Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the downside. Taiwan moved up; South Korea, Indonesia, Australia and Singapore moved down. Europe is currently mostly down. Spain is down 2%, Italy; Austria, France and Prague are down more than 1%; London, Germany, Belgium, Amsterdam and Norway are also down noticeably. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down a small amount. Oil is flat, copper is down. Gold and silver are up.

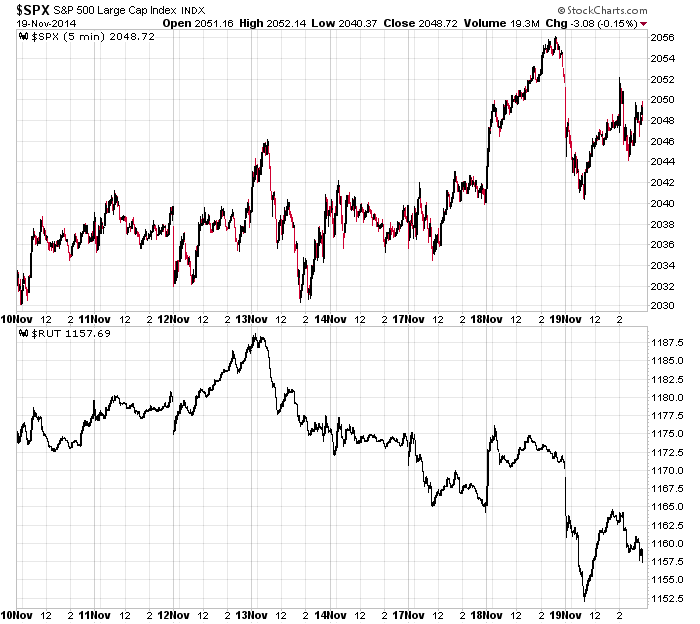

Wall St. remains a very unexciting place to operate. Volatility has shrunk, volume has declined and the intraday ranges have contracted. It wasn’t long ago the S&P would move 10-15 points during the first hour of trading and 20-30 for the day. Now we’re lucky to get a 12-15 point intraday range and 25 points for the week.

The decline in activity has resulted in less follow through for breakouts…heck just less energy for all moves. But it is what it is. The recent action is much more normal than the month of huge moves we got during October.

The most noticeable recent development has been the divergence between the large and small caps. The large hit a new high two days ago while the small caps have been in declined. Such a divergence can last in the short term, but many more times than not, the small caps pull the market down. Hence my stance to be careful with new longs. Here’s the S&P and Russell over the last eight days.

My stance stays the same. Overall I like the market, but in the near term I’m not overly excited about entering new positions. Wall St. is very boring right now. More after the open.

Stock headlines from barchart.com…

Target (TGT +7.39%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Dollar Tree (DLTR +1.03%) reported Q3 EPS of 69 cents ex-items, better than consensus of 64 cents.

Children’s Place (PLCE +1.38%) reported Q3 EPS of $1.70, weaker than consensus of $1.80.

Michaels (MIK -0.50%) reported Q3 EPS of 31 cents, above consensus of 26 cents.

Patterson Cos. (PDCO -0.56%) reported Q2 EPS of 54 cents, better than consensus of 51 cents.

Best Buy (BBY +1.83%) reported Q3 EPS of 32 cents, higher than consensus of 25 cents.

Copa Holdings (CPA +0.85%) reported Q3 adjusted EPS of $2.25, well above consensus of $1.99.

Caesar’s (CZR -6.20%) surged over 15% in after-hours trading after Bloomberg reported that Caeser’s released a plan to creditors that it would restructure its operating unit into a REIT.

L Brands (LB +0.45%) slid over 1% in after-hours trading after it reported Q3 EPS of 44 cents, stronger than consensus of 39 cents, and then raised guidance on fiscal 2014 EPS view to $3.21-$3.31 from $3.03-$3.18. This is still on the low end of consensus of $3.31.

Williams-Sonoma (WSM -0.26%) jumped over 5% in after-hours trading after it reported Q3 EPS of 68 cents, better than consensus of 63 cents.

Atento (ATTO +0.56%) reported Q3 adjusted EPS of 35 cents, less than consensus of 40 cents,

Salesforce.com (CRM -2.32%) fell over 4% in after-hours trading after it reported Q3 EPS of 14 cents, higher than consensus of 13 cents, but then said it sees Q4 EPS of 13 cents-14 cents, below consensus of 15 cents.

Keurig Green Mountain (GMCR -2.01%) reported Q4 adjusted EPS of 90 cents, well above consensus of 77 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Consumer Price Index

8:30 Initial Jobless Claims

9:00 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 Philly Fed Business Outlook

10:00 Existing Home Sales

10:00 Leading Indicators

10:30 EIA Natural Gas Inventory

Notable earnings before today’s open: BBY, BKE, BONT, BRC, CYBX, DATE, DCI, DLTR, GLOG, JKS, LQDT, MBLY, PDCO, PERY, PLCE, SMRT, SPB, WBAI

Notable earnings after today’s close: ADSK, ARUN, ASYS, GEOS, GME, GPS, INTU, MENT, MRVL, NGVC, RENN, ROST, SPLK, TFM, WAIR, ZOES

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 20)”

Leave a Reply

You must be logged in to post a comment.

The RUT is pretty beat up. My math tells me if IWM drops to 112.5 today there is going to be a nice bounce. And I am going long.

The president is running things as he stirs the pot tonight. Right now it appears that no one wants to own stocks. Sitting tight to watch if the year end rally is possible. spx + 2038 a sign the move is probable. Could go the other way too, without much effort.

Next equilibrium price 2026.75. Lets see if price stays above 2043.75 by todays close. The one issue to be wary is the showdown between the GOP and Obama in which by Dec. 11 congress must approve funds to keep from partial government shutdown similiarly to last year when Republicans demands led to a standoff to the presidents health care law.

Well, we are top of the daily es fork..small put short here..wave 4 complete…I hope…lol

and why would you be long now?