highs were very possible. But no way did I think the S&P would rally 200 points in 13 days. Chasing new longs here comes with lots of risk. I’ve been saying for two weeks the rest of the year should be good, but the exact timing of jumping in positions right now isn’t great. More after the open.

Stock headlines from barchart.com…

Wyerhaeuser (WY +1.39%) reported Q3 EPS of 33 cents, higher than consensus of 30 cents.

Citigroup (C +0.95%) fell 1% in after-hours trading after it lowered its Q3 results due to a $600 million increase in legal accruals.

Mohawk (MHK +0.80%) reported Q3 EPS ex-items of $2.44, better than consensus of $2.42.

Fluor (FLR +1.36%) reported Q3 EPS of $1.15, higher than consensus of $1.10.

Live Nation (LYV +0.44%) reported Q3 EPS of 49 cents, stronger than consensus of 38 cents.

Standard Pacific (SPF +0.25%) reported Q3 EPS of 14 cents, less than consensus of 15 cents.

Mylan (MYL +2.99%) reported Q3 EPS of $1.16, better than consensus of $1.14, and then raised guidance on fiscal 2014 EPS view to $3.54-$3.60, above consensus of $3.49.

Groupon (GRPN +3.45%) reported Q3 EPS of 3 cents, triple consensus of 1 cent, but then lowered guidance on Q4 Q4 EPS ex-items to 2 cents-4 cents, below consensus of 7 cents.

Expedia (EXPE +1.50%) reported Q3 adjusted EPS of $1.93, higher than consensus of $1.74.

Western Union (WU +1.64%) reported Q3 EPS of 44 cents, stronger than consensus of 38 cents.

Crown Castle (CCI +0.90%) reported Q3 FFO of $1.05, better than consensus of $1.01.

Starbucks (SBUX +1.02%) fell over 3% in after-hours trading after it reported Q4 adjusted EPS of 74 cents, right on consensus, although Q4 revenue of $4.20 billion was slightly less than consensus of $4.23. Starbucks then lowered guiidance on fiscal 2015 EPS to $3.08-$3.13, below consensus of $3.16.

LinkedIn (LNKD +1.70%) climbed more than 4% in pre-market trading after it reported Q3 EPS of 52 cents, stronger than consensus of 47 cents, and then raised guidance on fiscal 2014 EPS to $1.89, higher than consensus of $1.87.

Columbia Sportswear (COLM +0.16%) reported Q3 EPS of 93 cents, better than consensus of 87 cents, and then raised guidance on fiscal 2014 EPS to $1.80, higher than consensus of $1.76.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Personal Income and Outlays

8:30 Employment Cost Index

9:45 Chicago PMI

9:55 Reuters/UofM Consumer Sentiment

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: AON, AXL, BUD, CBOE, CLX, COL, COMM, CVX, D, GWR, HLT, HPY, ITT, IXYS, LM, MGI, MMP, MOG.A, MSG, NS, NTLS, NWL, OSK, PNM, PNW, SNE, SPR, TDS, TE, USM, VTG, WETF, WY, XLS, XOM

Notable earnings after today’s close: CMRE

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 31)”

Leave a Reply

You must be logged in to post a comment.

“Chasing new longs here comes with lots of risk.” Yea I sold like crazy in this pre market. I expect a pull back from today’s gap.. If so I will get back in. We have a bit to run.

i wonder if at around 1500 they run it up into the close

i commented some 2 weeks ago Arbe ,the japan mrime minister in asian trading had commented that he was letting the 1 trilion usd equivilant govt pension fund switch out of bonds into more risky equities

thats what i thought these last 2 weeks were and may well be so as a sell the offical announcement,which was watered down some what

the pension funds can now only use 50% in world equities and still keep 50%in japan bonds

and of that 50% in eqities half have to be in local japan equitiies

but the timing was great on the door step of usa elections

has japan finished its equity buying already–who knows

well the world central banks that all work together

todays tick indicator said the market was churning by holding cliose to middle line

telling us the instos were selling as other bought