Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. Malaysia and South Korea dropped more than 1%; India, Australia, Japan and Hong Kong also dropped noticeably. Europe is currently mostly down. Greece is down 5%; Russia, Prague and Austria are down more than 1%. Germany is up a small amount. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is down, copper up. Gold is down, silver is up.

It’s been a heck of a week. Coming in our bias was to the downside. The divergence between the small caps and large caps and nonsupporting breadth indicators told us a pullback was likely right around the corner. Overall this bias has served us well, but the Tuesday bounce certainly made us wonder. Tops are often of the rounded variety and take time to form. With lots of ups and downs, the invisible hand of the market works to shake the tree a little so as few traders as possible participate in the following move. Now the Dow and S&P 500 are sitting at 1-month lows, and the Nas and Russell are one solid down day from their own.

Seasonality wise, this is traditionally a weak week, but then things get much better into the end of the year. But the technicals are in bad shape, and given their current positions, a complete washout would be preferable over a bounce.

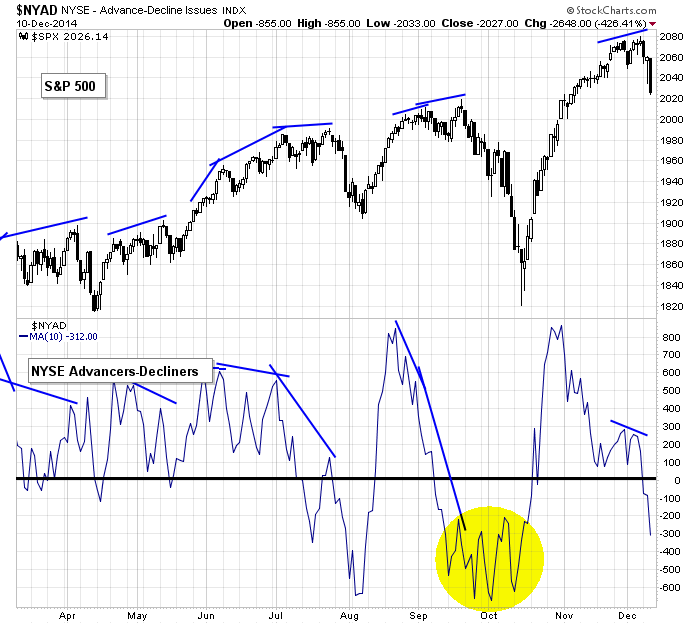

Here an example…the 10-day of the NYSE AD line. When the market is healthy, the indicator bounces up and down above 0 (small and brief penetrations of 0 are permitted). But a deeper penetration of 0 leads to a bigger pullback. This is what has happened. With the plunge over the last couple days, I’d rather see more selling lead to a complete washout of the indicator before the market attempted to bounce. This set up appears in many other indicators too.

If you don’t like to go short, get out of the way when the market puts off obvious warning signs. More after the open.

Stock headlines from barchart.com…

JPMorgan Chase (JPM -2.83%) was upgraded to ‘Outperform’ from ‘Underperform’ at CLSA.

Eli Lilly (LLY -1.61%) was upgraded to ‘Overweight’ from ‘Underweight’ at Morgan Stanley.

RadioShack (RSH -3.51%) reported a Q3 EPS loss of -$1.58, a much bigger loss than consensus of -$1.04.

Travelers (TRV -0.72%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Starboard Value reported a 5.1% stake in Staples (SPLS +2.42%) .

Toll Brothers (TOL -7.85%) was downgraded to ‘Underperform’ from ‘Sector Perform’ at RBC Capital.

Janus Capital reported a 10.6% passive stake in Rexnord (RXN -4.07%) .

Lowe’s (LOW -1.08%) said it sees fiscal 2014 EPS about $2.68, better than consensus of $2.67.

lululemon (LULU -2.16%) reported Q3 EPS of 42 cents, better than consensus of 38 cents.

Burlington Stores (BURL +0.50%) fell over 1% in after-hours trading after it filed to sell 8 million shares of common stock for its holders.

According to the WSJ, ebay (EBAY -0.23%) is considering a plan to eliminate at least 3,000 jobs, or 10% of its total work force, early next year as the company gets ready to separate its PayPal payments unit.

Men’s Wearhouse (MW -3.39%) reported Q3 adjusted EPS of 83 cents, less than consensus of 87 cents.

Third Avenue reported a 3.11% passive stake in Covanta (CVA -1.67%) .

Casey’s General Stores (CASY -1.16%) rose nearly 2% in after-hours trading after it reported Q2 EPS of $1.28, higher than consensus of $1.17.

Restoration Hardware (RH -0.25%) jumped over 5% in after-hours trading after it reported Q3 adjusted EPS of 49 cents, better than consensus of 48 cents, and then raised guidance on fiscal 2014 adjusted EPS view to $2.33-$2.35 from $2.29-$2.33, above consensus of $2.33.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Retail Sales

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: CIEN, LULU, MEI, MNR, RSH

Notable earnings after today’s close: ADBE, DDC, ESL, NDSN, ZQK

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 11)”

Leave a Reply

You must be logged in to post a comment.

The correlation expected in the market is missing: gold dollar etc. We may get a bounce today, but be suspicious, the CR that keeps the government moving is in jeopardy. Nice is we got on the track to year end, but we know better. hang tough.

Truly.. a very nice call on Monday. Well done Jason

Second that.. The way the market is bouncing I would say we need a nice washout.. Then go long or be wrong.

bkx loosing ground…

2nd +1k tik

sick market