Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Japan rallied 2.2%; South Korea, Indonesia and Singapore also did well. Hong Kong and China were noticeably losers. Europe is currently up across-the-board. Greece is up more than 2%; Spain, Italy, Germany, Austria, Belgium and Russia are up more than 1%. Futures here in the States point towards a flat open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up.

Yesterday the small caps and Nas dropped while everything else closed close to unchanged. The discrepancy is notable; otherwise the market remains in consolidation mode, and everything I talked about in the video posted over the weekend remains in place.

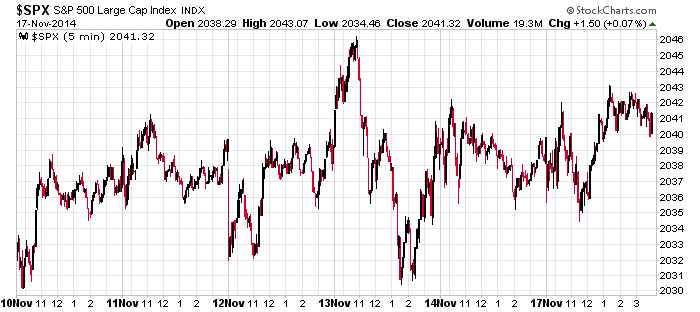

This is what what the S&P has done the last six days. Small range, no move has staying power, lots of sudden reversals. Consolidation. It’s normal and healthy. It’s also boring, but that’s the way it goes. Wall St. is boring much more that it’s exciting. Our job as traders is to recognize it and act accordingly, not force trades when the environment isn’t right.

Without much going on the last week, there’s much less for me to talk about. I still like the market overall, but I don’t think the risk/reward is very good for new trades. Play it safe. More after the open.

Stock headlines from barchart.com…

Macy’s (M -0.71%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

JA Solar (JASO +0.91%) reported Q3 EPS of 21 cents, higher than consensus of 18 cents.

Sony (SNE -1.84%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Wells Fargo (WFC +0.17%) was downgraded to ‘Market Perform’ from ‘Outperform’ at BMO Capital.

Discovery (DISCA -2.98%) was upgraded to ‘Neutral’ from ‘Sell’ at Citigroup.

Manitowoc (MTW -2.03%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

Home Depot (HD -0.21%) reported Q3 EPS of $1.15, better than consensus of $1.13.

Gabelli reported a 6.52% stake in Chiquita Brands (CQB +0.14%) .

Point72 reported a 5.1% passive stake in RCS Capital (RCAP +0.83%) .

Agilent (A -0.79%) reported Q4 EPS of 88 cents, less than consensus of 89 cents.

Urban Outfitters (URBN -0.06%) fell over 5% in after-hours trading after it reported Q3 EPS of 35 cents, below consensus of 41 cents.

Glenview Capital reported a 5.53% passive stake in Teradyne (TER -1.52%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:45 ICSC Retail Store Sales

8:30 Producer Price Index

8:55 Redbook Chain Store Sales

10:00 NAHB Housing Market Index

10:00 E-Commerce Retail Sales

4:00 PM Treasury International Capital

Notable earnings before today’s open: CYRN, DKS, HD, JASO, MANU, MDT, TJX, VVTV

Notable earnings after today’s close: GBDC, JACK, LZB, PETM, VIPS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 18)”

Leave a Reply

You must be logged in to post a comment.

very quiet this week, vol low. Earnings/sales reports this AM mixed. See a year end rally.as much desired. I am Holding div stocks, few bonds. Shiller says 20K Dow next year. Definitely….. maybe. When I was his student he was interesting, but wrong most of the time. Be happy.