Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed with a lean to the upside. China, Singapore, India did well; Malaysia and New Zealand lagged. Europe is currently posting big gains. Germany, France, Italy and Spain are up more than 2%; London, Austria, Amsterdam, Norway, Stockholm and Greece are up more than 1%. Futures here in the States point towards a big gap up for the cash market.

The dollar is up. Oil and copper are up. Gold and silver are up.

It’s party time. Asia did well, Europe is soaring and the futures in the US are up a bunch.

Mario Draghi announced the ECB is ready to expand its asset purchase programs saying: “If on its current trajectory our policy is not effective enough…we would step up the pressure…by altering accordingly the size, pace and composition of our purchases.”

Also, China cut its benchmark interest rate for the first time in two years.

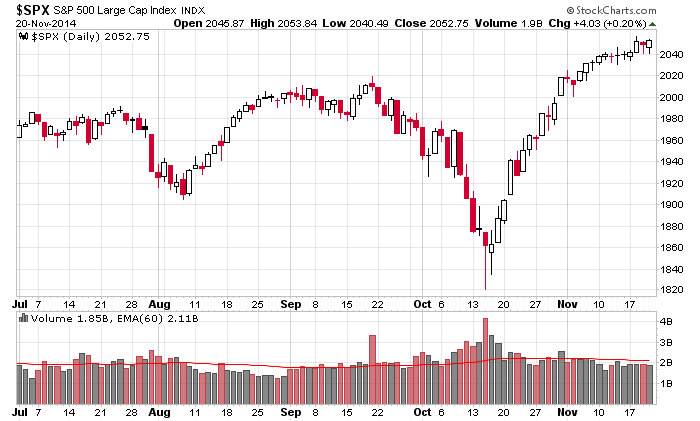

Here’s the daily S&P. It’s been defying gravity. Not only has the index gone up and up and up, there are very few days the last month the index has taken out its previous day’s low. That is consistent and steady buying. Energizer Bunny market.

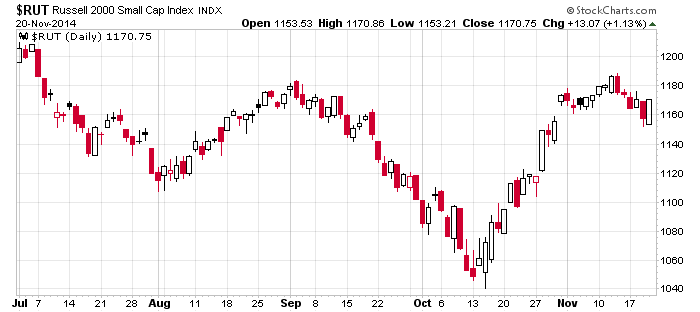

The small caps haven’t done as well. They barely took out their September high, and they’ve lagged the last week. But yesterday they led, and today they’ll gap up to the high. When they play catch up, they catch up fast.

My bias of course remains to the upside (although I’m under-invested right now). Looking forward, today is options expiration. It’s a meaningless day that used to result in lots of intraday volatility but doesn’t any more. It could act as a turning point, but constantly looking for turns often results in missing a lot of upside. Next week is holiday-shortened. The market will be dead Wednesday, closed Thursday and then only open a half-day Friday. Perhaps we keep floating higher in typical pre-holiday form?

The trend is up. Don’t fight it…but don’t get lazy. A turn will come when you least expect it…although I’d expect any pullback to be bought.

Stock headlines from barchart.com…

Foot Locker (FL +1.44%) reported Q3 EPS of 83 cents, better than consensus of 79 cents.

Citigroup reiterates its ‘Buy’ rating on DISH Network (DISH -3.27%) and raised its price target on the stock to $94 from $79.

Intel (INTC +4.66%) was downgraded to ‘Sell’ from ‘Underperform’ at CLSA.

eBay (EBAY -0.73%) was downgraded to ‘Sell’ from ‘Hold’ at Evercore ISI.

Dillard’s (DDS +9.28%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Park West Asset Management reported a 5.1% passive stake in Eagle Pharmaceuticals (EGRX +1.28%) .

Yum! Brands (YUM +2.08%) board authorized the company to repurchase up to $1 billion in additional shares of common stock.

Marvell (MRVL -0.52%) reported Q3 EPS of 29 cents, right on consensus, although Q3 revenue of $930.14 million was below consensus of $976.14 million.

Autodesk (ADSK -1.17%) rose over 3% in after-hours trading after it reported Q3 adjusted EPS of 25 cents, above consensus of 22 cents.

The Fresh Market (TFM +0.43%) fell nearly 2% in after-hours trading after it reported Q3 adjusted EPS of 27 cents, weaker than consensus of 28 cents.

GameStop (GME +0.60%) dropped over 10% in after-hours trading after it reported Q3 adjusted EPS of 57 cents, less than consensus of 61 cents.

The Gap (GPS +1.52%) slipped over 3% in after-hours trading after it reported Q3 EPS with benefits of 80 cents, above consensus of 79 cents, but then lowered guidance on fiscal 2014 EPS view to $2.73-$2.78, below consensus of $2.82.

Ross Stores (ROST +1.28%) climbed over 4% in after-hours trading after it reported Q3 EPS of 93 cents, better than consensus of 87 cents, and then raised guidance on fiscal 2014 EPS to $4.28-$4.32, higher than consensus of $4.27.

Intuit (INTU -0.75%) rose nearly 2% in after-hours trading after it reported a Q1 adjusted EPS loss of -10 cents, less than consensus of a -20 cent loss.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

11:00 Kansas City Fed Mfg Survey

Notable earnings before today’s open: ANN, BERY, FL, GMAN, HRG, HIBB, SIRO, TNP

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 21)”

Leave a Reply

You must be logged in to post a comment.

I read that the swiss people are going to vote on if they want the 20% of their fiat currency to be backed by gold. That could be a turner if they vote it in…probably a non event…

IWM opened at 114 yesterday and should open over 118 today. WOW!

Seasonality would lead to holding broad market positions. Oh, do use stops, since nothing is sure. where are markets headed — slowly up. Dividends are useful so I recommend a few. I am hold AAPL for a good Christmas, top said to be $168.

Going sailing today 50F at 50 o N lat. but raining, South to Panama for Christmas. Cheers to all.

the old ‘gap and dribble’ … how’s it going jase?

CEV…good to hear from you. Looks like gap-n-crap. Nice move off the gap open high.