Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China rallied almost 3%, and Malaysia moved up 1.6%. Japan dropped 2.25%, and South Korea and Taiwan fell more than 1%. Europe is currently mostly up. Greece is down another 2.8%; Russia is up 2.15%, and Norway, Stockholm and Germany are also doing well. Futures here in the States point towards a gap down open for the cash market.

The dollar is down. Oil and copper are down. Gold and silver are up.

We got a moderate down day Monday, and then followed it with a huge gap down Tuesday morning…but the gap down got bought, and the indexes rallied all day and recaptured most or all of the opening loss. It was the biggest intraday move since the October bottom. Very impressive since it came off a 5% down day for China and a 10% down day for Greece.

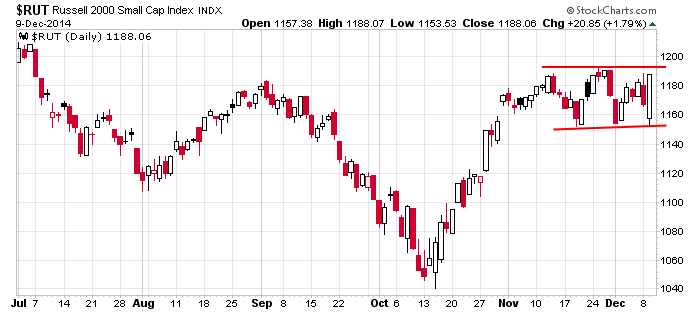

Here’s the Russell. Allowing for a tiny amount of wiggle room, the last two lows held, and now the index looks ready to attempt a breakout.

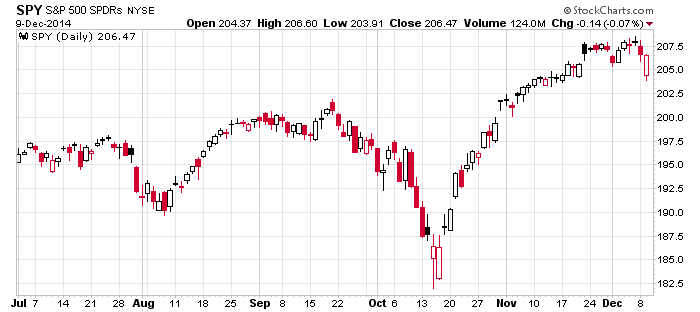

For a change, the S&P 500 doesn’t look as good. Here the S&P (via SPY so the gap is shown). This pattern looks sloppier. First the index hit a new high…then it took out the early-December low. Now it’s somewhere in the middle.

But there are still divergences between the market and some underlying indicators that need to be resolved, and until this takes place, I still lean towards a pullback. The AD line, AD volume line, new highs and others need to improve before I’m confident a move up can stick and have legs. More after the open.

Stock headlines from barchart.com…

Goldman Sachs (GS +0.14%) was downgraded to ‘Neutral’ from ‘Positive’ at Susquehanna.

Disney (DIS -0.92%) was downgraded to ‘Hold’ from ‘Buy’ at Topeka due to valuation.

Genesco (GCO +1.16%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

British Petroleum (BP -0.90%) was upgraded to ‘Buy’ from ‘Hold’ at Deutsche Bank.

Costco Wholesale (COST +0.50%) reported Q1 EPS of $1.12, higher than consensus of $1.09.

Yum! Brands (YUM -1.62%) fell nearly 5% in pre-market trading after the company said 2014 EPS, excluding some items, wil rise by a mid-single-figit percentage, well below a previous forecast of 20% growth.

Krispy Kreme (KKD +0.50%) fell over 4% in after-hours trading after it reported Q3 adjusted EPS of 18 cents, less than consensus of 19 cents.

Korn/Ferry (KFY +1.71%) rose over 3% in after-hours trading after it reported Q2 EPS of 51 cents, better than consensus of 45 ccents.

Lazard reported a 5.072% passive stake in Mobile TeleSystems (MBT -0.31%) .

CHC Group (HELI +7.35%) reported a Q3 EPS loss of -31 cents, a smaller loss than consensus of -38 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Quarterly Services Report

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: CMN, COST, FGP, FRAN, HOV, LAYN, LE, TITN, TOL, VRA

Notable earnings after today’s close: AVNW, CASY, CENT, IRET, MW, PPHM, RH, SIGM, SURG, WTSL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 10)”

Leave a Reply

You must be logged in to post a comment.

alien hindenburg spaceships are all over the place with the a/d line and new highs and lows in a vunerable spot

this is a bad omen

im short ym and looking for 17595 area for support..that would be dow 17600

missed that by 30 or so ticks..

and more.. no covering today..

spx hit obvious support of sept highs at 2023 and bounced

their are many more open gaps on all indexes lower

the quad witches will tell us which one

cheif naughty bear

The Omen to senses the confusion. Setting tight to see what the herd does in the face of the oil dance. overall keeping a few broad index etfs and the dividend portfolio. Cheers and hold on. No one is driving the bus.

” I still lean towards a pullback.”

Me too but not worth going short.