Options expire this Friday, so let’s take a look at the open-interest on SPY, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

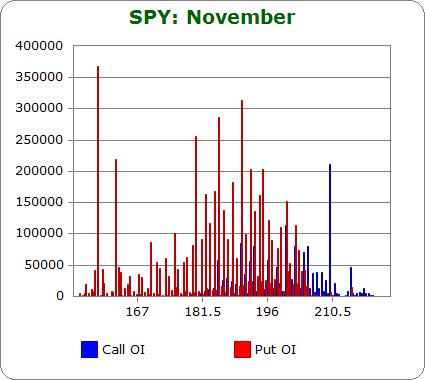

SPY (closed 204.48)

Puts out-number calls 2.0-to-1.0…less bearish than it’s been in the past.

Call OI is very sporadic. There are spikes at 195, 200, 202, 204, 205 and then a huge one at 210.

Put OI is much higher. There are spikes at 150, 160 and then OI is heavy or moderately heavy from 170 all the way up to 202.

Puts dominate, so we’ll want most of those to close worthless in order to cause the most pain. With SPY at 204.48, virtually all the put OI takes place at strikes below this level. Then the question becomes how far SPY can drop to close more calls worthless without allowing the put buyers to make money. My answer is: About 2 points. Most puts would still expire worthless, and all those calls at 202, 204 and 205 would be worthless too. Flat trading the rest of the week would cause a lot of pain; a slight move down would cause a little more.

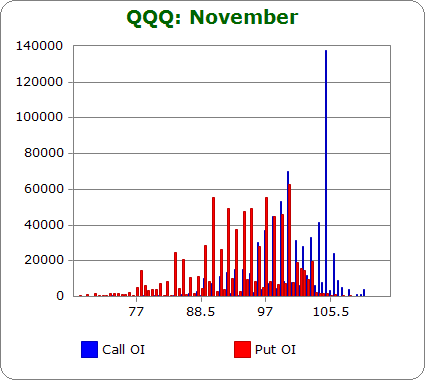

QQQ (closed 102.91)

Puts out-number calls 1.5-to-1.0…less bearish than it’s been in the past.

Call OI ramps up from 97 to 100 and then is moderately heavy until the huge spike at 105.

Put OI is very steady between 90 and 100.

These two zones overlap between 97-100. If QQQ can close near the middle of this range, most calls and puts will expire worthless, thereby inflicting the most amount of pain possible. Today’s close was at 102.91, three points higher than the range. A moderate move down is needed.

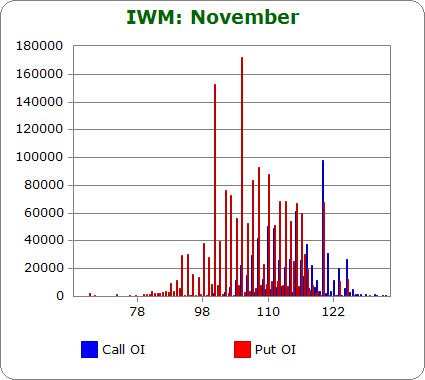

IWM (closed 115.72)

Puts out-number calls 2.1-to-1.0…more bearish than it’s been in the past.

Call OI is highest at 108, 110, 111, 115 and there’s a big spike at 120.

Put OI is consistently strong between 100 and 115, and then there’s a spike at 120.

There’s some inconsistent overlap between the two ranges, but since puts dominate, let’s focus on them. Today’s close was at 115.72 – just above the huge block of put OI but below the spike at 120. To me this is good enough. The idea is to determine max pain because there is no level everyone will lose. Flat trading the rest of the week would cause the most number of calls and puts to expire worthless. Any move down would allow some put buyers to make money while a smaller number of call buyers suffered – not a good trade off.

Overall Conclusion: To achieve max pain, SPY requires slightly down trading the rest of the week; QQQ needs a move down and IWM needs flat trading. I’m not surprised the indexes are not entirely on the same page. The indexes themselves haven’t been on the same page. Let’s conclude a slight move down is needed the rest of the week, but flat trading would be fine too.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

Very nice info piece. Best from you so far