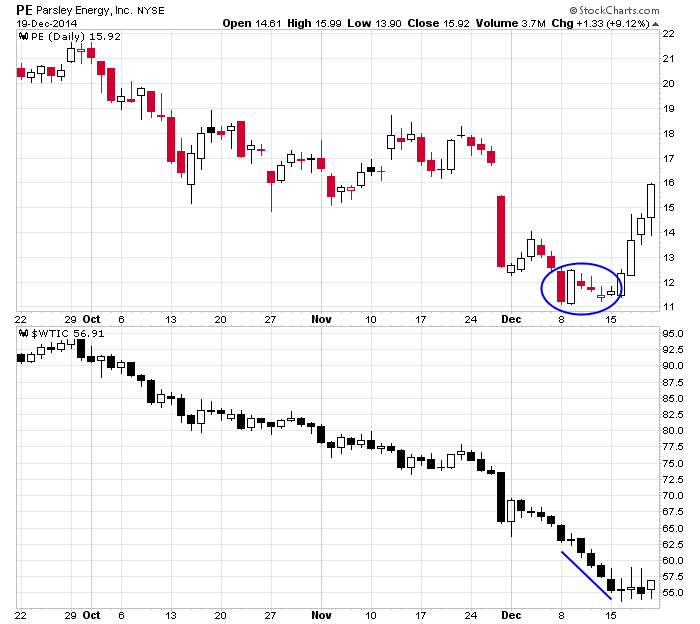

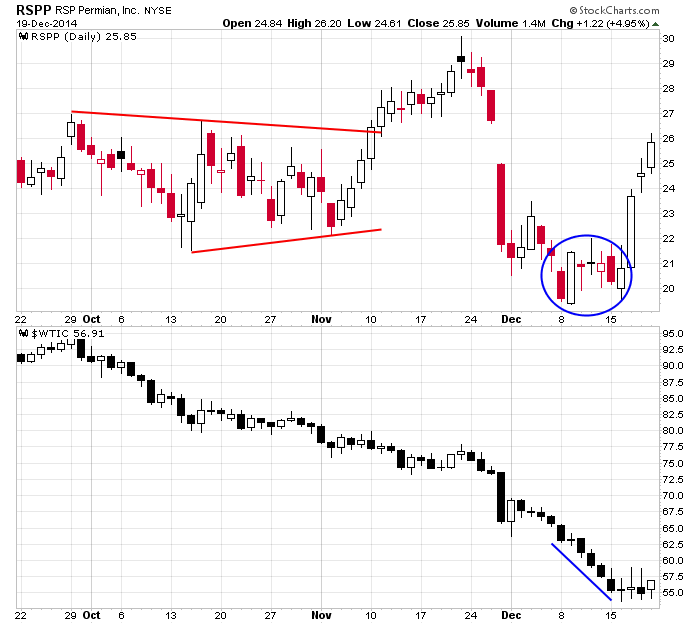

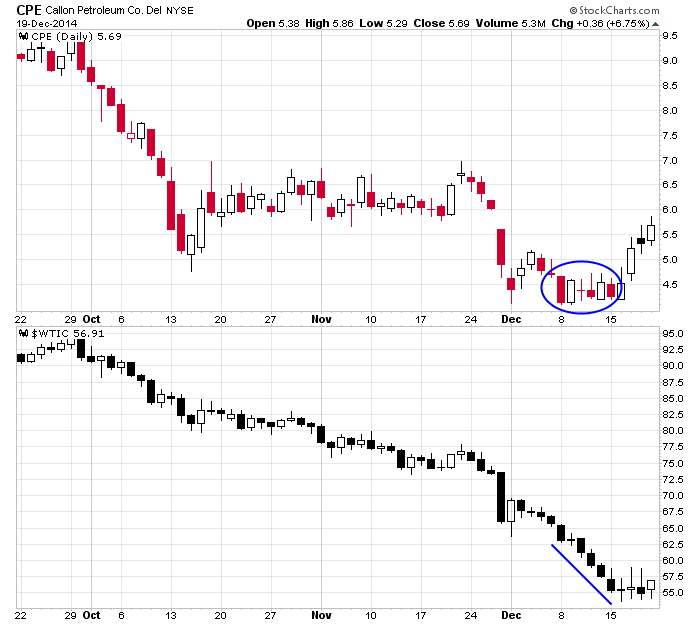

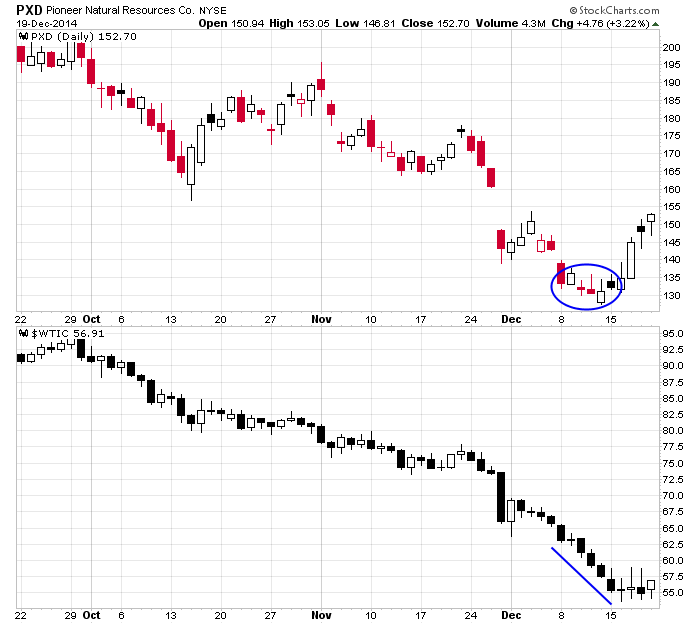

A development between crude oil and oil stocks formed over the last two weeks which help us spot a great trading opportunity last week. I explain in this video. (side note, while “filming,” the video automatically zoomed in and out, so the charts discussed are shown below).

0 thoughts on “VIDEO: Divergence Between Oil and Oil Stocks Helps Spot Opportunity”

Leave a Reply

You must be logged in to post a comment.

Thanks. Been tracking the majors XOM COP and such. Nice to see follow along action from these guys as confirmation.

US financials a bit iffy regarding overall market tone. Moreover, why have dry bulks been so laggy so long. Can only assume reflects global slowness and over capacity. Thing is when those do finally run, they run so fast it’s hard to jump on. Many are thin O/S making short covering squeezes extra trippy upside. Course if global slowdown continues then it’s mergers, closings. bankruptcies among small guys. Worse, the major dry bulks don’t even bother picking the bones so total losses in the stocks.

Biotechs on watch to see if their monster run comes to end as money seeks out these oil plays for run back to recent peaks. Then what’s next? Hold for more oil run or find fresh oversold area? Traders game.

I suspect there’s been some short covering in the oil STOCKS.

That’s been nice for a trade. But at some point the annual

P&Ls will be published, along with management comments

and guidance. Also, reserves will be downward priced.

I’m NOT saying the stocks will make new lows, but I wouldn’t

want to be long for more than a trade into no more than

late January.